The tax payment extension letter helps businesses legally defer tax deadlines with a complete template and process guide.

The tax payment extension letter allows businesses to request a lawful tax deferral from authorities. This article provides a standard template and a detailed procedure tailored for companies in Vietnam.

What is a Tax Payment Extension Request Letter?

A tax payment extension request letter is an important administrative document prepared by businesses, economic organizations, or individual business households to propose that their local tax authority allow a delay in the deadline for paying one or more types of due taxes. This document must follow the official template, clearly stating the reason for the extension, legal basis, types of taxes involved, the duration of the extension, and a commitment to fulfill tax obligations after the deferment period.

Amidst the current economic challenges in Vietnam—such as global inflation, rising production costs, shrinking export markets, and tight monetary policies—many businesses face liquidity issues and operational uncertainty. Additionally, geopolitical instability and higher capital costs have compounded financial pressures. Under such circumstances, tax payment extensions serve as a timely fiscal tool to reduce cash flow burdens, sustain business operations, and gradually restore competitiveness.

Note: Tax deferral is not a waiver or reduction of tax obligations. If the request is approved, the taxpayer is not charged late payment interest during the extension period, thereby reducing legal and financial risks.

Legal Basis:

- Law on Tax Administration No. 38/2019/QH14 (Article 62)

- Decree 126/2020/NĐ-CP

- Annual guidelines such as Decree 12/2023/NĐ-CP and Decree 82/2025/NĐ-CP

Benefits of Requesting a Tax Extension

1. Supports Cash Flow and Reduces Financial Pressure

Allows businesses to temporarily retain significant funds for urgent needs such as payroll, operations, debt repayments, or short-term investments.

2. Enhances Legal Compliance

Following the proper procedure ensures the business is not penalized for late payments and reinforces a professional, law-abiding image with tax authorities and partners.

3. Minimizes Risk of Administrative Penalties

If difficulties arise and no extension is requested, late payment penalties apply. Approved extensions, however, avoid such penalties and interest.

4. Provides Flexibility During External Challenges

In times of economic downturns, disasters, or pandemics, tax extensions offer macro-level policy support, giving businesses time to recover and maintain operations.

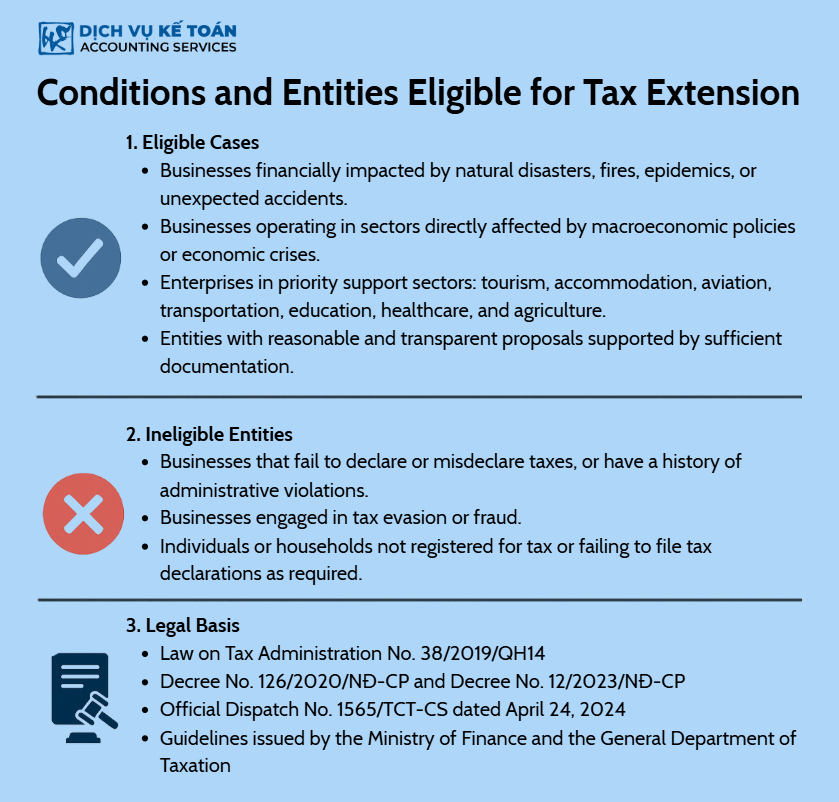

Eligibility and Conditions for Tax Extension Requests

1. Eligible Cases:

- Businesses suffering financial loss due to natural disasters, fires, epidemics, or unexpected accidents.

- Businesses affected by macroeconomic policy shifts or economic crises.

- Enterprises in prioritized sectors like tourism, lodging, aviation, transport, education, healthcare, and agriculture.

- Proposals must be reasonable, transparent, and backed by documentation.

2. Ineligible Cases:

- Businesses that intentionally failed to declare or misdeclared taxes and have a history of administrative violations.

- Entities involved in tax evasion or fraud.

- Individuals or households not registered for tax or failing to submit required declarations.

3. Legal References:

- Law on Tax Administration No. 38/2019/QH14

- Decree 126/2020/NĐ-CP

- Decree 12/2023/NĐ-CP (dated 14/04/2023)

- Official Letter 1565/TCT-CS (dated 24/04/2024)

- Future decrees and updates from the General Department of Taxation or Ministry of Finance

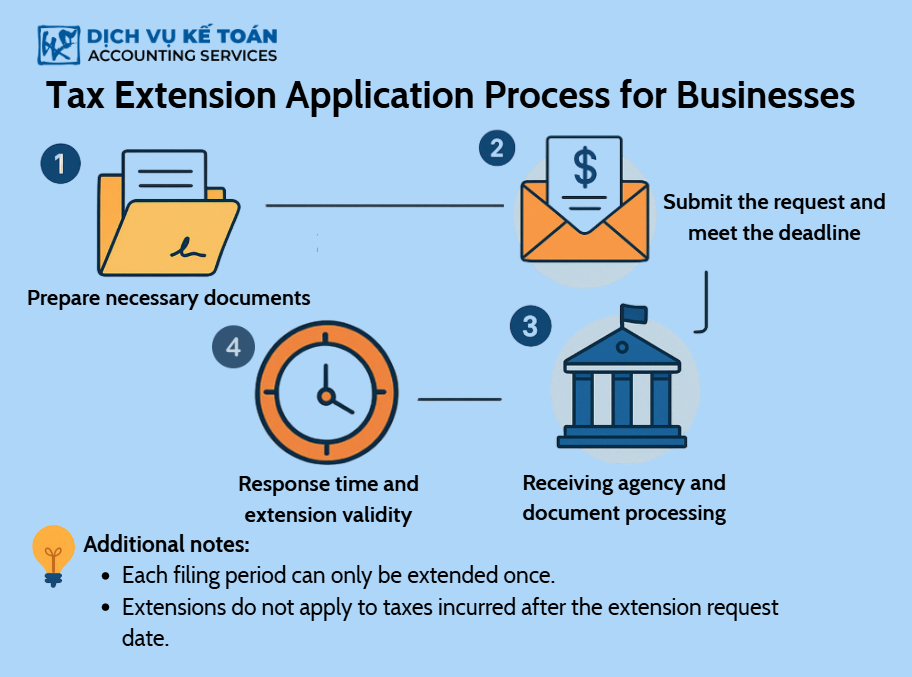

Tax Extension Request Process

1. Prepare the Required Documents:

- Extension request letter (template per Decree 82/2025/NĐ-CP)

- Documents supporting the reason for extension

- List of taxes to be deferred (e.g., CIT, VAT)

- Power of attorney (if signed by someone other than the legal representative)

2. Submit the Request and Deadline:

Per Decree 82/2025/NĐ-CP, the request must be correctly formatted, timely, and submitted by:

- Submission methods:

- Through the electronic tax system (eTax)

- In person at the tax office

- Via postal mail

- Deadline: On or before May 30, 2025, for all eligible taxes

3. Types of Tax and New Deadlines:

VAT:

- Feb 2025 → New due: Sep 20, 2025

- Mar 2025 → Oct 20, 2025

- Apr 2025 → Nov 20, 2025

- May & Jun 2025 → Dec 20, 2025

- Q1/2025 → Oct 31, 2025

- Q2/2025 → Dec 31, 2025

CIT:

- Q1/2025 → Oct 30, 2025

- Q2/2025 → Dec 30, 2025

Important Note: Late submissions are not eligible for the extension and will be penalized for late payments.

4. Processing Authority and Response Timeline:

- Received by the local Tax Department

- Processing time: 7–10 working days

- If incomplete, the tax office will issue a request for corrections

5. Response and Extension Validity:

- If the application is valid, no reply is needed; the extension is automatically updated in the tax system

- If not valid or lacking documentation, the tax authority will notify the applicant

Extension Validity: Begins after the original due date, extended based on the specific tax type.

- No late payment interest is charged during the extended period

Additional Notes:

- Each declaration period can only be extended once

- Extensions do not apply to tax amounts incurred after the requested deferral date

Latest Tax Extension Request Letter Template

1. Structure:

- National title and slogan

- Company name, tax code, head office address

- Addressed to: Direct tax authority

- Request details: types of taxes and deferment duration

- Reasons: Specific and verifiable

- List of attached documents

- Commitment to fulfill tax obligations after extension

- Signed and stamped by the legal representative

2. Form Filling Notes:

- Do not leave any section blank

- Keep the explanation concise, supported with data

- Use formal administrative language

- Include all necessary documents, with verification if required

Download the form template here insert hyperlink

Creating a tax extension request letter demonstrates a business’s proactive and responsible compliance with tax obligations. It serves not only as a temporary financial relief but also as a legal safeguard against penalties during times of hardship.

To stay compliant and updated, businesses should regularly monitor announcements and guidance from tax authorities.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).