Form 01/DNXN: Official letter confirming completion of tax obligations helps businesses terminate tax obligations quickly and in accordance with regulations. Form 01/DNXN: Official letter confirming completion of tax obligations is a necessary document when businesses want to terminate their tax codes. This article will guide you on how to write and use the tax obligation confirmation form 01/DNXN correctly.

Form 01/ĐNXN: What is the Tax Clearance Confirmation Letter?

Form 01/ĐNXN – Request for Tax Obligation Clearance Confirmation (issued under Circular No. 80/2021/TT-BTC) is an important document in tax administrative procedures. It is commonly used by individuals or organizations to request confirmation from the tax authority that they have fulfilled all tax obligations to the State.

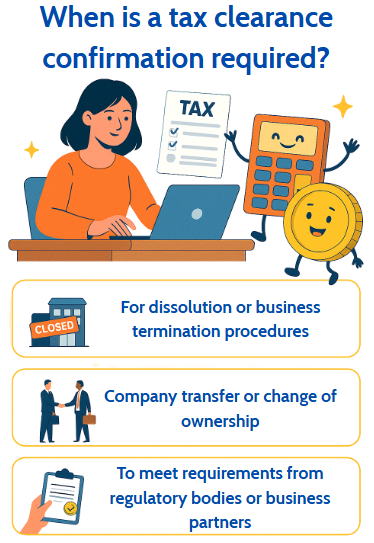

When is a tax clearance confirmation required?

1. For dissolution or business termination procedures

When an enterprise is dissolved or terminates its operations, one of the mandatory steps is to obtain confirmation of tax obligation fulfillment from the tax authority.

This confirmation serves as a basis for the enterprise to complete the dissolution dossier with the Department of Planning and Investment or relevant regulatory bodies.

2. Company transfer or change of ownership

In the event of capital transfer or full acquisition of a company, the transferee often requires a tax clearance confirmation to ensure there are no outstanding tax liabilities from prior periods.

3. To meet requirements from regulatory bodies or business partners

Certain administrative procedures (related to customs, banking, foreign investment, etc.) or bidding dossiers may require enterprises to submit a tax clearance confirmation to prove that they are operating transparently and in compliance with the law, in order to proceed with the application or process.

Procedure for submitting and processing the tax clearance confirmation letter

1. Documents to be prepared

-Official letter using Form 01/ĐNXN

-Financial statements and tax declarations up to the time of the confirmation request

-Decision on dissolution or termination of operations (if applicable)

2. Submission location and processing time

–Submit directly to the Tax Sub-Department managing the enterprise.

-Average processing time: 5 to 7 working days.

-In case of any issues, the tax authority may request additional documentation or invite the enterprise’s representative for clarification.

Form 01/ĐNXN – Tax Clearance Confirmation Letter is an essential document that helps enterprises officially terminate their tax code and conclude their tax obligations with the tax authority in accordance with proper procedures.

Properly drafting and submitting the document in compliance with regulations will save time and help avoid potential future complications. Enterprises are advised to regularly update their forms according to the latest legal provisions to ensure validity and completeness of their tax documentation.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).

Click register now to get the form here