The conditions for merging the financial statements of a newly established enterprise within the last 90 days of the year are in accordance with Vietnamese accounting regulations. According to regulations, the conditions for merging the financial statements of an enterprise are applied when a newly established enterprise is within 90 days before the end of the fiscal year, allowing the report to be merged into the following year.

What is the Consolidation of Financial Statements for Enterprises?

The condition for consolidating financial statements (FS) of an enterprise is a special regulation that allows newly established enterprises within a short time before the end of the fiscal year to choose to consolidate the FS of their founding year into the following fiscal year. This regulation is not mandatory but is a reasonable option to reduce accounting workload, save costs, and align with the initial operational setup of the enterprise.

According to Circular 200/2014/TT-BTC and its guiding documents, if a business is established within 90 days before the end of the fiscal year, it is permitted not to prepare a separate FS for the first year but to consolidate it with the FS of the following year. However, this only applies if there is no special request from tax authorities, auditors, investors, or other relevant parties to prepare separate reports.

Reasons for Allowing FS Consolidation into the Next Year

1. Legal regulations on the fiscal year and timing of enterprise establishment

According to the Accounting Law and related guiding documents, the fiscal year is usually determined from January 1 to December 31. However, newly established enterprises may face special situations where the actual operating time in the first year is too short to reflect business efficiency. Preparing a separate FS for only a few weeks of operation will not accurately reflect the financial status and may lead to resource waste.

Therefore, the law allows newly established enterprises within 90 days before the fiscal year ends to choose to consolidate the report into the following year. This is a flexible mechanism that aligns with practical enterprise management.

2. Why the 90-day threshold? Practical significance

The 90-day period was chosen to ensure a balance between providing truthful, reasonable financial information and reducing administrative procedures for newly established businesses. In the last three months of the year, most enterprises are still in the preparation stage—recruiting, completing licenses, and have not incurred many economic transactions. Therefore, mandatory separate reporting may not accurately reflect operational realities.

The 90-day period is also reasonable for managers to consider whether to consolidate and to organize accounting properly from the beginning.

Procedures and Documentation for FS Consolidation

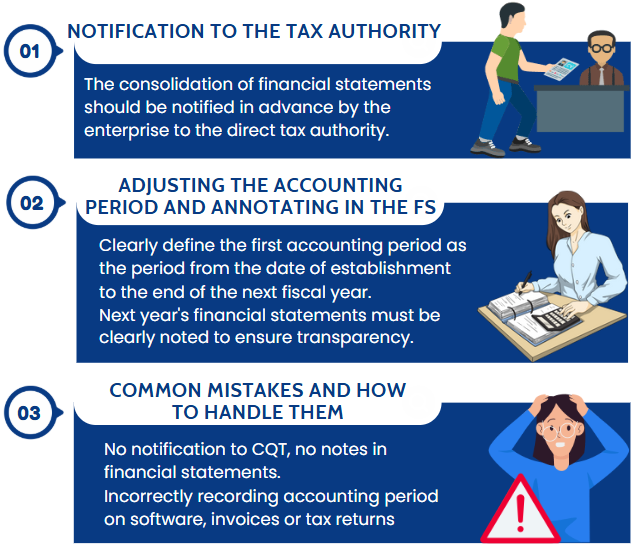

1. Notification to the Tax Authority

Prepare an official letter requesting FS consolidation and submit it directly to the Tax Authority at the enterprise’s registered office. The letter must clearly state the reason, demonstrate that the enterprise meets the conditions, and cite the applicable legal basis.

FS consolidation should be notified in advance to the tax authority managing the enterprise to avoid misunderstandings regarding the omission of reporting obligations for the first year.

2. Adjusting the accounting period and annotating in the FS

The enterprise must clearly define the first accounting period as spanning from the establishment date to the end of the next fiscal year. In the FS of the following year, it must be clearly annotated that: “The financial statements include data from the first year (from establishment date to December 31 of the following year) in accordance with Circular 200…” to ensure transparency.

3. Common mistakes and how to handle them

Some enterprises fail to notify the tax authority or omit annotation in the FS, leading to administrative penalties or being asked to submit additional reports. Additionally, incorrectly recording the accounting period in software, invoices, or tax declarations can cause confusion.

The solution is to review all documents and accounting systems from the beginning and consult with a tax accountant to ensure compliance.

Tax and Audit Considerations When Consolidating FS

1. Impact on tax finalization in the first year

When consolidating FS, enterprises still need to declare and pay applicable taxes incurred in the first year (if any), such as VAT, business license tax, and personal income tax. Although no separate FS is prepared, these data must still be compiled and stored for inspection and audit purposes.

In particular, the business license tax must still be paid in the founding year (unless exempted under Decree 22/2020/ND-CP).

2. Auditing and transparency in the following year

If the enterprise is subject to auditing, the auditor must be provided with full documentation for the entire first year, even if consolidated. The audit must ensure complete data to issue an appropriate audit opinion.

Additionally, investors, banks, or partners may request clarification of the reason for report consolidation, so enterprises must prepare full supporting documents to enhance reliability.

The consolidation of financial statements for newly established enterprises is a flexible regulation that facilitates startup operations in the early stages. However, to apply it correctly and avoid legal risks, businesses must clearly understand the conditions, procedures, and fully perform tax declaration obligations during the consolidation period. Planning accounting from the outset, notifying tax authorities, and ensuring transparency in FS will help businesses save costs while ensuring compliance with Vietnam’s accounting regulations.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).

Click register now to get the form here