1. . Tax reporting services

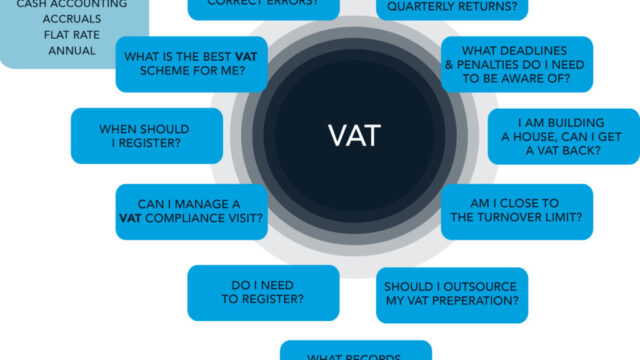

What is a tax reporting service?

Tax reporting services are responsible for performing tasks related to VAT declaration, PIT declaration, provisional CIT declaration, year-end CIT report and final settlement, making accounting books, accounting explanations, completing accounting records, revenue and expense records, procedures for money labor

What is a tax report?

A tax report is the declaration of input value-added tax invoices incurred during the purchase or purchase of services and sales invoices issued by the entity itself as the output Value-Added Tax. Tax reports are considered as a bridge for tax administration agencies to grasp the business situation of businesses. Therefore, understanding and accurately the provisions of the law on tax reporting such as: The types of corporate tax declarations to be filed, the time limit for filing tax returns and the time to pay the tax of the enterprise when they arise is a very necessary issue.

So, what does the tax report consist of?

Types of declarations must be submitted monthly or quarterly:

- Monthly or quarterly vat return of the business.

- Report on the use of invoices quarterly.

- Calculate and pay provisional corporate income tax (if any) quarterly.

- Monthly or quarterly Personal Income tax return.

- Taxes incurred (if any).

2. How to make a quarterly tax report

– VAT report

In the period, even if it does not arise or arise, the enterprise still has to file vat reports. VAT has two methods of calculation: the deduction method and the direct method.

If declaring taxes according to the deduction method, the accountant needs to prepare documents and papers including:

- Form No. 01/GTGT: VAT declaration.

- List of invoices for goods and services sold and purchased.

- Other annexes (if any).

If the enterprise declares according to the direct method, the accountant needs to prepare a dossier that includes:

- VAT declaration according to form 03/GTGT if calculated directly on the added value.

- VAT declarations according to form 04/GTGT and invoices for sale of goods and services sold on form 04-1/GTGT if calculated directly on revenue.

– Personal Income Tax Report

+ Pit tax declaration according to quarter accounting using the form of declaration: 02/KK-TNCN quarterly.

+ In case of tax deduction for income from capital investment, transfer of securities, copyrights, franchising, winning prizes, the declaration and submission shall be made and submitted according to form No. 03/KK-TNCN quarterly.

+ In case in the quarter, the company does not incur personal income tax deduction (i.e. no payable tax amount), it is not required to file a tax declaration.

+ If the company is subject to quarterly tax payment, the deadline for filing pit tax returns is the 30th day of the month after the quarter (e.g. the third quarter is October 30, 2013)

– The dossier of provisional CIT declaration for quarterly is:

- Quarterly CIT declaration according to form 01A/CIT

- Quarterly CIT declaration according to form No. 01B/CIT

- The deadline for filing tax returns and filing taxes: no later than the first 30 (or 31) months after the quarter.

* In case enterprises are extended to pay CIT in the first quarter of 2013 according to circular No. 16/2013/TT-BTC dated February 8, 2013 of the Ministry of Finance, the time limit for payment of CIT in the first quarter of 2013 is no later than October 30, 2013.

– Report on the use of invoices.

Report on the use of invoices in the first quarter submitted no later than April 30, the second quarter, submitted no later than July 30, the third quarter submitted no later than October 30, the fourth quarter submitted no later than January 30 of the following year:

+ Form: BC26-AC issued together with Circular No. 39/2014/TT BTC

Form: BC26-AC reports on invoice usage

After the end of the fiscal year (December 31 of every year), the deadline for submitting financial statements will be the 90th day from December 31. And tax accounting services must hand over to your company some of the following records:

- Id and password login to the general department of taxation website for you to check if the tax accounting service has paid the full tax report?

- Print and hand over the set of financial statements to submit to the district/district statistics office where your company is headquartered.

- No later than 60 days after the expiration date of the annual financial statements, tax accounting services must hand over all accounting books, import-export-existence summary tables, entry-export-existence details, receipts- expenditures, cash fund books, bank deposit books, fixed asset depreciation books, tool allocation book,… by soft file (excel file) and hard file (paper file) for your company to store

Deadline for submission of quarterly tax reports.

- Applicable in Article 27 of Circular No. 39/2014/TT-BTC:

- The latest tax payment deadline for the first quarter of the year is April 30;

- The latest deadline for the second quarter is July 30;

- The latest deadline for the third quarter is October 30;

- The latest deadline for the fourth quarter is january 30 of the following year.

Note making quarterly tax reports

+ Monthly/quarterly VAT return

No later than the 30th day of the month immediately at the end of the reporting quarter for enterprises submitting VAT reports quarterly and no later than the 20th day of the month adjacent to the month of reporting for enterprises submitting VAT reports by month. The determination of submission of VAT reports by month or quarter is by the enterprise itself at the beginning of the fiscal year. For small and medium-sized enterprises, choosing a quarterly VAT reporting period is being used more.

Note: In the period, if there is no buying/selling activity (the enterprise does not have a buy/sell invoice), the VAT declaration must still be filed.

The time limit for payment of VAT (if any incurred) is the final deadline of the VAT declaration.

+ Report on the use of quarterly invoices

The declaration period is similar to the VAT declaration above.

Note: In the period, if the use of invoices does not arise, the enterprise still has to submit a report on the use of invoices. But if your business hasn't made an invoice issue notice, you don't have to file this type of return.

+ Calculate and pay provisional corporate income tax quarterly

As of November 15, 2014, as prescribed in Article 17 of Circular No. 151/2014/TT-BTC, enterprises do not have to submit provisional CIT declarations but still have to pay provisional CIT if the enterprise determines the provisional CIT amount.

By the end of the fiscal year, if the CIT amount shown in the CIT final settlement report >20% of the provisional CIT amount of 4 quarters of the year combined, the enterprise will be fined for late payment of CIT for this 20% difference.

+ Monthly/quarterly personal income tax return

Depending on the business situation, the enterprise will declare PIT monthly/quarterly. Details are as follows:

– If the enterprise is declaring VAT quarterly, naturally, the PIT declaration will be declared quarterly.

– If the enterprise is declaring VAT monthly, then consider the amount of pit tax temporarily paid to determine whether the pit declaration will be submitted monthly or quarterly.

+ Case1: If the amount of PIT is temporarily paid in the month < 50.000.000 đồng (Nhỏ hơn 50tr đồng) thì kê khai theo quý.

+ Case2: If the amount of PIT is temporarily paid > VND 50,000,000 (Greater than VND 50 million), it shall be declared monthly.

The determination of the declaration period as above will be determined once in the first month of the fiscal year.

If in the month/quarter, the enterprise shall pay wages and wages to employees but this salary and remuneration amount is not up to the level of pit payment, it is not required to make and file pit declarations. Pursuant to Clause a.1, Clause 1, Article 16 of Circular No. 156/2013/TT-BTC dated November 6, 2013, it is stipulated: "Organizations and individuals paying income incurred with personal income tax deductions shall be taxed by month or quarter. In case in the month or quarter, an organization or individual paying income that does not incur personal income tax deductions is not required to file a tax return.