Minutes of replacing erroneous electronic invoices according to Decree 70/2025/ND-CP, updated with new and valid processing procedures. Minutes of replacing erroneous electronic invoices according to Decree 70/2025/ND-CP are important content to help businesses handle invoice errors in accordance with regulations. Let’s learn how to apply minutes of replacing electronic invoices, minutes of adjusting invoices according to the latest standards.

- What is the adjustment record of erroneous e-invoices under Decree 70/2025/NĐ-CP?

- Handling e-invoice errors under Decree 70/2025/NĐ-CP

- Guide to preparing an adjustment record for e-invoices under Decree 70/2025/NĐ-CP

- Responsibilities and penalties for not preparing adjustment records in accordance with regulations

What is the adjustment record of erroneous e-invoices under Decree 70/2025/NĐ-CP?

The adjustment record of an erroneous e-invoice is a document that records the agreement between the seller and the buyer upon discovering errors in an already issued e-invoice that needs to be replaced by a new one.

According to Point b, Clause 2, Article 19 of Decree 123/2020/NĐ-CP, amended by Clause 13, Article 1 of Decree 70/2025/NĐ-CP:

“Before adjusting or replacing erroneous e-invoices as prescribed at Point b of this Clause, in cases where the buyer is an enterprise, economic organization, other organization, business household, or individual business, the seller and buyer must prepare a written agreement clearly stating the error. If the buyer is an individual, the seller must notify the buyer or post the notification on the seller’s website (if any). The seller shall retain the written agreement and present it upon request.”

Handling e-invoice errors under Decree 70/2025/NĐ-CP

1. Abolishment of the regulation on e-invoice cancellation

Previously, under Decree 123/2020/NĐ-CP, when errors were found in issued e-invoices, businesses were required to cancel the erroneous invoice and issue a new one.

However, Clause 13, Article 1 of Decree 70/2025/NĐ-CP amending Article 19 of Decree 123/2020/NĐ-CP specifies that erroneous e-invoices are no longer required to be canceled. Instead, businesses must apply methods of adjustment or replacement for the incorrect e-invoice.

2. Error handling in e-invoices

In cases where the company name or buyer’s address is incorrect, but the tax code is accurate and tax obligations are not affected:

-The seller must notify the tax authority of the erroneous e-invoice using Form 04/SS-HĐĐT via the enterprise’s e-invoice system.

-Notify the buyer. No need to issue a new invoice.

If errors involve the tax code, product price, VAT rate, tax amount, or incorrect product/service descriptions, the seller may choose to prepare an adjustment or replacement invoice.

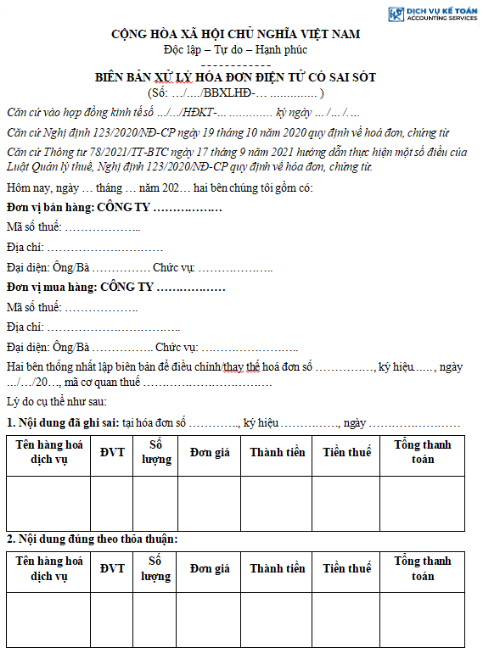

Guide to preparing an adjustment record for e-invoices under Decree 70/2025/NĐ-CP

1. Latest adjustment record template

Businesses must use a template that complies with current regulations. The adjustment record should include the following:

-Information of the seller and buyer

-Details of the original invoice (number, code, issue date)

-Description of the error

-Corrected/replacement content

-Confirmation and signature of both parties

2. Important notes:

It is mandatory to prepare an adjustment record between the seller and buyer before making any adjustments/replacements (for organizations, businesses, and business households).

Businesses are allowed to issue one adjustment/replacement invoice for multiple erroneous invoices in the same month and for the same customer.

If a previous adjustment method has been applied to an invoice, subsequent handling must follow the same method. Switching from adjustment to replacement or vice versa is not allowed.

3. Time and deadline for making a record according to Decree 70/2025/ND-CP

There is no definition tool on the limit of adjusting the installation amplitude or replacing after detecting a defect.

However, to ensure the prescribed maintenance and avoid legal risks, the seller should make the adjustment or replacement as soon as possible after detecting the defect and completing the record of agreement with the buyer.

Responsibilities and penalties for not preparing adjustment records in accordance with regulations

1. Responsibilities of the seller and buyer

-Seller is primarily responsible for reviewing, detecting, and initiating contact with the buyer to prepare the adjustment record.

–Buyer must cooperate to confirm the error and sign the adjustment record.

-Both parties must retain the documentation as required by law.

2. Administrative penalties under Decree 70/2025/NĐ-CP

Applicable penalties may include:

-A fine from VND 2,000,000 to VND 5,000,000 for failure to prepare an adjustment record for invoice errors.

-A fine of up to VND 10,000,000 if the error affects tax obligations and no adjustment record is made.

-Depending on severity, the tax authority may require re-filing or impose tax assessments.

The adjustment record for erroneous e-invoices is a critical legal tool that enables businesses to promptly correct errors without affecting their tax obligations. Understanding the provisions in Decree 70/2025/NĐ-CP helps ensure proper procedures, avoids penalties, and promotes transparency in accounting and financial operations.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).

Click register now to get the form here