Understand tax evasion and how businesses are penalized under Vietnam’s current tax regulations.

Tax evasion is a serious offense that affects national revenue. This article explains what tax evasion is, the forms it takes, and the penalties companies may face for evading taxes under Vietnamese law.

- What is Tax Evasion?

- Common Forms of Tax Evasion

- 1. Misreporting and underreporting tax obligations

- 2. Non-declaration or failure to file tax returns

- 3. Creating fake invoices or illegal invoice trading

- 4. Establishing shell companies to legitimize expenses

- 5. Claiming undocumented or ineligible expenses

- 6. Transfer pricing abuse

- 7. Cross-border transactions and digital services

- Negative Impacts of Tax Evasion

- Legal Basis and Penalties

What is Tax Evasion?

Tax evasion is the deliberate act of failing to fully comply with tax obligations in order to reduce the amount of tax payable to the state. This behavior is illegal and severely affects the national budget and fairness in the business environment. With digital transformation and economic integration, tax evasion methods are becoming increasingly sophisticated and complex.

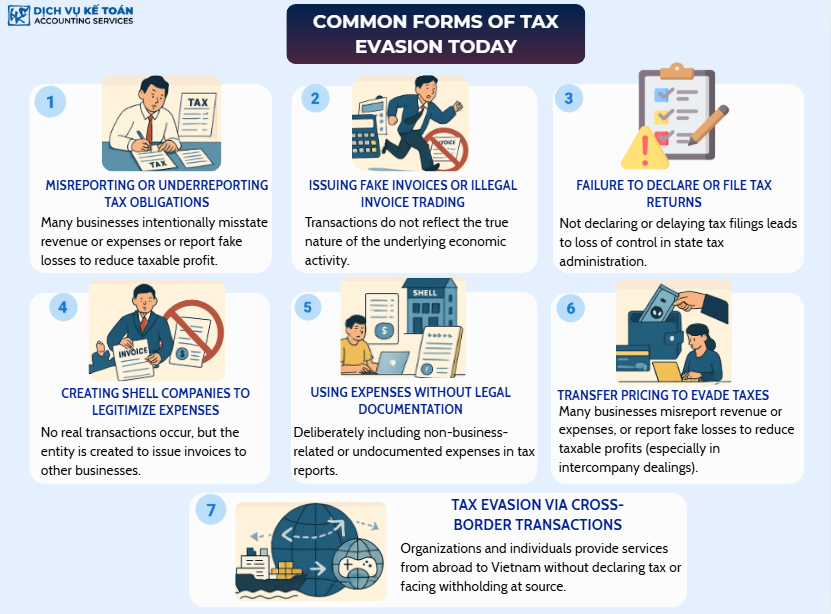

Common Forms of Tax Evasion

1. Misreporting and underreporting tax obligations

Many businesses intentionally misreport revenue, inflate expenses, or create fake losses to reduce taxable income. This is often done by altering invoices, bookkeeping records, or fabricating fictitious transactions. Loopholes in the legal system and opaque internal accounting make detection difficult.

2. Non-declaration or failure to file tax returns

Common among small businesses or irregularly operating enterprises, this tactic delays tax payments and avoids audits. Some entities deliberately defer filing to legally exploit cash flow or evade inspections, which leads to significant penalties under Decree 125/2020/ND-CP.

3. Creating fake invoices or illegal invoice trading

One of the most common tactics is using invoices from inactive companies or fictitious firms to inflate costs and reduce taxes. These activities often involve organized networks and can lead to criminal prosecution.

4. Establishing shell companies to legitimize expenses

Shell companies are fake entities with no real business operations. They are created solely to issue invoices, allowing other businesses to record fictitious costs and evade taxes. This undermines fair market competition and is difficult to monitor.

5. Claiming undocumented or ineligible expenses

Examples include personal expenses, undocumented receipts, excessive hospitality costs, or fake payments to employees. These are excluded from deductible expenses and subject to back tax collection and fines.

6. Transfer pricing abuse

Multinational corporations shift profits to low-tax jurisdictions by manipulating the prices of intra-group transactions. This requires complex international cooperation and expert audits. Despite regulations, enforcement in Vietnam remains limited due to resource constraints.

7. Cross-border transactions and digital services

E-commerce and cross-border digital services present challenges for tax enforcement. Many foreign providers supplying services to Vietnam avoid tax registration and payment due to gaps in current policies and technical limitations.

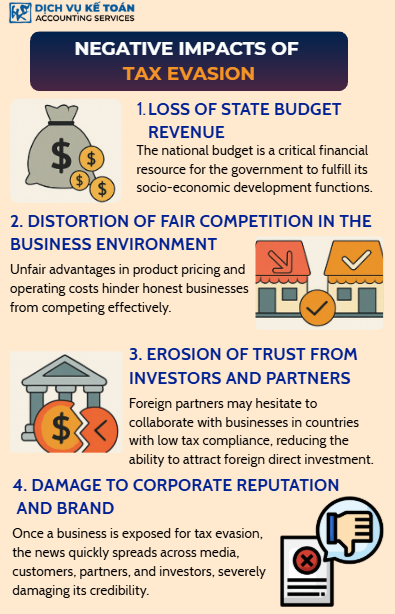

Negative Impacts of Tax Evasion

1. Loss of national revenue

Tax evasion deprives the state of vital financial resources, delaying public infrastructure projects and weakening social services such as healthcare and education.

2. Unfair competition

Tax-evading businesses gain artificial cost advantages, undermining legitimate competitors and distorting market dynamics.

3. Eroding investor and partner confidence

Frequent tax scandals reduce investor confidence in Vietnam’s transparency and market stability, affecting FDI and international cooperation.

Read more: FOREIGN COMPANY SERVICES – Accounting service in HCMC

4. Damaged corporate reputation

Businesses caught evading taxes face media scrutiny, loss of customer trust, contract cancellations, and a decline in shareholder value.

Legal Basis and Penalties

1. Tax Administration Law and guiding regulations

Vietnam’s Tax Administration Law (2019) and Decree 125/2020 provide the legal framework for defining, detecting, and penalizing tax violations.

2. Penal Code 2015 (amended 2017)

Serious tax evasion constitutes a criminal offense under Article 200, with fines up to VND 4.5 billion and imprisonment of up to 7 years.

3. Administrative penalties for businesses

Fines range from 20% to 300% of the evaded tax, plus late payment interest. Authorities may also suspend operations or revoke business licenses.

4. Criminal liability for individuals

Responsible persons, such as legal representatives and chief accountants, may face criminal charges, professional bans, and compensation liabilities.

5. Determining evaded tax and time limits

Authorities use tax filings, invoices, and third-party data. The statute of limitations is 5 years for administrative penalties and 10 years for criminal prosecution.

Tax evasion is a serious violation that harms national interests and corporate credibility. Understanding tax evasion practices, associated penalties, and implementing preventive measures is crucial for legal and sustainable business development.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).