Instructions for checking when submitting incorrect tax sub-items, helping businesses handle the process correctly and avoid penalties. Submitting incorrect tax sub-items is a common mistake in the tax declaration process. This article provides instructions for checking tax sub-items and handling when submitting incorrectly to help businesses avoid penalties and ensure compliance with legal regulations.

- What is an Incorrect Tax Sub-Item Payment?

- Common Reasons for Incorrect Tax Sub-Item Payments

- Consequences of Incorrect Tax Sub-Item Payments

- Official Letter Template and Procedure for Verifying Incorrect Tax Sub-Item Payments

- Instructions for Verifying and Handling Incorrect Tax Sub-Item Payments

- Conclusion

What is an Incorrect Tax Sub-Item Payment?

In the state budget system, each type of tax or fee is assigned a specific sub-item code to help tax authorities categorize, record, and track tax payments accurately. An incorrect tax sub-item payment occurs when a business or individual transfers money to the state budget but selects the wrong sub-item code corresponding to the tax obligation. Although the amount has been transferred, if the sub-item code is incorrect, the payment will not be properly recognized as fulfilling the taxpayer’s obligation.

This type of mistake can occur with many kinds of taxes, such as value-added tax (VAT), corporate income tax (CIT), and business license tax. Therefore, understanding the sub-item codes and the process for verifying and correcting errors is essential for corporate accounting departments.

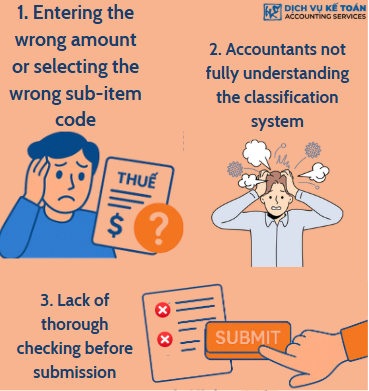

Common Reasons for Incorrect Tax Sub-Item Payments

1. Entering the wrong amount or selecting the wrong sub-item code

During electronic tax payments or while filling in payment information, accountants may enter the wrong amount or select an incorrect tax sub-item code. This usually stems from insufficient checking or confusion about the structure of sub-item codes.

2. Accountants not fully understanding the classification system

New or untrained staff who are unfamiliar with sub-item classifications often confuse different tax types or mix tax sub-items with other fees. This leads to choosing the wrong code when making a tax payment.

3. Lack of thorough checking before submission

Many companies lack strict internal control procedures and fail to double-check tax information before confirming the transaction, which leads to undetected errors.

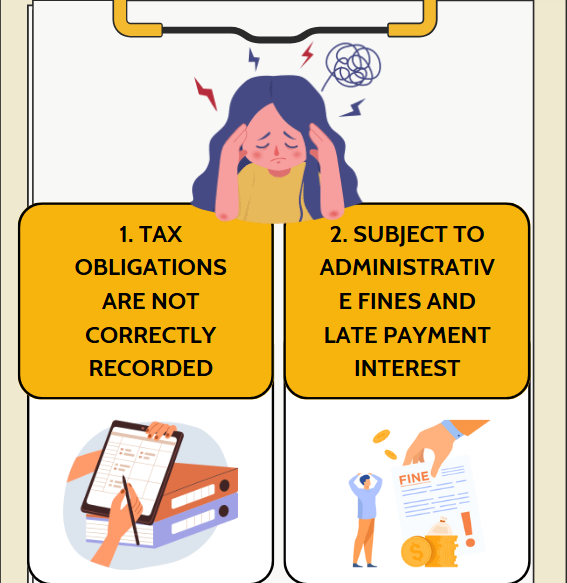

Consequences of Incorrect Tax Sub-Item Payments

1. Tax obligations are not correctly recorded

Even if the money has been transferred to the budget, if the sub-item is incorrect, the taxpayer’s obligation is still considered unfulfilled. This may affect the issuance of tax obligation completion certificates.

2. Subject to administrative fines and late payment interest

If the tax authority cannot properly record the payment, the system may classify it as an outstanding balance and begin calculating late payment interest. If the error is not promptly verified and corrected, the company may face administrative penalties and interest charges.

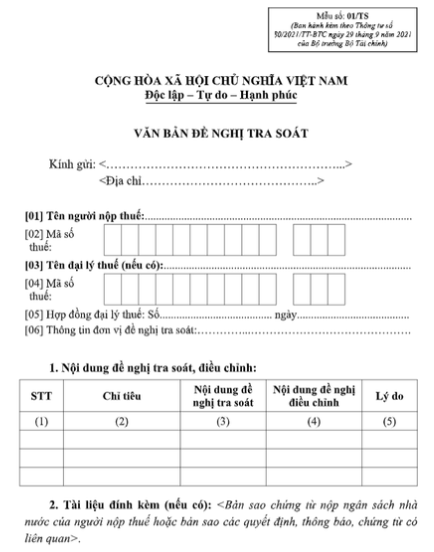

Official Letter Template and Procedure for Verifying Incorrect Tax Sub-Item Payments

1. Latest official letter template for verification (Form 01/TS)

The latest verification letter template (Form 01/TS), issued under Circular No. 80/2021/TT-BTC dated September 29, 2021, by the Minister of Finance, allows businesses to request adjustments to incorrect tax payment information. It includes: taxpayer details, nature of the error, amount, date of payment, treasury account, and the correct sub-item.

2. Submission methods: online, in person, or by mail

Businesses may submit the verification letter directly at their local Tax Department, through the e-tax system (etax), or via certified postal service. Online submission is encouraged due to its efficiency and ability to track processing status.

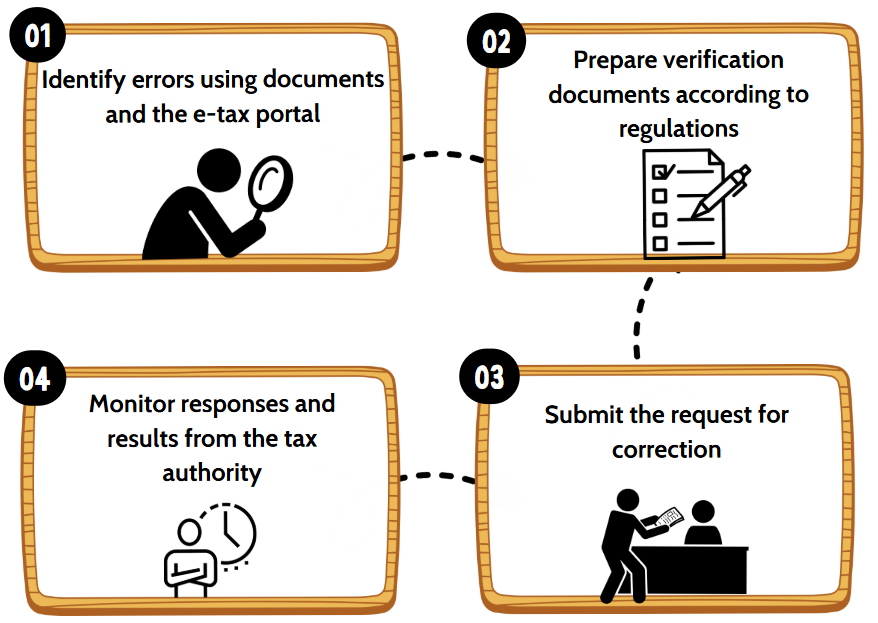

Instructions for Verifying and Handling Incorrect Tax Sub-Item Payments

1. Identify errors using documents and the e-tax portal

Businesses should regularly reconcile bank statements, payment receipts, and the e-tax system to detect any incorrect tax sub-item payments. If an error is found, all relevant details must be identified to prepare the verification request.

2. Prepare verification documents according to regulations

The dossier includes: Form 01/TS verification letter, a copy of the state budget payment receipt, bank transfer statement (if available), and other documents as required by each Tax Department. All documents should be certified by the business.

3. Submit the request for correction

Once the dossier is complete, the business submits it to the tax authority. The tax office will review the documents and, if eligible, issue a notification to correct the payment.

4. Monitor responses and results from the tax authority

Processing time is usually 5–10 business days. Businesses should monitor email, notifications on the e-tax system, or directly contact tax officers to follow up on progress.

Conclusion

1. Businesses must carefully verify information before making payments

Information such as the sub-item code, revenue item name, and budget account must be carefully reviewed before payment to avoid unnecessary mistakes.

2. Maintain records and regularly update regulations

All tax payment documents should be fully archived. Accountants should also stay updated with the latest forms and procedures issued by the General Department of Taxation.

3. Train accounting staff on tax sub-item classification

Companies should conduct regular training or updates for their accounting team to improve their ability to identify and classify the correct tax sub-item codes, preventing errors and saving time on corrections.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).

Click register now to get the form here