Guidelines for determining the correct VAT declaration period for businesses. Apply correctly monthly or quarterly to avoid penalties. Determining the VAT declaration period is an important step for businesses to comply with tax laws. Depending on revenue, the “VAT declaration period” can be monthly or quarterly, helping to optimize tax management and avoid the risk of penalties.

What is the Determination of VAT Filing Period?

The value-added tax (VAT) filing period is the time frame within which businesses must prepare and submit VAT declarations and remit the tax arising during that period to the tax authority. Determining the correct filing period is crucial for complying with tax laws, avoiding administrative penalties, and managing the business’s cash flow effectively. Currently, businesses may choose to declare VAT either monthly or quarterly, depending on specific conditions outlined in Circular 80/2021/TT-BTC and the Law on Tax Administration.

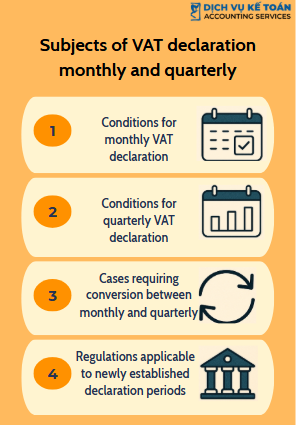

Applicable Entities for Monthly and Quarterly VAT Filing

1. Conditions for Monthly VAT Filing

Businesses with total revenue from the sale of goods and provision of services in the preceding year exceeding VND 50 billion must file VAT returns monthly. The tax authority will determine the revenue based on the previous year’s final tax return as a classification basis.

2. Conditions for Quarterly VAT Filing

Businesses with total revenue in the preceding year of VND 50 billion or less may opt to file VAT returns quarterly. This option is more favorable for small enterprises as it reduces the frequency of reporting and eases cash flow pressure in the short term.

3. Mandatory Switching Between Monthly and Quarterly Filing

Businesses can only redefine their VAT filing period at the beginning of each calendar year. If their revenue in the previous year rises above or falls below the VND 50 billion threshold, they must apply the corresponding filing period for the following year. Filing periods cannot be changed mid-year, even if revenue fluctuates during the current year.

4. Rules for Newly Established Enterprises

Newly established businesses that have not yet determined their revenue will default to quarterly VAT filing. After completing the first fiscal year, the actual revenue will serve as the basis for determining the filing period for the following year.

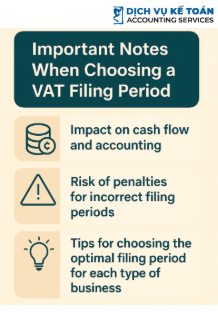

Key Considerations When Choosing a VAT Filing Period

1. Impact on Cash Flow and Accounting

Quarterly filing helps reduce pressure on short-term cash flow and accounting costs. Conversely, monthly filing requires businesses to frequently prepare reports and meet tax payment deadlines.

2. Risk of Penalties Due to Incorrect Filing Period

Choosing the wrong filing period may result in administrative penalties by the tax authority, or even tax reassessment if significant errors occur. Understanding the proper filing schedule helps businesses avoid such risks.

3. Tips for Choosing the Optimal Filing Period by Business Type

-Businesses with fluctuating revenue should consider quarterly filing for better cash flow control.

-Businesses frequently requesting VAT refunds should opt for monthly filing to shorten refund processing time.

-Export businesses or those operating in sectors with high input VAT rates should prioritize monthly filing to take advantage of faster VAT refund opportunities.

Frequently Asked Questions about VAT Filing Periods

1. Can the VAT filing period be changed mid-year?

No. Filing periods are determined and may only be changed at the beginning of the calendar year. Throughout the year, businesses must follow the registered period or the one notified by the tax authority.

2. What if the business has no revenue during a filing period?

The business must still prepare and submit the VAT return on time, even if there is no revenue during that period. Late submission may still result in penalties.

3. How does the filing period affect VAT refunds?

The filing period affects the timing of VAT refund processing. Quarterly filing generally results in longer refund timelines compared to monthly filing. Businesses should consider this factor when selecting their appropriate filing period.

Correctly determining the VAT filing period helps businesses comply with tax laws, optimize tax administration processes, and avoid the risk of penalties. Depending on the business scale and operational characteristics, companies should proactively review annual revenue and register the suitable filing period. If uncertain, consulting an accountant or tax expert is highly recommended for the best outcome.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).