Tax revenues that are focused on the State Budget are the state's incomes formed during the state's participation in the distribution of social wealth in the form of value. Taxation is the premise necessary to maintain political power and perform the functions and tasks of the state.

1. What is a tax? What is the state collecting taxes for?

Tax is a compulsory payment that individuals (individuals) and legal entities (organizations) are obliged to perform to the state, arising on the basis of legal documents issued by the State, not of a price and refunded directly to the tax payer.

Many people wonder what taxes are for, what does the state collect taxes and do with that tax money, or what is the effect of taxes that we have to extract wages and profits to pay? Very simple:

- What is a tax? As a necessary source of funding for the maintenance, operation and implementation of functions and tasks of state agencies for the purpose of social stability and development.

- Normal taxes: for the purpose of collecting budgets and regulating social income.

- Special taxes: for special purposes, e.g. excise taxes on alcohol, tobacco and automobile imports to limit the consumption of these goods by individuals; or irrigation fees to raise funds for the development, restoration of irrigation systems, water regulation of localities …

After completing the procedures for registration of establishment of the company, being granted a business license and tax code by the Department of Planning and Investment, the enterprise must make the initial tax declaration dossier with the tax authority and pay the taxes in the regulations.

2. CORPORATE TAXES PAYABLE AFTER ESTABLISHMENT

There are 4 main taxes in Vietnam that businesses need to pay attention to after establishment.

2.1. Fees (taxes) for cards

From January 1, 2017, the name "card tax" was replaced by a "license fee", which is a mandatory tax paid annually by businesses.

- Subjects paying the subject fees:economic components specified in Decree No. 139/2016/ND-CP;

- Subjects exempt from the subject fee: supplemented and changed under Decree No. 22/2020/ND-CP;

- Tax rates and time limits for paying the subject fees: Depending on the time of business registration and the level of revenue, the tax level will vary, from VND 300,000 per year to VND 3,000,000 per year.

Note: After being granted a business license, the enterprise must submit the license fee declaration to the tax authority directly managing – this is an important legal procedure after the establishment that the enterprise must carry out.

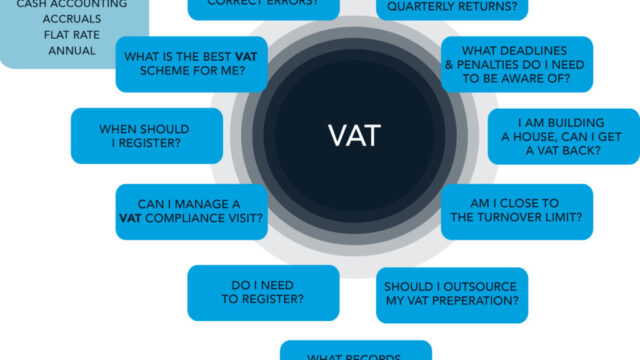

2.2. Value-added tax (VAT)

Value-added tax (VAT), or sales tax, is the difference between vat bought and VAT sold.

In order to determine the amount of VAT payable, enterprises need to determine whether the method of vat declaration is a method of deduction or direct method. At that time:

- VAT declaration under the deduction method

If the output VAT is greater than the input VAT, the enterprise must pay that difference. Conversely, if the output VAT is less than the input, the enterprise will be deducted the difference.

- VAT declaration by direct method

For the method of declaring VAT directly will be calculated in two ways: directly on revenue and directly on VAT.

Method 1: Declare by direct method on revenue

The VAT rate for this method is determined based on the actual business lines at the enterprise. For example: The distribution and supply of goods is 1%; service is 5% (Refer to Article 13 of Circular No. 219/2013/TT-BTC).

Method 2: Declare by direct method on GTGT

This method usually applies to businesses that have activities of trading, processing gold, silver, gemstones. At that time, VAT will be calculated as 10% of the added value.

2.3 Corporate Income Tax (CIT)

CIT is a tax levied on the final profit of the enterprise, after deducting reasonable expenses.

- Subjects of corporate income tax payment: all individuals, organizations, establishments producing and trading in goods and services that generate income.

- How to calculate corporate income tax

CIT payable = CIT calculation price x Tax rate

2.4. Personal Income Tax (PIT)

PIT is a tax that enterprises pay on behalf of employees.

PIT in monthly, monthly or quarterly declarations but settled by year.

- How to calculate personal income tax

Payable PIT = Income calculated in PIT x Tax Rate

Of which:

– Income calculated in PIT = Income subject to PIT – Deductions;

– Income subject to PIT = Total PIT paid by the company – Incomes excluding PIT.

- Personal income tax deductions

– Family deduction:

- For yourself: VND 11,000,000/person/month;

- For dependents: VND 4,400,000/person/month.

– Compulsory insurance: social insurance, health insurance, unemployment insurance and occupational insurance in some special fields.