Discover how professional accounting services can help you save costs and ensure legal

Accounting services are essential for modern businesses. With “accounting services”, professional accounting, and accounting service providers, you can minimize risks and enhance operational efficiency.

What is Accounting Service?

Accounting services are professional solutions provided to businesses for managing financial tasks such as bookkeeping, financial reporting, tax filing, auditing, and legal compliance related to finances. These services help businesses save costs, ensure legal compliance, and avoid tax and legal risks, while optimizing their financial management.

With a team of professional accountants and advanced accounting software, these services ensure accurate and timely execution of accounting tasks, allowing businesses to focus on their core activities.

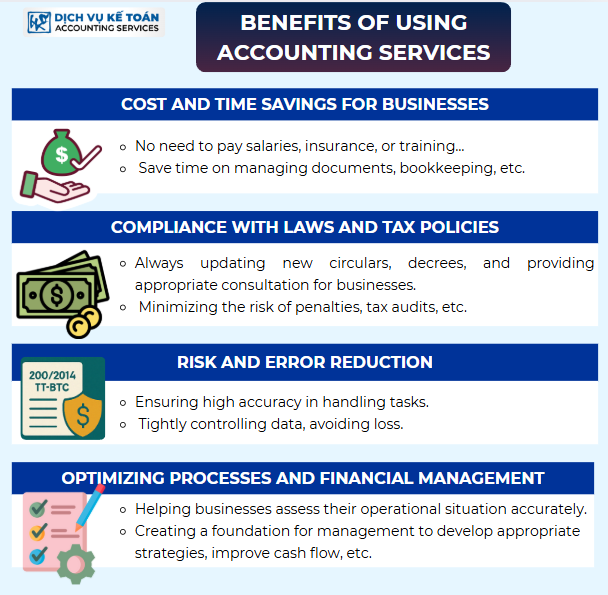

Benefits of Using Accounting Services

1. Cost and Time Savings for Businesses

Maintaining an internal accounting department requires significant costs, including salaries, insurance, training, and recruitment. By outsourcing accounting services, businesses can reduce these costs and pay for flexible and efficient services. Additionally, outsourcing accounting tasks helps save time, as these services utilize professional processes and technology to handle documents and financial reports efficiently.

2. Ensuring Legal Compliance and Taxation Policy Adherence

Vietnam’s tax laws change frequently and are complex, which can be challenging for small and medium-sized enterprises (SMEs) to stay updated and comply with. Professional accounting services help businesses keep track of the latest legal updates and ensure compliance with tax regulations, thus minimizing the risk of penalties or tax audits.

3. Reducing Risks and Errors in Bookkeeping

Accounting errors can lead to serious consequences, such as financial imbalances or issues with tax authorities. With a team of experienced professionals and modern accounting software, accounting services ensure high accuracy in handling invoices, records, and financial reports. These systems also provide tight control over data and prevent asset leakage.

4. Optimizing Financial Management Efficiency

Accounting services help businesses generate detailed and transparent financial reports, enabling them to accurately assess their financial position. These reports not only track revenues, costs, and profits but also analyze financial indicators such as liquidity ratios, capital turnover, and profitability. This information is essential for business leaders to make informed decisions, optimize cash flow, and improve their competitive edge.

Read more: FOREIGN COMPANY SERVICES – Accounting service in HCMC

Common Types of Accounting Services

1. Full-Service Accounting

Full-service accounting is an ideal solution for businesses that do not have an in-house accounting department or do not wish to set one up. This service includes everything from bookkeeping, financial reporting, tax filing, to providing consultation on tax settlement and representation in dealings with tax authorities. The major benefit of full-service accounting is cost-saving and time optimization for the business.

2. In-House Accounting Services

In-house accounting services focus on managing day-to-day financial activities, controlling cash flow, and overseeing daily operations. This service includes building an internal, transparent, and scientific bookkeeping system that allows businesses to quickly grasp their financial situation. In addition, in-house services help businesses analyze costs and optimize financial resources, enhancing operational efficiency.

3. Audit and Financial Reporting Services

For businesses that need to raise capital, secure bank loans, or undergo mandatory audits, financial reporting services are essential. These services ensure that financial reports are prepared according to Vietnamese Accounting Standards (VAS), fully, accurately, and transparently. Additionally, these services support independent audits and provide explanations of financial data when required by tax authorities or partners.

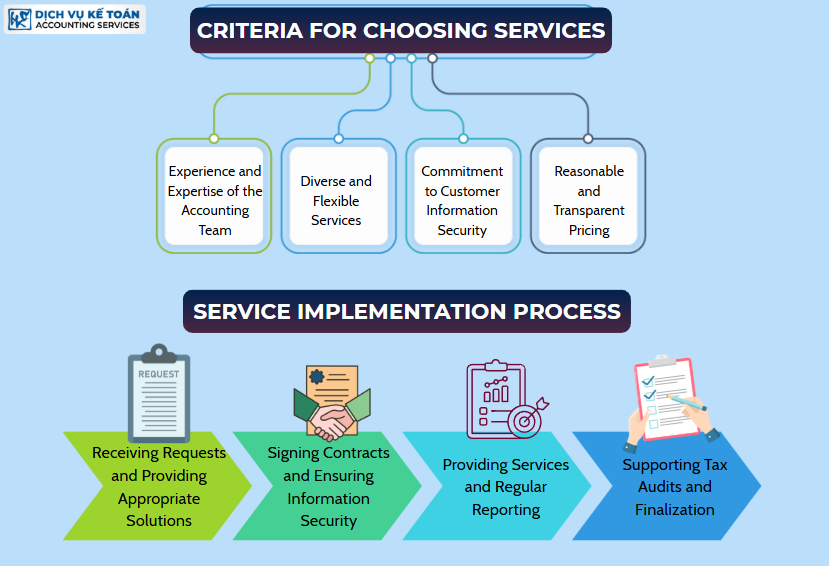

Criteria for Choosing a Reliable Accounting Service Provider

1. Experience and Expertise of the Accounting Team

A reliable accounting service provider should have a team of experienced professionals with relevant certifications and up-to-date knowledge. The team must understand the accounting procedures for different types of businesses (such as commercial, manufacturing, construction, and services) to provide the most optimal solutions.

2. Diverse and Flexible Service Offerings

A trusted accounting service company should offer various service packages to meet the needs of a business at different stages of development. From basic packages to advanced services, from full-service accounting to partial services like financial reporting, tax filing, and periodic audits, the company should offer tailored solutions for each client.

3. Data Security and Customer Privacy Commitment

Accounting documents contain sensitive business information. Therefore, an accounting service provider should have strict security procedures to protect client data. The contract should clearly outline the responsibility and liabilities related to data privacy, ensuring the security of financial information.

4. Transparent and Reasonable Pricing

A professional accounting service provider will offer clear and transparent pricing upfront, with no hidden fees. Pricing will be based on the scope and scale of services required by the business, with several pricing packages available to suit different industries and business sizes.

Accounting Service Implementation Process

1. Initial Consultation and Tailored Solutions

When a business contacts the accounting service provider, the company will gather information about the business model and specific needs. Based on this, the service provider will offer tailored solutions suited to the industry, scale, and growth objectives of the business.

2. Contract Signing and Data Security

Once the scope of work and service fees are agreed upon, both parties will sign a detailed contract with clear terms about progress, responsibilities, and data protection. This contract serves as a legal foundation to protect both parties’ interests.

3. Service Execution and Periodic Reporting

The accounting service provider will assign a dedicated staff member to handle the business’s bookkeeping, tax filing, and financial reporting on a periodic basis. All processes will be digitized and securely stored to ensure transparency and accuracy.

4. Tax Auditing and Tax Settlement Support

When tax authorities conduct audits or inspections, the accounting service provider will assist the business in preparing documentation, explaining data, and defending their rights, thereby minimizing the risk of tax penalties or tax arrears.

Using accounting services enables businesses to reduce costs, mitigate risks, and ensure compliance with legal regulations while optimizing their financial management. Choosing a reliable accounting service provider with experienced professionals and flexible services will be a key factor in a business’s long-term sustainability and competitive advantage. High-quality accounting services are essential for businesses to establish their position in the market and develop effective management strategies.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).