Decoding “Full-Package Accounting Services”: What will clients receive? This guide breaks down all the deliverables, benefits, and how to choose the right accounting firm.

Considering outsourcing your accounting? This guide decodes what a ‘full-package accounting service’ truly includes, from tax filing to financial consulting. Understand the benefits and what to expect from a top accounting service company.

- Decoding “Full-Package Accounting Services”: What Will Clients Receive?

- What is a Full-Package Accounting Service?

- So, What Specific Tasks Does “Full-Package” Include?

- The Outstanding Benefits of Using a Full-Package Accounting Service

- Which Businesses Should Use a Full-Package Accounting Service?

- How to Choose a Reputable Accounting Service Company?

Decoding “Full-Package Accounting Services”: What Will Clients Receive?

As a business owner, you want to dedicate all your passion and time to developing products, finding customers, and expanding the market. However, the harsh reality is that paperwork, bookkeeping, and complex regulations on tax, accounting, and insurance are consuming a significant portion of your resources. You are considering outsourcing accounting but are hesitant, not knowing what a full-package accounting service is and whether it is truly the solution to your problem. This article will analyze the benefits of accounting services and help you clearly understand the value that a reputable accounting service company provides.

What is a Full-Package Accounting Service?

A Full-Package Accounting Service can be simply understood as an enterprise entrusting the entire work and responsibility of its accounting department to an external professional service company. Instead of building a cumbersome in-house accounting department with multiple staff (general accountant, tax accountant, payroll accountant, etc.), a business only needs a single point of contact to handle all issues from A to Z, from recording an input invoice to year-end tax finalization and representing the company before authorities.

Imagine this service as having an “outsourced accounting department” complete with all roles: an experienced Chief Accountant who bears legal responsibility, a general accountant specializing in bookkeeping, and specialists knowledgeable in tax, labor, and insurance. They all work for the benefit of your business, ensuring your financial and accounting system operates smoothly, accurately, and in absolute compliance with the law, but at a much more reasonable cost than operating it yourself. This is the optimal solution to free your business from administrative burdens to focus on core competencies.

So, What Specific Tasks Does “Full-Package” Include?

“Full-package” means the service provider will perform all arising accounting tasks on behalf of the business. The scope of work can be customized, but generally, it will include the following four main areas:

1. Tax-Related Tasks (Declaration, Finalization)

This is the most critical area and often the main reason businesses seek accounting services.

The tasks include:

Periodic tax declarations: Preparing and submitting VAT and PIT declarations monthly or quarterly, depending on the scale and form of the business’s operations.

Annual tax finalization: Preparing and submitting annual CIT and PIT finalization reports at the end of the fiscal year.

Other taxes: Declaring and paying the annual business license tax, as well as other taxes that may arise.

Monitoring and notification: Monitoring and notifying the business of the amount of tax payable and the payment deadline to avoid late payment penalties.

2. Bookkeeping and Financial Statement Tasks

The service provider will act as a true general accountant for the business, ensuring the bookkeeping system is always transparent and accurate.

Document processing: Classifying and checking the validity and legality of input and output invoices and documents.

Accounting entries: Recording all economic transactions into the accounting book system in accordance with Vietnamese Accounting Standards (VAS).

Financial statement preparation: Preparing and completing the year-end financial statement package, including the Balance Sheet, Income Statement, Cash Flow Statement, and Notes to the financial statements.

Bookkeeping system management: Printing and archiving the entire bookkeeping system in accordance with legal regulations.

3. Labor – Payroll – Social Insurance Tasks

HR and payroll matters often involve many complex regulations, and a full-package service will help the business handle them smoothly.

Payroll calculation: Preparing detailed monthly payrolls for all employees.

Social Insurance (SI) management: Handling procedures for registering new employees, reporting increases or decreases in labor; and managing claims for sickness, maternity, and work accident benefits for employees.

PIT management: Registering personal tax identification numbers for new employees, and calculating and withholding PIT monthly.

4. Consulting and Representation before Tax Authorities

This is an outstanding added value that only professional service firms can provide.

Consulting: Proactively updating on new tax and accounting policies and advising the business on optimal solutions for costs, cash flow, and operational structure to be both legal and most beneficial.

Legal representation: Acting on behalf of and representing the business to directly explain figures to the tax authorities during tax audits and inspections. With their deep experience and expertise, they will protect the legal interests of the business in the best possible way.

The Outstanding Benefits of Using a Full-Package Accounting Service

Entrusting accounting work to a professional unit is not merely “hiring someone to do the work,” but a strategic investment that brings many outstanding benefits.

1. Cost savings

This is the most obvious benefit. Let’s do a simple comparison: to build a basic accounting department, you need at least 1-2 accountants and 1 chief accountant. The monthly costs will include salaries, bonuses, SI, office space, computers, accounting software, training costs, etc. This total cost can amount to tens or even hundreds of millions of VND per month. Meanwhile, the fee for a full-package accounting service is often just a fraction of that figure, yet you get the service of an entire team of experts.

2. Ensuring professionalism, accuracy, and legal compliance

Accounting service companies possess a team of highly specialized and experienced personnel who are always updated with the latest legal knowledge. They have standardized work processes and cross-checking systems to ensure all reports and declarations are thoroughly reviewed before issuance. This helps to eliminate subjective errors that a single in-house accountant might make, ensuring your bookkeeping is always accurate and 100% compliant with regulations.

3. Minimizing risks and unnecessary penalties

The world of tax and accounting is always fraught with legal risks if not handled correctly: late declaration submissions, incorrect declarations, improper accounting entries, lost invoices, etc. All can lead to heavy penalties and tax arrears. When using a full-package service, the service company takes responsibility for the accuracy of the work they perform. They have the expertise to identify and prevent these risks, acting as a shield to protect your business.

4. Helping management focus on core business activities

This is the greatest strategic benefit. Instead of headaches over numbers, constantly changing regulations, and tax audits, the management can have complete peace of mind and dedicate their full time and energy to what truly creates value: product development, customer care, marketing, and strategic planning. With a solid back office, a business can confidently move forward.

Which Businesses Should Use a Full-Package Accounting Service?

Full-package accounting services are suitable for many types of businesses, especially:

Startups and newly established businesses

In the early stages, resources are limited, and founders need to focus maximally on business development. Outsourcing accounting helps them establish a standard financial system from day one at an optimal cost.

Small and Medium-sized Enterprises (SMEs)

This is the largest client group. SMEs often do not have the budget to maintain a fully functional accounting department, yet their workload and compliance requirements are increasingly complex. A full-package service is the perfect solution to this problem.

Foreign-Invested Enterprises (FIEs)

FIEs often face language barriers and differences in legal systems. Collaborating with a local accounting service firm that has a deep understanding of Vietnamese regulations is a wise and safe choice.

Businesses undergoing restructuring or needing to clean up their books

When the internal accounting system has problems and the books are messy, hiring a professional unit to “clean up” and re-establish processes is extremely necessary.

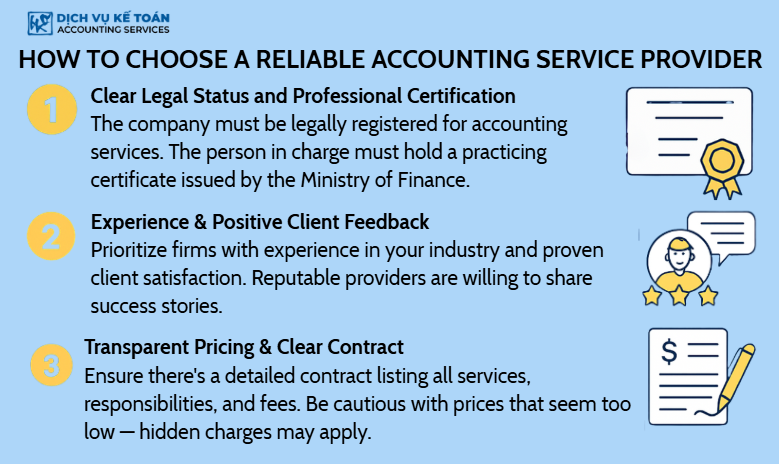

How to Choose a Reputable Accounting Service Company?

The market has many providers, but to make the right choice, you need to evaluate them based on clear criteria.

1. Criterion 1: Legal capacity and professional practice certificates

This is the prerequisite. A reputable company must have a clear business registration for accounting services. More importantly, the individuals responsible for the professional work (especially the person signing the reports) must hold accounting or auditing practice certificates issued by the Ministry of Finance. Ask them to provide these documents for verification.

2. Criterion 2: Experience and client reviews

Prioritize companies with many years of experience that have served clients in your industry. Don’t hesitate to ask about their key clients or search for reviews and comments about the company on independent channels. A reputable company will not be afraid to share its success stories.

3. Criterion 3: Clear quotation and scope of work

A professional provider will always have a detailed and transparent contract and quotation. It should clearly list all the tasks they will perform, the responsibilities of each party, and the associated fees. Be wary of suspiciously cheap quotes, as they may cut corners or have hidden costs that arise later.

A Full-Package Accounting Service is not merely a cost-saving solution, but a strategic investment in the safety and sustainable development of a business. By entrusting the burden of accounting and tax to experts, management can free themselves from complex tasks, minimize legal risks, and focus wholeheartedly on driving the business forward. Choosing a reputable and professional service partner is the first step in building a solid financial foundation for long-term success.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).