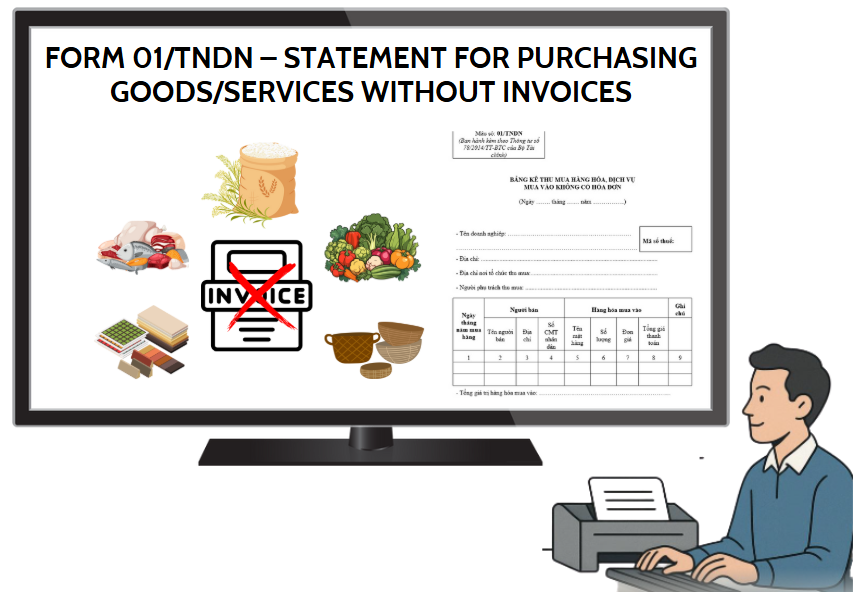

Form 01/TNDN – List of purchased goods/services without invoices according to the latest regulations. Form 01/TNDN – List of purchased goods/services without invoices is an important accounting form for businesses when purchasing from individual households. This article will guide you on how to make Form 01/TNDN correctly and effectively.

What is Form 01/TNDN – Statement for Purchasing Goods/Services without Invoices?

Form 01/TNDN is an official form issued by the Ministry of Finance of Vietnam to record the purchase of goods or services from individuals or households who are unable to provide invoices.

Preparing this statement allows enterprises to declare and legitimize deductible expenses when calculating corporate income tax (CIT), ensuring tax compliance at year-end settlement and avoiding cost exclusion during tax inspections.

Applicable Subjects and Conditions for Using Form 01/TNDN

1. Applicable subjects

Form 01/TNDN applies to enterprises purchasing goods or services from individuals or non-business households who do not issue invoices but have valid sales documentation as prescribed.

According to Article 4 of Circular No. 96/2015/TT-BTC, business expenses without invoices may still be deductible (valid expense) if documented with Form 01/TNDN (attached to Circular No. 78/2014/TT-BTC) in the following cases:

– Purchasing agricultural, forestry, or aquatic products directly from producers or fishermen.

– Purchasing handmade products made from jute, sedge, bamboo, rattan, straw, coconut shell, or agricultural by-products from non-business artisans.

– Purchasing sand, gravel, stone, or soil directly from individuals or households that extract and sell.

– Purchasing scrap or recyclable materials collected by individuals.

– Buying assets or services from non-business individuals or households.

– Buying from individuals/households earning less than the VAT threshold (under VND 100 million/year).

2. Conditions

– Form 01/TNDN is used when purchasing goods or services under VND 20 million per transaction without a legal VAT invoice, provided the transaction meets the subject conditions.

– In these cases, the statement serves as a valid substitute for an invoice to record the expense.

3. Real-life examples

– Steel company buying scrap metal from small street collectors.

– Seafood restaurant buying fresh fish and shrimp directly from fishermen at the port.

– Travel company buying handmade bamboo gifts from local artisans to present to clients.

– Company hiring a freelance plumber to repair a broken pipe.

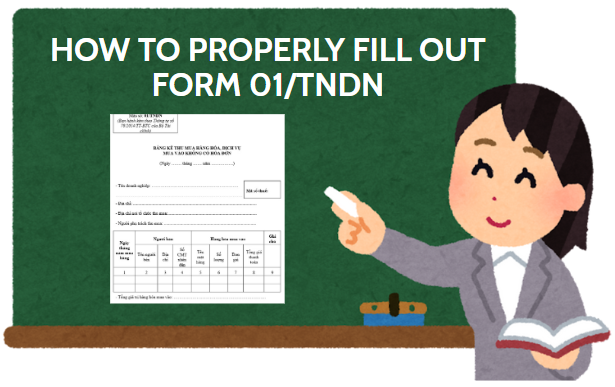

How to Properly Fill Out Form 01/TNDN

1. Form content

The form should include:

– Enterprise information: name, address, tax code

– Person responsible for procurement

– Detailed purchasing address

2. Statement structure

– Column 1: Date of purchase

– Column 2: Seller’s name

– Column 3: Seller’s address

– Column 4: Seller’s Citizen ID number

– Column 5: Name of purchased goods/services

– Column 6: Quantity

– Column 7: Unit price

– Column 8: Total amount paid

– Column 9: Notes (timing, product quality, additional costs, etc.)

3. Notes when preparing and signing the form:

– Besides the person in charge of procurement, the form must be signed by the legal representative of the company and stamped with the company seal.

– Retain the statement along with all relevant documents (payment slips, delivery notes, seller’s ID copies, or verification documents).

Form 01/TNDN is a crucial tool to help businesses legitimize expenses incurred from non-invoice purchases. However, to be accepted during tax finalization, businesses must understand the regulations, prepare the form accurately, and attach all required supporting documents.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).

Click register now to get the form here