The sample letter requesting cancellation of submitted tax declarations helps businesses handle errors effectively and in accordance with legal regulations. The sample letter requesting cancellation of submitted tax declarations is a necessary procedure when businesses declare incorrectly. Using the correct form will help cancel the submitted tax declaration quickly and legally.

What is a sample letter requesting to cancel a submitted tax return?

In tax declaration and payment activities in Vietnam, it is not uncommon for businesses to accidentally submit incorrect declarations on the tax system, leading to errors and unwanted legal consequences. When that happens, businesses need to carry out procedures to cancel the submitted tax return using a valid letter form.

This will help businesses cancel the return by providing a valid reason and convincing the tax authority of the legitimacy of the proposal.

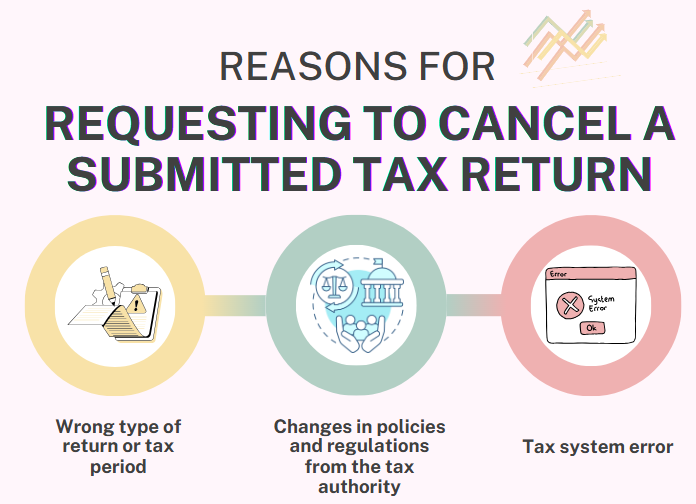

Reasons for requesting to cancel a submitted tax return

1. Wrong type of return or tax period

In many cases, businesses declare the wrong type of return, the wrong tax period, or a return that is not subject to occurrence but still submit it.

This causes confusion for the tax authority in recording data and can lead to the risk of administrative sanctions. For example:

- Wrongly submitting a VAT return using the direct method instead of the deduction method.

- Wrong accounting year (fiscal year) or incorrect declaration time.

- The enterprise is in a period of inactivity but still submits a declaration.

2. Changes in policies and regulations from the tax authority

There are cases where the enterprise has declared according to the old regulations but then the tax authority issues new instructions. When this happens, the enterprise needs to request to cancel the submitted declaration to comply with the current instructions.

3. Tax system error when submitting electronic declaration

In some cases, due to system errors or network congestion, the enterprise has submitted incorrect information or submitted duplicate declarations multiple times. These errors need to be corrected immediately by requesting to cancel the excess declaration.

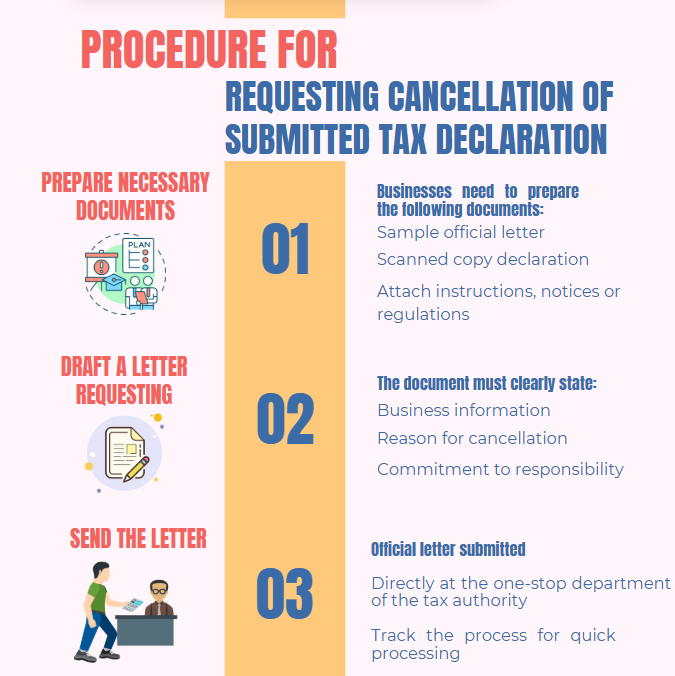

Procedure for requesting cancellation of submitted tax declaration

1. Prepare necessary documents

Enterprises need to prepare the following documents:

- Sample letter requesting cancellation of tax declaration

- Scanned copy of the submitted declaration on the tax system

- Can attach instructions, notices or new regulations to convince the tax authority to increase reasonableness

2. Draft a letter requesting cancellation according to the form

The letter needs to clearly state the following items:

- Enterprise information: company name, address, tax code

- Name of the type of declaration to be canceled, tax period

- Reason for requesting cancellation

- The enterprise commits to take responsibility for the accuracy of the letter

3. Send the letter to the direct tax authority

Enterprises submit documents directly to the one-stop department of the tax authority, then monitor the system and notifications from the tax authority.

If there is a request for explanation or provision of additional information, the enterprise needs to respond immediately so that the declaration cancellation process is processed quickly.

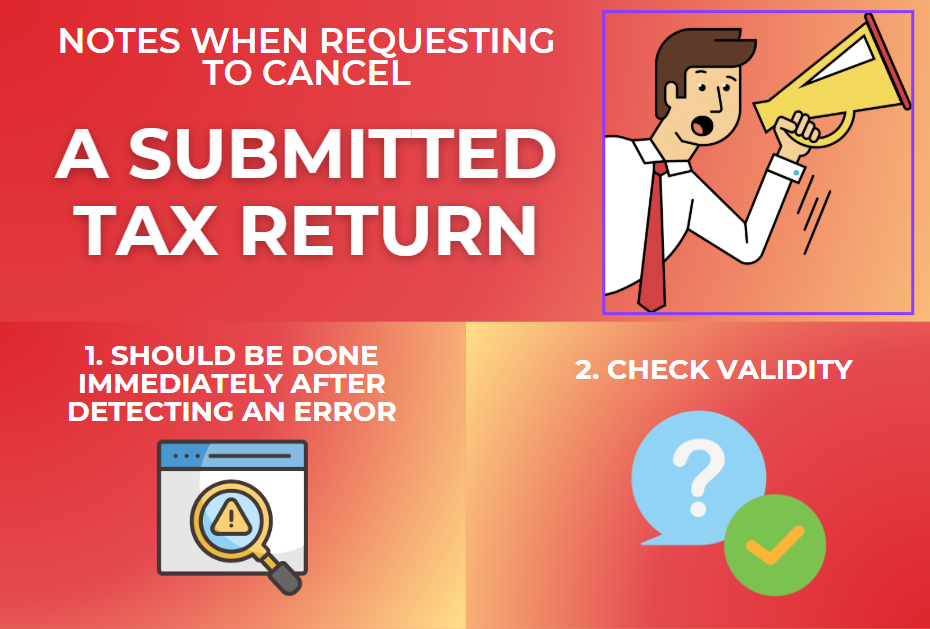

Notes when requesting to cancel a submitted tax return

1. Should be done immediately after detecting an error

When detecting an error, it should be proactively handled as soon as possible. Prolonged delay will make the problem more serious, and businesses will be penalized for submitting incorrect or late declarations.

2. Check validity

The reason for cancellation must be legitimate: The declaration to be canceled must have a clear and reasonable reason, avoid submitting a cancellation request for personal reasons, without sufficient basis.

Check the tax declaration results: If the declaration submission is just a mistake without any tax obligations arising, the cancellation will be easier.

Requesting to cancel a submitted tax return is an important process and must be done in accordance with regulations to avoid legal troubles. Businesses need to draft a valid document, clearly stating the reason and send it to the tax authority in accordance with the procedure. Compliance with the instructions not only helps businesses minimize errors but also increases professionalism and transparency in tax declaration activities.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).

Click register now to get the form here