Understand the personal income tax declaration and essential notes for accurate and lawful filing.

Filing a personal income tax declaration is a critical process for any individual with taxable income. Proper and compliant declaration helps you avoid unnecessary risks and penalties. This article will guide you through important aspects of “Personal Income Tax Declaration”, “how to file”, and “filing notes”.

- Personal Income Tax Declaration: Important Points to Remember When Filing Tax

- What is a Personal Income Tax Declaration (PIT)?

- Who Must File a PIT Declaration?

- What is a PIT Withholding Certificate?

- Filing Deadlines and Cycles for PIT Declarations

- How to File a PIT Declaration Correctly

- Important Considerations When Filing PIT

Personal Income Tax Declaration: Important Points to Remember When Filing Tax

The Personal Income Tax (PIT) declaration is an essential procedure for individuals with taxable income. Accurate filing and adherence to the regulations will help avoid unnecessary risks and mistakes. Let’s explore the key points related to “Personal Income Tax Declaration”, “Personal Income Tax Filing”, “Filing Instructions”, and “Important Considerations for Personal Income Tax Filing”.

What is a Personal Income Tax Declaration (PIT)?

A Personal Income Tax (PIT) declaration is a document submitted by individuals or organizations paying income to report tax liabilities related to the income generated during a specific period. This procedure is essential for tax authorities to determine the correct amount of tax to be paid or refunded.

According to the Tax Administration Law No. 38/2019/QH14, the PIT declaration can be submitted monthly, quarterly, or annually depending on the income type, amount, and taxpayer category. Additionally, individuals can proactively file to request a tax refund or make tax adjustments if they have multiple income sources within the year.

The PIT declaration is not only a legal obligation but also a right for individuals to prove the amount of tax paid, claim deductions, or request refunds if there is a discrepancy between the tax withheld and the actual amount owed.

There are two main types of PIT declarations:

- Temporary declarations (monthly, quarterly): Applied for income-paying organizations.

- Annual tax reconciliation: For individuals and businesses to consolidate and adjust tax obligations after the fiscal year.

Who Must File a PIT Declaration?

Correctly identifying the entities required to file a PIT declaration is fundamental for complying with the regulations and avoiding legal violations. According to current laws, the following entities must file:

- Residents with taxable income

- Present in Vietnam for 183 days or more in the calendar year.

- Have a permanent residence or a long-term rental agreement in Vietnam.

- Earn income from salaries, wages, business, property rental, etc.

- Must file a tax return if they have multiple income sources or if they are eligible for a tax refund.

- Non-residents

- Foreigners residing in Vietnam for less than 183 days per year.

- Taxed on all income generated in Vietnam at a fixed tax rate (20%).

- The organization paying income is responsible for withholding and filing taxes on their behalf.

- Income-paying organizations (businesses and other entities)

- Organizations paying salaries, bonuses, or other compensations to individuals.

- Responsibilities include:

- Withholding taxes on taxable income.

- Filing tax declarations monthly or quarterly.

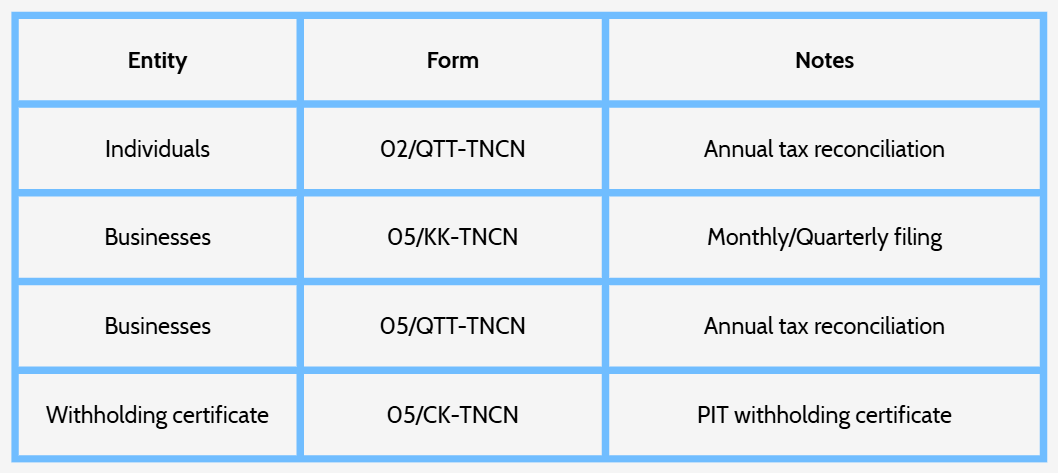

- Issuing withholding certificates (Form 05/CK-TNCN) to employees.

- Filing annual reconciliation for individuals with only one source of income.

Learn more: Personal Income Tax: Definition and Calculation Methods

What is a PIT Withholding Certificate?

A PIT withholding certificate is a document issued by the income-paying organization to the individual, confirming that PIT has been withheld from their income.

- Form used: 05/CK-TNCN (issued under Circular 80/2021/TT-BTC).

- This certificate is used for year-end tax reconciliation or as a basis for requesting a tax refund.

- Withholding certificates are issued only when taxes have been properly withheld and paid by the organization.

- Can be issued in either paper or electronic form with authentication codes.

Filing Deadlines and Cycles for PIT Declarations

- Monthly and Quarterly Filing

- Monthly: For businesses withholding more than 50 million VND of PIT per month.

- Quarterly: For businesses with PIT withheld less than 50 million VND per month or newly established businesses.

- Annual Tax Reconciliation

- Filing period: From January 1 to March 31 of the following year.

- Individuals with multiple income sources or those requesting tax refunds must file their declarations.

- Deadlines and Late Filing Penalties

- Monthly filing: Latest by the 20th of the following month.

- Quarterly filing: Latest by the 30th of the following quarter.

- Annual tax reconciliation: Latest by March 31 of the following year.

- Late filing penalties: A penalty of 0.05% per day for delayed submissions, and enforcement actions may be taken for prolonged delays.

How to File a PIT Declaration Correctly

1. Filing PIT for Individuals

- Use Form 02/QTT-TNCN for income from salaries and wages as per Circular 80/2021/TT-BTC.

- Gather withholding certificates (Form 05/CK-TNCN) from your employer.

- Calculate your total income, allowable deductions (such as family deductions, insurance, charity contributions).

- Access the online portal at https://thuedientu.gdt.gov.vn to submit your declaration.

- Submit your tax declaration online and attach any supporting documents for a refund (if applicable).

- Deadline: Before March 31 of the following year.

2. Filing PIT for Businesses

- Businesses are responsible for withholding and filing taxes on behalf of employees.

- Use:

- Form 05/KK-TNCN for monthly or quarterly filing.

- Form 05/QTT-TNCN for annual reconciliation.

- Generate the XML file via HTKK or iHTKK software.

- Log in to the electronic tax portal, sign electronically, and submit the declaration.

- Monitor feedback and handle any errors (if applicable).

3. Forms to Be Used for PIT Filing

Download the forms here

4. How to Submit PIT Declarations Online

The tax authorities encourage both individuals and businesses to file their PIT declarations online to save time and improve processing efficiency. Below are the specific instructions:

For Individuals:

- Via website:

- Visit https://thuedientu.gdt.gov.vn.

- Log in or register an individual account.

- Select “Online Filing” → Choose Form 02/QTT-TNCN.

- Enter income information, deductions, and taxes withheld.

- Submit the declaration and attach the refund documents (if applicable).

- Via eTax Mobile App:

- Download from CH Play or App Store.

- Log in using your individual tax ID.

- Select “File and Pay PIT” and follow the on-screen instructions.

For Businesses:

- Log in to https://thuedientu.gdt.gov.vn with your business account.

- Select the appropriate filing period (monthly, quarterly, yearly) and form.

- Sign electronically using your USB token and submit the XML file.

- Monitor the status of your submission in the “Check Status” section.

Important Considerations When Filing PIT

1. Common Filing Mistakes

- Missing income from multiple sources.

- Incorrect deductions or withholdings.

- Failing to attach refund documents.

- Using the wrong form or filing period.

2. How to Correct a Submitted Declaration

- Log in to the tax system → Go to “Submitted Declarations”.

- Select the “Amend” option and update the incorrect information.

- Submit the amended declaration and provide an explanation (if necessary).

- Monitor for confirmation from the tax authorities.

3. Retention of Records and Supporting Documents

- Individuals should retain copies of withholding certificates, declarations, and electronic confirmations.

- Retention period: At least 5 years as per the Tax Administration Law.

- Businesses should maintain both electronic and paper records for future audits.

Filing PIT is not only a legal obligation but also an action to safeguard the rights of taxpayers. Whether you are an individual or a business, complying with regulations, using the correct forms, and filing on time will help minimize risks and avoid unnecessary penalties. Particularly, utilizing online filing services helps make the process faster, more transparent, and more efficient than ever before.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).