The chief accountant is an important position in every business, responsible for managing finances, overseeing accounting activities, and ensuring compliance with legal regulations. However, recruiting the right chief accountant is not always easy. This article will help you understand the role of the chief accountant, the necessary requirements, and key considerations when hiring for this position in a business.

What is a Chief Accountant?

Main Role of the Chief Accountant

The chief accountant plays the role of overseeing the financial operations of a business, ensuring that all transactions are recorded in accordance with regulations. They also assist the management in making strategic financial decisions based on accurate data. In addition, the chief accountant must ensure that financial reports are prepared on time, comply with current accounting regulations, and support other departments in managing budgets.

Daily Tasks of the Chief Accountant

The daily tasks of a chief accountant include reviewing accounting records, overseeing the preparation of financial reports, monitoring cash flow, and ensuring that income and expenses are recorded accurately and legally. They are also responsible for budgeting, verifying and analyzing financial data to detect errors or fraud, and implementing appropriate measures to maintain the financial stability of the business.

Difference Between a Chief Accountant and an Accountant

An accountant primarily performs tasks such as record-keeping and financial reporting, while the chief accountant manages, supervises, and makes decisions regarding the company’s financial strategy. The chief accountant needs to have the ability to coordinate the work of the entire accounting department, plan long-term finances, and provide optimal solutions to ensure effective financial operations.

Skills and Experience Requirements

A chief accountant needs to have management, financial analysis, strategic planning, and communication skills, along with the ability to work with stakeholders. Additionally, they should have experience in the accounting field, possess relevant professional certifications, and understand the legal regulations related to corporate finance.

Importance of the Chief Accountant in a Business

The chief accountant ensures that the business always complies with accounting regulations, helping the business avoid financial risks and supporting sustainable development. They also serve as a bridge between the business and regulatory authorities, ensuring the business meets its tax obligations and maintains transparent and accurate financial reports.

Which Businesses Need to Appoint a Chief Accountant?

Legal Regulations Regarding the Chief Accountant

According to Vietnamese law, businesses must appoint a chief accountant within 12 months from the date of establishment to ensure financial transparency. This regulation helps businesses maintain a robust accounting system and comply with financial reporting standards. Companies that fail to comply may face administrative fines or other legal penalties.

Businesses That Are Required to Have a Chief Accountant

Medium and large enterprises, joint-stock companies, and foreign-invested companies are all required to have a chief accountant. This requirement ensures better financial control, protects the interests of shareholders and investors, and helps the business operate more efficiently. The chief accountant in these businesses also plays a role in improving the quality of financial reports and supporting strategic decision-making.

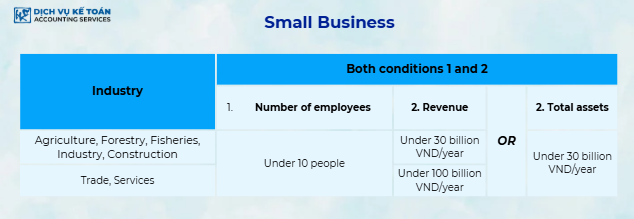

Cases Where a Business Does Not Need a Chief Accountant

Micro-enterprises may not need a chief accountant but must still ensure that their financial accounting complies with regulations. However, they are still required to have an accountant or hire accounting services to ensure legal compliance and avoid financial risks. Hiring external accounting services can be an optimal solution for small businesses looking to save costs while maintaining operational efficiency.

Chief Accountant for Micro-enterprises

Micro-enterprises can hire external chief accountant services instead of appointing an in-house staff member. This helps save costs while maintaining professionalism and adhering to accounting regulations. Additionally, using external accounting services brings the benefit of expertise, as businesses can access a team of experienced accountants knowledgeable about the legal regulations.

Chief Accountant for Foreign-invested Enterprises

Foreign-invested enterprises are required to have a chief accountant to ensure compliance with the legal regulations in Vietnam. The chief accountant plays a crucial role in controlling finances and ensuring that financial reports adhere to both Vietnamese and international regulations. Therefore, they need strong knowledge of international accounting standards and the ability to work with major audit organizations.

Who is Not Allowed to Be a Chief Accountant?

Legal Criteria to Become a Chief Accountant

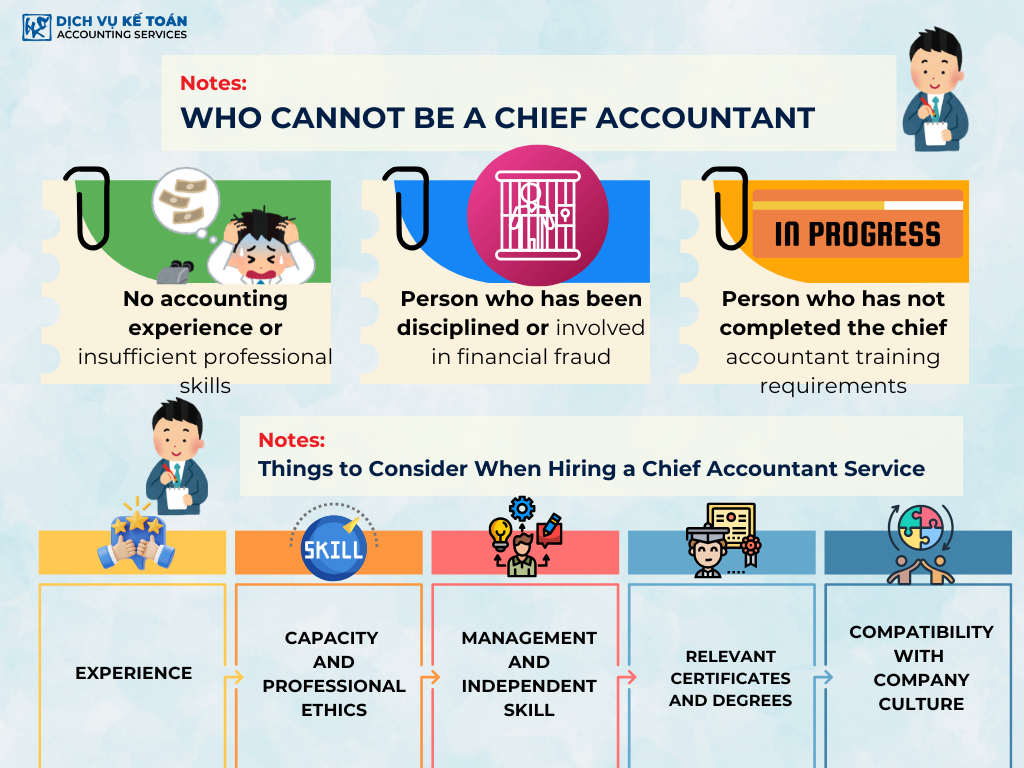

According to Vietnamese law, a person wishing to become a chief accountant must meet certain legal criteria. They must have a degree in accounting or finance, at least three years of experience working in the accounting field in businesses, and a chief accountant certification issued by a competent authority. Individuals who do not meet these criteria are not allowed to hold the position of chief accountant in a business.

Individuals Prohibited from Holding the Chief Accountant Position

The law also specifies who cannot hold the chief accountant position. Individuals with a criminal record related to financial violations, embezzlement, fraud, or accounting fraud are prohibited from holding this position. Additionally, those who have been disciplined in the accounting field or have violated accounting regulations during their previous work are also disqualified from becoming a chief accountant. This is to ensure transparency, honesty, and responsibility in the business’s accounting operations.

Process of Verifying the Chief Accountant’s Qualifications

To ensure compliance with accounting regulations, before appointing someone as a chief accountant, the business must conduct a thorough verification of the candidate’s qualifications. The verification steps include checking their degree, work experience, chief accountant certification, and personal records. Additionally, businesses may require candidates to undergo professional tests to evaluate their practical abilities. This ensures that the business selects a chief accountant with the appropriate competence and professional ethics.

Handling Violations in Accounting

If a chief accountant violates legal regulations or engages in financial fraud, the business may face penalties as per current regulations. The penalties may include administrative fines, compensation for damages, or even criminal charges if the violation is serious. Therefore, the chief accountant must take high responsibility in their work and strictly comply with legal regulations to avoid unfortunate consequences.

Importance of Professional Ethics in the Chief Accountant Role

Professional ethics are essential for a chief accountant. They need to adhere to principles of honesty, transparency, and objectivity in their work. A chief accountant with strong ethics helps the business operate smoothly, avoid financial fraud risks, and ensure sustainable development. Furthermore, they also have a responsibility to train and guide the accounting staff, ensuring that the accounting team in the business operates professionally and effectively.

Key Considerations When Hiring a Chief Accountant

Hiring a chief accountant is an important decision that significantly impacts the financial development of a business. Below are key factors to consider when hiring a chief accountant:

Experience and Expertise

Experience is a crucial factor when hiring a chief accountant. Businesses should look for candidates with experience in accounting within companies of similar size. If possible, prioritize candidates with experience working in foreign companies, as they will have a better understanding of international accounting standards and requirements.

Ensuring Competence and Professional Ethics

The chief accountant must not only have professional knowledge but also possess high ethical standards. Those with strong ethical principles will ensure transparency in accounting operations and help avoid financial fraud risks. Therefore, when hiring a chief accountant, businesses should check the candidate’s background and gather references from previous employers.

Ability to Work Independently and Manage Teams

The chief accountant must work independently while also managing the accounting department. Therefore, candidates should have leadership abilities and be effective in teamwork. Team management skills and the ability to organize work are crucial for a chief accountant.

Relevant Certifications and Qualifications

Candidates should hold accounting, finance, and other relevant certifications. International certifications such as CPA (Certified Public Accountant) or ACCA (Association of Chartered Certified Accountants) will be a significant advantage.

Cultural Fit with the Company

The chief accountant will closely collaborate with other departments within the company, so cultural fit is an important factor. The business must ensure that the chief accountant can easily integrate into and work effectively in the company’s environment.

See more: Common Types of Taxes

The chief accountant plays a very important role in every business, especially in ensuring financial transparency and complying with legal accounting regulations. However, hiring a chief accountant is not an easy task, requiring businesses to carefully consider factors such as experience, professional competence, and ethical standards. A competent chief accountant will help the business develop stably and sustainably.

If your business is looking for a chief accountant, make sure you choose someone who has the necessary skills and qualities to meet the job requirements, while helping the company thrive in a transparent and efficient financial environment.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).