Taxation is the premise necessary to maintain political power and perform the functions and tasks of the state. Taxes are based on the state of the economy (GDP, consumer price index, producer price index, income, interest rate,…). Taxes are carried out on the principle of non-direct refunds mainly

1. . What is a tax?

What is a tax? So far there is no unified concept of taxation. From different angles of different economists, there is a different concept of taxation.

One of the most popular concepts of taxation is that "Tax is a mandatory, non-refundable revenue of the State directly to organizations and individuals in order to meet the state's spending needs for the common good".

There is also the other concept that "a tax is a mandatory financial fee or some other tax that applies to the taxpayer (an individual or legal person) who must pay a government organization to fund various public expenditures."

The tax was first imposed in ancient Egypt around 3000-2900 BC, and if you do not pay or evade taxes against paying taxes, you will be fined in accordance with the law.

2. All the tax problems you may not know about

Speaking of taxes, there are many issues that we need to know and learn, each citizen must fulfill his tax obligations to the State while also being a contributor to the management of tax sources.

2.1. Why tax? Characteristics of taxes

When human society is formed, a leadership organization is created and worked to benefit all. This sets out that there must be a common fund to carry out and spend on the necessary tax affairs that are formed. Today, taxes have become an indispensable tool in any society. The State sets a tax regime contributed by the population to have money spent on its existence and activities.

Characteristics of the tax:

Tax revenues that are focused on the State Budget are the state's incomes formed during the state's participation in the distribution of social wealth in the form of value.

- Taxation is the premise necessary to maintain political power and perform the functions and tasks of the state.

- Taxes are based on the state of the economy (GDP, consumer price index, producer price index, income, interest rate,…).

- Taxes are carried out on the principle of non-direct refunds.

2.2. The role of taxation.

Taxes play an important role in the current society without state taxes will not be able to operate strongly.

Revenues of the State budget: Taxes are considered the most important revenue, of a long-term stability nature, and as the economy grows, the more this revenue increases.

The tool contributes to the adjustment of macroeconomic objectives: Contributing to the implementation of the function of inventory, control, management of guiding and encouraging production development, expanding circulation for all economic sectors in the direction of development of the state plan, actively contribute to the adjustment of major imbalances in the national economy.

2.3. Tax classification

Based on many different criteria, people divide taxes into many types to be easily managed.

Classification by collection form includes:

- Direct collection tax: A tax levied directly on the income and benefits earned by economic organizations or individuals. For example: corporate income tax, personal income tax, land ownership transfer tax.

- Indirect tax is a tax paid to the State by manufacturers, traders or service providers by adding this tax to the selling price for consumers. Example: Value-added tax, excise tax, import and export tax.

Classification by administrative nature includes:

- State (national) taxes: paid into the central budget

- Local taxes: paid into local government budgets

This classification is often used in national accounting, based on how the organization manages revenues and budgets that enjoy them.

Tax classifications by economic nature include:

- Based on the economic factors taxed: Taxes are divided into taxes on income, taxes on consumer property, taxes on property, taxes on enterprises

- Based on the factors and economic factors subject to tax: Taxes include taxes on enterprises such as: Card tax, import and export tax, personal income tax, natural resources tax, excise tax, fees, other fees, land tax, household tax, tax on products.

- Based on the sector, taxes are divided by the economic sectors taxed: For example, taxes on insurance, taxes on savings, taxes on real estate …

2.4. Tax accounting

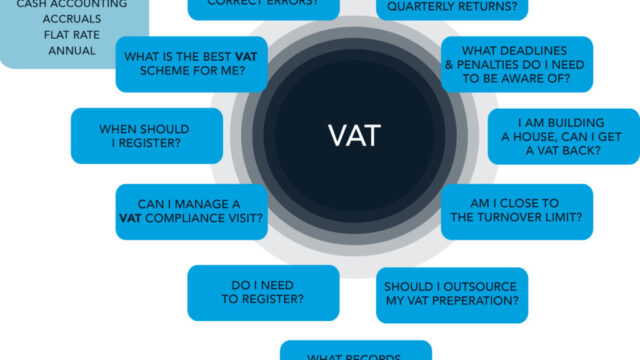

Tax accounting is one of the indispensable positions in every business in modern society. The process of developing trade is increasing, tax control is one of the extremely difficult issues not only for the state but also for each enterprise.

Tax accounting occurs regularly and periodically to ensure the rights and obligations of enterprises to pay taxes to the State. Tax accounting is important, the information of trading and trading is planned. archiving and general tax calculations as a basis for determining taxes that enterprises and economic organizations operating business must pay to the State.

In the past, tax accountants often manage invoices, paper documents this makes tax accountants very busy and overloaded with work, and often make unnecessary errors. The introduction of electronic invoice software marks a new turning point in the application of technology and production management.

Electronic invoices help tax accountants can manage, look up invoices anytime, anywhere, make invoices quickly easily, especially the cost of storing, transporting, preserving invoices is reduced to the maximum to bring optimal efficiency for businesses.

Tax is publicly transparent to ensure a strong society, paying taxes is both a responsibility and a duty of businesses.