Should small businesses hire an accountant? Discover the key benefits of using professional accounting services.

Should small businesses hire an accountant? With terms like “outsourced accounting” and “accounting for small businesses,” this article explores why accounting is essential for the sustainable growth of your business.

- Do Small Businesses Need to Hire an Accountant?

- What Are the Benefits When Small Businesses Hire an Accountant?

- Risks When Small Businesses Lack Professional Accounting

- Comparison Between In-House and Outsourced Accounting

- When Should Small Businesses Consider Using Accounting Services?

- Criteria for Choosing Suitable Accounting Services for Small Businesses

Do Small Businesses Need to Hire an Accountant?

In the early stages of startup and initial operations, many small business owners often wonder whether hiring an accountant is truly necessary. With limited budgets and resources, some businesses opt to handle accounting themselves using software or assign it to a multitasking employee. However, the question arises: is this approach truly effective and sustainable?

This article delves into the role of accounting for small businesses, the benefits of utilizing professional accounting services, and the risks of neglecting financial accounting in business operations.

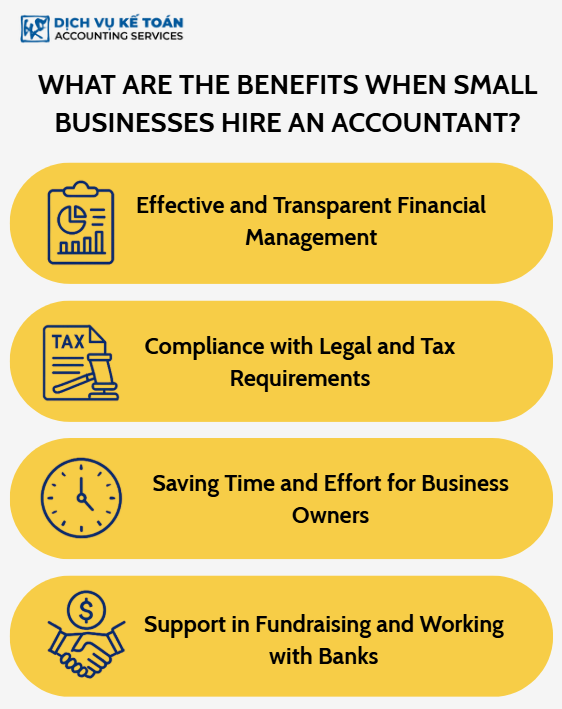

What Are the Benefits When Small Businesses Hire an Accountant?

Hiring an accountant—whether as an internal staff member or through outsourced accounting services—brings numerous practical benefits to small businesses.

1. Effective and Transparent Financial Management

A well-structured accounting system helps small businesses control cash flow, understand income and expenses, determine break-even points, and assess business performance over time. This foundation enables business owners to make accurate decisions, from cost adjustments to investment strategies.

2. Compliance with Legal and Tax Requirements

Vietnam’s Accounting Law and Tax Law clearly stipulate obligations regarding bookkeeping, financial reporting, VAT declarations, corporate income tax, personal income tax, etc. A professional accountant ensures all procedures are correctly executed, helping businesses avoid administrative penalties.

3. Saving Time and Effort for Business Owners

Instead of grappling with numbers, invoices, and tax reports, business owners can focus on core activities like sales, market development, and customer care.

4. Support in Fundraising and Working with Banks

A clear and transparent accounting system builds trust with investors and financial institutions.

Risks When Small Businesses Lack Professional Accounting

Not having a professional accountant isn’t just a staffing shortfall; it leads to numerous financial, legal, and operational risks.

1. Incorrect Tax Declarations – Penalties or Back Taxes

Tax regulations in Vietnam frequently change. If the person handling accounting isn’t up-to-date with new circulars or decrees, the business may face incorrect declarations, missed taxes, or even forgotten filings. This can result in administrative fines and back taxes over multiple years, severely impacting cash flow.

2. Lack of Reliable Data for Management

Accounting isn’t solely for tax purposes; it’s a tool for business owners to “see” their company’s financial health. Without accurate accounting data, owners can’t determine actual net profits, inventory levels, or assess the risk of receivables.

3. Ineligibility for Audits or Fundraising

One key criterion when seeking investment or applying for government or bank support programs is having transparent financial reports, prepared according to accounting standards and auditable if necessary. Without professional accounting, or with poorly prepared reports, investors may question the business’s transparency and financial management capabilities.

Damage to Image and Reputation

A minor accounting error can attract scrutiny from tax authorities. If a business is publicly listed as a violator or faces tax enforcement, it not only disrupts operations but also tarnishes the company’s image. In today’s era of transparency, this is particularly dangerous for small businesses building trust with partners and customers.

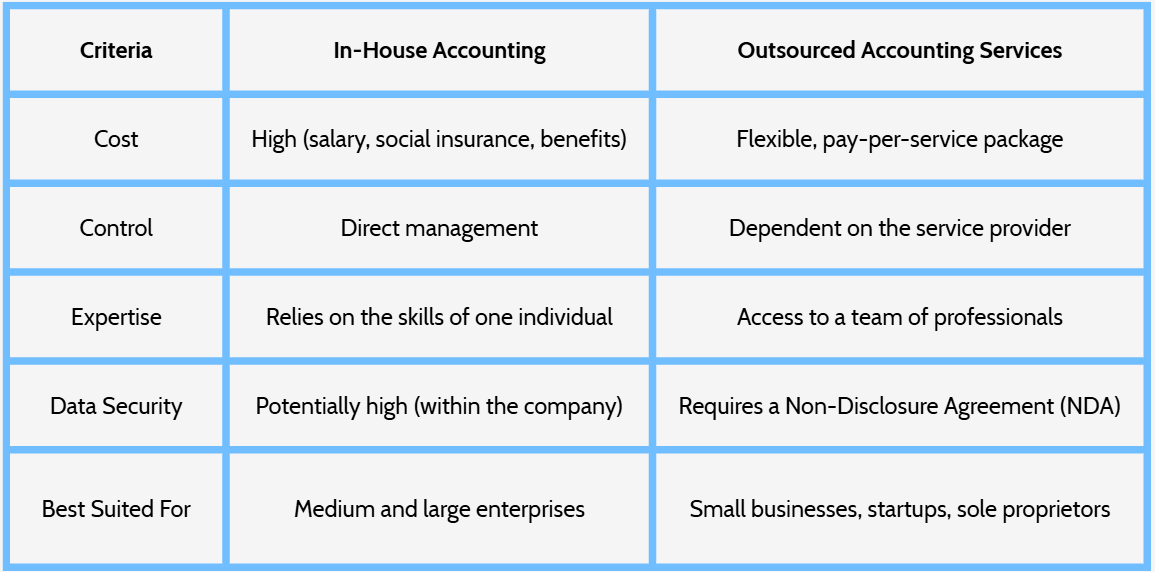

Comparison Between In-House and Outsourced Accounting

Both in-house accounting and outsourced accounting services have their own pros and cons. Businesses need to consider their needs and resources.

When Should Small Businesses Consider Using Accounting Services?

Not all small businesses need to hire an accountant from the outset, but in the following cases, using accounting services is necessary:

When the Business Starts Generating Regular Monthly Revenue

At this point, cash flow becomes complex, requiring an accountant to monitor and report.

When Required to Declare Taxes and Prepare Financial Reports

According to regulations, businesses must declare taxes quarterly and prepare annual reports. Doing this independently can easily lead to errors without expertise.

When Working with Banks or Investors

This is when businesses need to demonstrate professionalism and transparency through accounting records.

When Aiming to Save Time and Resources

Instead of recruiting and training in-house accountants, small businesses can use outsourced accounting services to optimize costs.

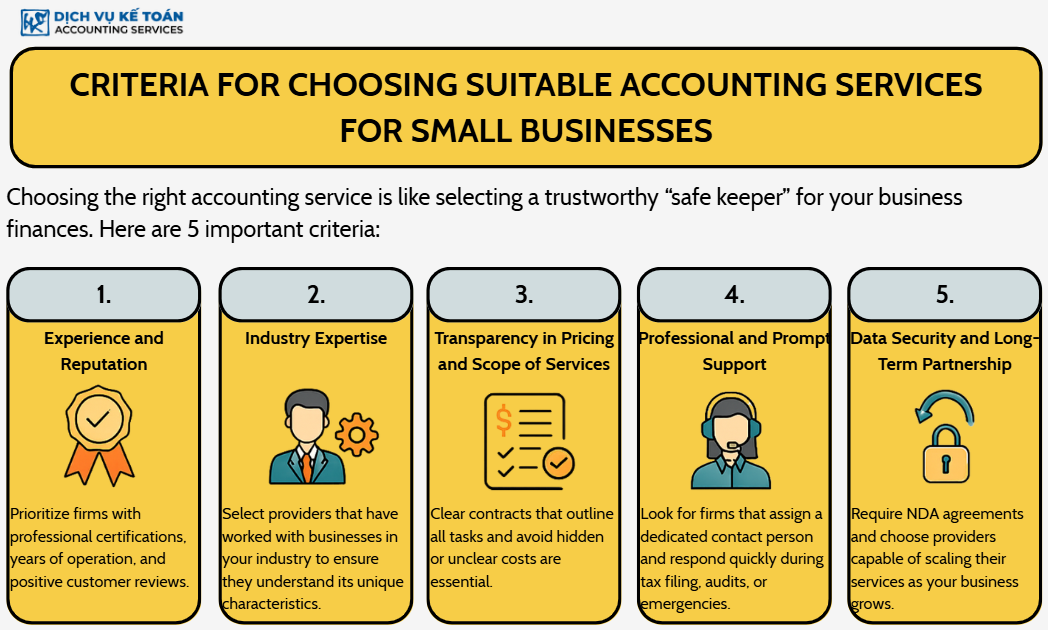

Criteria for Choosing Suitable Accounting Services for Small Businesses

Selecting appropriate accounting services is akin to finding a trustworthy “safe keeper” for your business. Here are important criteria not to overlook:

1. Experience and Reputation

Prioritize accounting firms with years of operation, certified professionals, and experience with various business types. Research customer reviews, feedback on Google Reviews, social media, or business forums.

2. Understanding of Your Industry

Accounting for the trade sector differs from construction, manufacturing, logistics, or services. Choosing a firm experienced in your field ensures smoother collaboration and time savings.

3. Clear and Transparent Service Pricing

A reputable accounting service always discloses service packages, clearly listing included items—from tax declarations, financial reporting to tax finalization support, and financial management consulting.

4. Prompt and Professional Support

Quick response times and readiness to assist during critical periods like tax declarations, finalizations, or unexpected incidents are crucial. Prefer firms with diverse customer support channels (email, Zalo, hotline, online accounting software) and dedicated personnel for your business.

5. Data Security and Long-Term Commitment

Accounting documents contain sensitive information related to business operations and finances. Therefore, businesses should require a confidentiality agreement (NDA) with the service provider. Additionally, choose partners willing to upgrade services as your business grows, avoiding disruptions from changing providers.

The question “Do small businesses need to hire an accountant?” is no longer about whether to hire, but rather how and when to hire, and which provider to choose for optimal efficiency. A professional accounting system not only ensures legal compliance but also serves as a foundation for sustainable management and development.

If you’re a small business owner, seriously consider using outsourced accounting services today to avoid risks and create advantages for the future.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).