The New Regulations on Personal Income Tax for 2026 in Vietnam mark a significant policy shift aimed at easing the financial burden on residents and expatriates. The core change is the sharp increase in the Mức giảm trừ gia cảnh 2026 (Personal Exemption). Furthermore, the proposed Luật Thuế TNCN sửa đổi (Revised PIT Law) includes a restructured Biểu thuế lũy tiến mới (New Progressive Tax Schedule) and specific tax rules for business individuals. This article provides a comprehensive breakdown of these key amendments, ensuring your compliance and optimal tax strategy for the upcoming year.

- I. What are the New Regulations on Personal Income Tax for 2026?

- II. Personal Exemption Hike – The Crucial Decision Effective from the 2026 Tax Period

- 3. Benefits to Workers’ Disposable Income

- III. Core Points in the Draft Revised PIT Law

- IV. Guide to PIT Calculation Using the New Formula for 2026

- V. Necessary Actions for Businesses and Taxpayers

I. What are the New Regulations on Personal Income Tax for 2026?

The New Regulations on Personal Income Tax for 2026 represent a set of the most critical tax policy adjustments to Personal Income Tax (PIT) in Vietnam, including a National Assembly Standing Committee Resolution on increasing the Personal Exemption (GTGC) and extensive proposals for amending the draft PIT Law (replacement). The core objective of these changes is to ensure fairness, reduce the tax burden on citizens amidst inflation and rising living costs, and modernize the tax system to align with economic growth and average per capita income. The official increase of the Mức giảm trừ gia cảnh 2026 (2026 Personal Exemption) to 15.5 million VND/month is the most direct and powerful change, significantly boosting the disposable income of workers.

1. Objectives and Significance of the Amendment

This round of PIT Law amendments holds exceptional significance, not just in terms of tax technique but also social and macroeconomic policy. The primary objective is to balance the interests of the State and the people, ensuring that minimum living income is not taxed, thereby promoting social equity. Its significance is also rooted in the fact that the cumulative Consumer Price Index (CPI) fluctuation has exceeded the 20% threshold compared to the most recent adjustment (in 2020), mandating the Government to submit the adjustment for National Assembly review as stipulated by the Law. The reduction in tax obligations for citizens is expected to stimulate domestic consumption, fueling sustainable economic growth in the following years.

2. Legal Basis and Effective Date (Resolution and Draft Law)

The changes within the New Regulations on Personal Income Tax for 2026 are built upon two main legal bases:

- National Assembly Standing Committee Resolution: Officially approved the adjustment of the Personal Exemption. This Resolution is effective immediately upon signing and applies from the 2026 tax period (January 2026). This is the earliest and most certain regulation to take effect.

- Draft PIT Law (Replacement): Expected to be passed by the National Assembly and effective from July 1, 2026. This draft includes systemic changes such as the New Progressive Tax Schedule (5 brackets) and new tax regulations for business individuals. Businesses must closely track the official passing date of the Law to prepare for the transitional period in 2026.

II. Personal Exemption Hike – The Crucial Decision Effective from the 2026 Tax Period

The adjustment of the Personal Exemption (GTGC) level is always the central focus of any PIT policy discussion. After careful analysis of macroeconomic factors and public aspirations, the National Assembly made a landmark decision, officially confirming that the new GTGC levels will apply from the 2026 tax period.

1. Official Personal Exemption Levels Applied

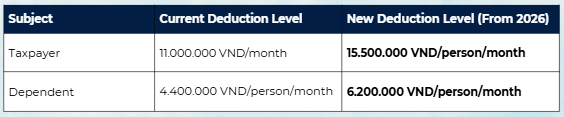

On October 17, 2025, the National Assembly Standing Committee voted to approve the Resolution adjusting the GTGC based on the highest option proposed by the Government. The decision takes immediate effect but applies to the tax period starting from 2026.

- For the taxpayer (Self-Exemption): The exemption level is officially raised from 11,000,000 VND/month to 15,500,000 VND/month. This increase of 4.5 million VND reflects the GDP growth and average per capita income during the 2020-2025 period.

- For each dependent: The exemption level is officially raised from 4,400,000 VND/month to 6,200,000 VND/month. This adjustment aims to support families with dependent burdens, bringing the exemption closer to actual living costs.

This change is regarded as one of the most timely and significant policy decisions in recent years, helping middle and upper-middle-income workers significantly reduce their tax liabilities. The decision is based not only on the CPI but also on the economic growth rate, demonstrating the State’s long-term vision for balancing state revenue with improving citizens’ lives. For Foreign Direct Investment (FDI) companies operating in Vietnam, this adjustment increases the competitiveness of the net salary package in the Vietnamese market compared to other countries in the region, especially for experts with families and multiple dependents.

2. Comparison and Impact on the Tax Threshold

The new Personal Exemption levels fundamentally change the income threshold subject to tax, enabling millions of workers to shift to a non-taxable PIT status.

The Approximate Gross Income Threshold is calculated based on the formula: New GTGC + Mandatory Insurance Contributions (approx. 10.5% Gross).

- Clear Impact: The GTGC increase raises the tax threshold by nearly 41%. This means that an individual with a Gross Income of approximately 20 million VND and one dependent, who previously had to pay tax under the old rule, will no longer be required to pay from 2026.

- Reducing Bracket 1 Burden: The Ministry of Finance estimates that this change will move nearly 50% of those currently paying tax at Bracket 1 (5% tax rate) out of taxable status. This significantly reduces the administrative burden and allows citizens to retain a critical amount of money for expenditure.

The calculation of the tax threshold must be done precisely, including mandatory insurance contributions as stipulated by law. Companies should proactively disseminate this comparison table to employees to help them understand the benefits they receive. For high-income individuals, although they will still pay tax in the higher brackets, this increased exemption still helps them save a fixed amount of tax monthly, thereby increasing their net after-tax income.

3. Benefits to Workers’ Disposable Income

The greatest benefit of the New Regulations on Personal Income Tax for 2026 is the direct and substantial increase in the Disposable Income (Net Income) of workers.

- Improved Living Standards: The increase in net income enables citizens to spend more on education, healthcare, and other essential needs, thus improving the quality of life amidst inflation and rising living costs.

- Stimulating Domestic Consumption: When citizens retain more money, aggregate demand in the economy is stimulated, driving the development of production and service sectors. This is a crucial macroeconomic measure for maintaining sustainable growth momentum.

- Increased Satisfaction and Engagement: For businesses, the automatic receipt of higher net income by employees is a positive factor that does not increase the company’s Gross Salary costs. This indirectly enhances employee satisfaction and engagement with the organization.

For high-level experts and expats, the increase in the dependent exemption to 6.2 million VND/person/month is particularly significant, as they often have greater financial burdens for their families. This adjustment helps Vietnam’s compensation package become more competitive in the region, attracting international talent for long-term work.

III. Core Points in the Draft Revised PIT Law

Parallel to the Resolution on the Personal Exemption, the Draft PIT Law (replacement) currently under review by the National Assembly also contains systemic changes that affect tax calculation and administration for various groups.

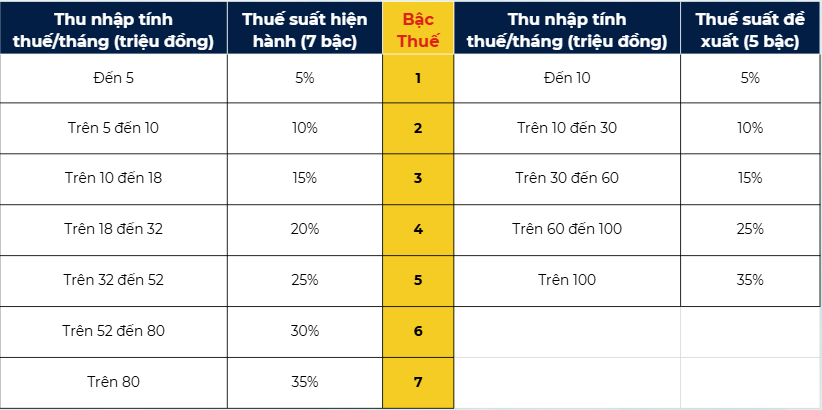

1. Changes to the Progressive Tax Schedule (From 7 Brackets to 5 Brackets)

The proposal to shorten the Progressive Tax Schedule is an effort to simplify the tax system, reduce calculation complexity, and make tax rates more reasonable for upper-middle-income earners.

- Significance of Shortening: The reduction in tax brackets clearly benefits the group with Taxable Income (TNTT) from 10 million to 60 million VND/month. This group will apply a lower tax rate to a portion of their income compared to the current 7-bracket schedule. For example, an individual with TNTT of 35 million VND will be subject to a 15% tax rate on the portion above 30 million, instead of the previous 20%. This creates a positive shift, easing the tax burden on the middle class and strengthening the equity of the tax system.

- Implications for Accounting: Accounting departments must prepare for a second update to the tax calculation formula in 2026 (after updating the GTGC level) if the New Tax Schedule takes effect mid-tax period. This change requires absolute precision in applying tax rates and calculating year-end tax settlements/refunds.

2. New Regulation on the 17% Tax Rate for Business Individuals

The Draft Law proposes a new approach for business individuals (business households, property lessors, etc.), replacing the current fixed-rate tax method (direct tax on revenue).

- Profit-Based Taxation: Business individuals with revenue exceeding the regulated threshold (expected to be 1 billion VND/year) will apply a profit-based tax calculation method (Taxable Income).

- PIT\ Payable = Taxable\ Income \times 17\%

- Taxable Income = Revenue – Deductible Expenses.

- Classification of Business Households: The division of business households into 3 groups for tax administration (under 200 million exempt, 200 million – 3 billion apply ratio on revenue, over 3 billion apply tax on profit) aims to increase transparency and encourage large business households to convert to the enterprise model for development opportunities and better financial management.

- Significance: Applying a 17% tax rate on profit instead of a fixed rate on revenue offers greater fairness for business individuals, as they only pay tax on their actual income. However, this requires business individuals to maintain stricter bookkeeping and management of invoices and receipts, creating a significant demand for professional accounting services.

For companies providing accounting services, this is a major opportunity to expand consulting and tax filing support services for individual and business household clients. Experts need to be proficient in the regulations regarding deductible expenses to advise their clients, helping them optimize taxes under the new law.

Read more: FOREIGN COMPANY SERVICES – Accounting service in HCMC

3. Addition of Taxable or Exempt Income Items

The Draft Law also clarifies and supplements certain income items to align with current realities.

- Exemption for Reasonable Lump-Sum Expenses: Tax exemption for lump-sum expenses provided to employees, such as for phone, business travel, and office supplies, is proposed, provided there is a clear internal expenditure regulation. This gives businesses more flexibility in structuring welfare policies and optimizing taxes for employees.

- Inclusion of Digital Economy Income: The Draft supplements regulations on taxing income arising from digital economy platforms and new types of digital assets. This ensures the comprehensiveness of the Law, covering all income sources arising in the technological era.

- Exemption for State Budget Salaries: Tax exemption is proposed for salaries and wages paid from the state budget for certain specific professions (e.g., police, military).

Clarity in defining exempt income items helps businesses minimize the risk of tax collection from the tax authorities due to incorrect application of regulations on allowances and benefits. HR and Accounting departments need to collaborate closely to review internal expenditure regulations, ensuring they comply with the new conditions to benefit from tax incentives.

IV. Guide to PIT Calculation Using the New Formula for 2026

The PIT calculation from 2026 will use the new exemption levels, and potentially the 5-bracket progressive tax schedule, requiring absolute precision from accounting professionals.

1. Detailed Illustrative Examples of Tax Calculation with New Exemption Levels

To better visualize the impact, we will apply the new exemption levels (15.5 million and 6.2 million) to a high-income individual, using the current 7-bracket tax schedule.

- Example: Individual C – Manager, Gross Income 80,000,000 VND/month, with Spouse and 1 Child (2 Dependents)

- Gross Income (Salary): 80,000,000 VND

- Mandatory Insurance (10.5%): 8,400,000 VND

- Self-Exemption: 15,500,000 VND

- Dependent Exemption (2 people): 2 * 6,200,000 = 12,400,000 VND

- TNTT = 80,000,000 – 8,400,000 – 15,500,000 – 12,400,000 = 43,700,000 VND

- Tax Calculation using the 7-bracket schedule:

- Bracket 1 (5%): 5 million * 5% = 250,000 VND

- Bracket 2 (10%): 5 million * 10% = 500,000 VND

- Bracket 3 (15%): 8 million * 15% = 1,200,000 VND

- Bracket 4 (20%): 14 million * 20% = 2,800,000 VND

- Bracket 5 (25%): (43.7 – 32) * 25% = 11.7 million * 25% = 2,925,000 VND

- Tax Payable: 250,000 + 500,000 + 1,200,000 + 2,800,000 + 2,925,000 = 7,675,000 VND

- Comparison with Old Regulation: If the old GTGC level were applied (11 million + 2*4.4 million = 19.8 million), the old TNTT would be 52.8 million VND. The old Tax Payable was 10.3 million VND. Thanks to the new regulation, Individual C saves 2,625,000 VND/month in tax, a highly significant benefit.

These figures clearly illustrate the impact of the GTGC increase, even before the New Tax Schedule (5 brackets) takes effect. When the 5-bracket schedule is applied, the tax payable for Individual C may further decrease, depending on the re-segmentation of the tax thresholds.

2. Documentation and Notes for Dependent Registration

The dependent exemption level (6.2 million VND/person/month) only applies when the taxpayer has completed the registration procedure and been issued a dependent tax code.

- Standardized Procedure: Businesses should proactively review all dependent documentation of their employees. Require employees to provide complete legal documents (Birth Certificate, Disability Certificate, documents proving inability to work/low income, etc.) to ensure valid registration.

- Principle of Exemption Calculation: The 6.2 million VND amount is calculated for the full month, even if the dependency arises within that month. However, a dependent can only be calculated as an exemption for one taxpayer in the same tax year. Duplicated registration will lead to errors and potential tax collection.

- Verification and Archiving: The Accounting Department is responsible for verifying the validity of the documentation and archiving it carefully to present to the tax authority upon inspection request, ensuring absolute compliance with tax law.

This is an administrative but extremely critical task, especially for companies with a large number of employees with dependents. Delays or errors can result in employees not receiving the benefit, leading to dissatisfaction and internal disputes.

V. Necessary Actions for Businesses and Taxpayers

To smoothly transition to the New Regulations on Personal Income Tax for 2026, businesses and individuals need to implement a specific and professional action plan.

1. Requirements for Updating Accounting Systems and Payroll Software

Ensuring technical compliance is the top priority.

- Updating Core Parameters: Immediately in Q4/2025, IT and Accounting units need to plan to change the GTGC parameters in the software (ERP, Excel, or specialized accounting software) effective from January 1, 2026.

- Flexibility with the Tax Schedule: The system must be able to seamlessly switch between the 7-bracket and 5-bracket tax schedules within 2026 if the New Tax Schedule takes effect mid-year. This requires setting effective date parameters within the system.

- In-depth Stress Testing: Conduct trial payroll runs for groups of employees with different incomes (low, medium, high, with/without dependents) using different GTGC levels and Tax Schedules to ensure that calculations are 100% accurate before official application.

Businesses should avoid manual updates due to the high risk of errors and instead work with software vendors to implement automatic updates. Errors in monthly tax calculation, even minor ones, will accumulate into major errors during year-end tax finalization.

2. Compliance and Internal Communication Plan

Tax changes always come with the risk of errors if not communicated and applied correctly.

- Specialized Training: Organize in-depth training sessions on the Revised PIT Law for the entire Accounting, HR, and Finance team. This helps them master the new tax calculation rules (new GTGC, potentially 5-bracket schedule) and regulations on dependent documentation.

- Transparent Communication: Use internal communication channels (email, intranet, workshops) to clearly announce the new GTGC levels and how they impact net income. Transparency in the dependent registration process encourages employees to comply proactively.

- Periodic Review: Establish a periodic review process (e.g., quarterly) for PIT calculation and dependent documentation in 2026, especially during the Tax Schedule transition period (if any), to detect and correct errors promptly.

Tax compliance is a primary responsibility for businesses. A clear compliance plan not only helps avoid administrative tax penalties but also reinforces the company’s reputation with employees and state management agencies.

The New Regulations on Personal Income Tax for 2026 mark a significant milestone in Vietnam’s tax reform. The increase in the Personal Exemption to 15.5 million VND/month and 6.2 million VND/dependent is a timely decision, demonstrating the State’s strong support for citizens, especially the middle class, helping to boost disposable income and stimulate the economy.

For the business community, these changes, along with proposals regarding the Revised PIT Law and the New Progressive Tax Schedule, necessitate serious and professional preparation. Updating payroll systems, restructuring compensation policies, and ensuring strict compliance with dependent documentation regulations are key actions. This proactive approach not only helps businesses optimize costs but also creates a more attractive working environment.

Accounting Services in Vietnam is committed to supporting your business in analyzing, advising, and effectively implementing the New Regulations on Personal Income Tax for 2026, ensuring the most accurate and efficient compliance with tax laws.

If you have any questions, please contact our Hotline at (028) 3820 1213 or email us at info@wacontre.com for prompt consultation and support. With an experienced team, Service thanhlap.wacontre.com is always ready to serve customers in the most enthusiastic and efficient manner. (For Japanese customers, please contact Hotline: (050) 5534 5505).