Complying with tax obligations is a mandatory requirement for any business from the moment of its establishment. Taxes are not only a legal duty but also reflect a company’s responsibility to society and the state. However, understanding the types of taxes that need to be paid, how to file them, and the accompanying legal regulations can be quite complex. This article will help businesses grasp the essential types of taxes and important information to ensure legal compliance and avoid unnecessary risks.

What is Tax? The Role of Taxation for Businesses

Definition of Tax

Tax is a mandatory financial obligation that individuals and organizations must fulfill to the government. Unlike fees or service charges that have a direct exchange value, tax payments are non-refundable. Tax revenues are used to fund public services such as education, healthcare, infrastructure, and national defense.

Types of Taxes: Direct and Indirect Taxes

- Direct Taxes: Levied directly on the income or assets of taxpayers, such as Corporate Income Tax (CIT) and Personal Income Tax (PIT).

- Indirect Taxes: Applied to transactions or consumption, such as Value-Added Tax (VAT) and Special Consumption Tax (SCT). These taxes are usually included in the price of goods or services.

The Role of Taxation for Businesses

Taxation is not only a legal obligation but also a way for businesses to demonstrate compliance with the law. Proper tax payment helps businesses build credibility, avoid legal risks, and contribute to social development.

Consequences of Non-Compliance with Tax Obligations

Businesses that violate tax regulations may face administrative penalties, legal liability, or enforcement measures such as business suspension. This can severely impact the company’s reputation and operations.

Types of Taxes Businesses Must Pay

What is License Tax (Business License Fee)?

License tax, also known as the business license fee, is an annual tax imposed on businesses based on their charter capital or revenue.

Tax Rates: The license tax ranges from 300,000 to 3,000,000 VND per year, depending on the business size.

Exemption for Newly Established Businesses: According to Decree 22/2020/NĐ-CP, newly established businesses are exempt from license tax in their first year of operation.

Learn more: 10 Cases Exempt from License Tax Payment

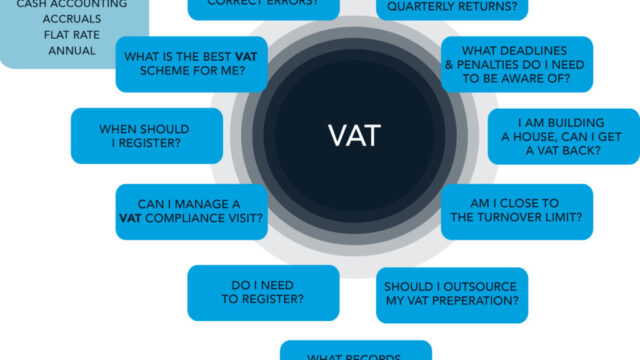

What is Value-Added Tax (VAT)?

Value-Added Tax (VAT) is an indirect tax imposed on the added value of goods and services at each stage of production and consumption.

VAT Declaration Methods:

- Deduction Method: Applied to large enterprises that issue VAT invoices and can deduct input VAT.

- Direct Method: Applied to small businesses that calculate VAT based on revenue without deducting input tax.

Learn more: What is VAT? Essential Information Accountants Should Know About Value-Added Tax

What is Corporate Income Tax (CIT)?

Corporate Income Tax (CIT) is applied to a company’s net profit after deducting reasonable expenses.

Current Tax Rates:

- The standard CIT rate is 20%.

- Certain specific industries may qualify for preferential tax rates lower than 20%.

Learn more: Corporate Income Tax and Essential Information You Need to Know

What is Personal Income Tax (PIT)?

Personal Income Tax (PIT) is applied to employees’ income, including salaries, bonuses, and other earnings.

Employer’s Responsibility:

Businesses are responsible for withholding and remitting PIT on behalf of their employees.

Current Family Deduction Rates:

- 11,000,000 VND/month for the taxpayer.

- 4,400,000 VND/month for each dependent.

Learn more: What is Personal Income Tax (PIT)? Definition and Legal Regulations

Other Specific Taxes

In addition to major taxes, businesses may be subject to Special Consumption Tax (SCT), Resource Tax, or Import-Export Tax, depending on their industry and operations.

Tax Declaration and Payment Process

Document Preparation Step

Preparing tax declaration documents is the first and crucial step to ensure a smooth filing process. Businesses must collect and organize relevant documents such as input and output invoices, payroll records, employment contracts, and other necessary paperwork.

Key Requirements:

- Documents must be prepared according to the official tax authority forms.

- Proper and complete preparation reduces errors during filing and verification.

- Missing or incorrect documents may result in rejected tax filings or penalties for non-compliance.

Using Electronic Tax Filing Software

Electronic tax filing software has become mandatory for most businesses. The HTKK (Tax Declaration Support) system provided by the General Department of Taxation allows businesses to submit tax returns online without visiting the tax office. This not only saves time but also improves accuracy.

Besides HTKK, other software like MISA and Fast also support tax filing. Businesses should ensure they regularly update their software to comply with the latest regulations.

Tax Payment Deadlines

Each type of tax has a specific deadline:

- License Tax: Must be paid before January 30 each year.

- VAT and PIT: Can be paid monthly or quarterly, depending on revenue size.

- CIT Finalization: Must be completed before March 31 of the following year.

Businesses should track their tax payment schedule to avoid delays, which can affect credibility and result in late payment penalties.

Common Mistakes in Tax Filing

Errors in tax filing are common, especially for new businesses. Some frequent mistakes include:

- Entering incorrect figures.

- Forgetting to declare certain income or expenses.

- Not attaching required supporting documents.

These errors can result in rejected tax filings or requests for additional documentation. Businesses should carefully review their tax filings before submission to minimize risks.

Tax Account Security

Electronic tax accounts are essential for tax submission. Businesses must secure their account information to prevent misuse or cyberattacks.

Key security measures include:

- Regularly updating passwords.

- Not sharing login details with unauthorized individuals.

- Using security software to prevent unauthorized access.

Latest Legal Regulations on Taxation

License Tax Exemption for New Businesses

According to Decree 22/2020/NĐ-CP, newly established businesses are exempt from license tax in their first year of operation. This policy aims to encourage startups and support small businesses during their initial challenging phase.

✅ Important Notes:

- Businesses must accurately declare their tax exemption in the initial tax declaration.

- Late or incorrect filings may still result in administrative penalties.

Updated VAT Rates for Certain Industries

The standard Value-Added Tax (VAT) rate is 10%. However, specific industries such as tourism, public transportation, and education qualify for a preferential 5% VAT rate to support post-pandemic economic recovery.

✅ Business Impact:

- This tax reduction lowers costs and stimulates consumer demand.

- Businesses in these sectors should stay updated on policy changes to maximize tax benefits.

Corporate Income Tax (CIT) Incentives

Companies operating in high-tech, scientific research, and environmental protection sectors may qualify for preferential CIT rates ranging from 10% to 15%.

✅ Key Considerations:

- Tax incentives can apply for 5 to 10 years, depending on the industry.

- To qualify, businesses must register with tax authorities and meet specific criteria, such as investment scale and economic impact.

Stricter Tax Penalty Regulations

Tax violation penalties have been tightened to enhance compliance. Late payments, incorrect declarations, or tax evasion now face stricter fines.

✅ New Penalty Rates:

- Late payment penalty: 0.03% per day.

- Maximum fines can reach hundreds of millions of VND.

- Businesses must strictly comply with tax laws to avoid financial penalties.

Tax Payment Extensions in Special Cases

The government has issued decrees allowing extensions for VAT, CIT, and PIT payments in special cases like natural disasters, pandemics, or economic downturns.

✅ How to Apply for an Extension:

- Businesses must submit a formal request on time to be considered for an extension.

- This measure helps companies ease financial pressure and maintain operations during difficult periods.

Business Tax Support Services

Benefits of Using Tax Support Services

Tax support services help businesses file and pay taxes on time, while minimizing errors and compliance risks. Additionally, tax experts can provide strategic advice on how businesses can legally benefit from tax incentives, leading to cost savings and improved operational efficiency.

Legal Tax Consulting

One of the biggest advantages of tax support services is detailed legal consulting. This includes:

- Updating businesses on the latest tax regulations.

- Guiding tax document preparation.

- Answering tax-related queries to help businesses avoid legal violations.

This service ensures businesses comply with tax laws and avoid unnecessary penalties.

Online Tax Filing and Payment Assistance

Modern tax support services go beyond traditional tax filing; they also assist with electronic tax submission through government portals. This ensures accuracy and efficiency, making it particularly beneficial for large businesses handling complex tax data.

Tax Auditing and Risk Management

Tax auditing is a crucial part of tax support services. It helps businesses identify potential errors and risks early, allowing them to:

- Improve internal tax processes.

- Be better prepared for tax inspections.

- Avoid unexpected fines and penalties.

Cost-Effective and High Efficiency

Tax support services are available at reasonable costs, making them suitable for businesses of all sizes. The benefits of minimizing risks and optimizing tax costs far outweigh the initial investment, allowing businesses to focus on their core activities.

Ensuring Tax Compliance for Sustainable Business Growth

Understanding different types of taxes and fulfilling tax obligations is essential for business sustainability and legal compliance. Key taxes, including License Tax, VAT, Corporate Income Tax (CIT), and Personal Income Tax (PIT), provide a solid legal foundation for businesses.

Using professional accounting services can help businesses manage taxes efficiently, save time, and focus on growth. Regularly updating tax regulations is crucial to ensure timely compliance and avoid penalties.For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).