Officially abolishing business license tax in 2026: update on roadmap, impact on businesses, guidance for accountants in preparing documents – avoiding risks when converting. The article analyzes the Officially abolishing business license tax in 2026, abolishing business license fees in 2026, roadmap to abolish business license fees, current business license fee levels in 2025; suggests what accountants need to do to help businesses transition smoothly.

What is business license tax?

Business license tax (current legal name is business license fee) is an annual fee applied to organizations, individuals, and business households when participating in production and business activities. In essence, this is not a tax calculated on income or revenue, but a fee that is a condition for legal operation, associated with the status of a business entity or the scale of capital/business location.

From a management perspective, although the business license fee is not large, it is still a compliance risk point because the declaration and payment procedures often “fall” at the beginning of the fiscal year while businesses are busy summarizing, making budgets, settling taxes and closing accounting books. Therefore, the official abolition from 2026 (presented below) will help reduce workload and compliance costs for the finance and accounting department.

Legal basis & roadmap for abolishing business license fees

On May 17, 2025, the National Assembly issued Resolution 198/2025/QH15 on a number of special mechanisms and policies for private economic development. Clause 7, Article 10 of this Resolution clearly stipulates “Stop collecting and paying business license fees from January 1, 2026”. This is the direct legal basis and has come into effect to establish the abolition of business license fees from 2026.

From 00:00 on January 1, 2026, businesses, households and individuals doing business are no longer obliged to declare and pay business license fees from 2026 onwards. All obligations for periods before this time (for example, outstanding in 2025, late payment, overdue fines…) must still be handled according to current laws. In other words, abolition is about the future, not about eliminating the remnants of the past.

Scope of application & affected subjects

The scope of abolition is comprehensive, applicable to all entities previously subject to paying business license fees. This means that the following groups of entities will no longer incur business license fee expenses from 2026, while reducing declaration and payment procedures at the beginning of the year:

- Previously operating enterprises (all types) and dependent units (branches, representative offices, business locations) established from 2026.

- Newly established enterprises from 2026 onwards

- Business households, business individuals.

From 2026 onwards, there will no longer be business license fee obligations, so there will be no issue of exemption/reduction as in previous years (for example, exemption for the first year for newly established enterprises or exemption for 3 years for enterprises converted from business households according to Decree 22/2020/ND-CP). Enterprises only need to ensure that they have paid off their obligations before 2025 (if any) and keep records and documents for future inspection.

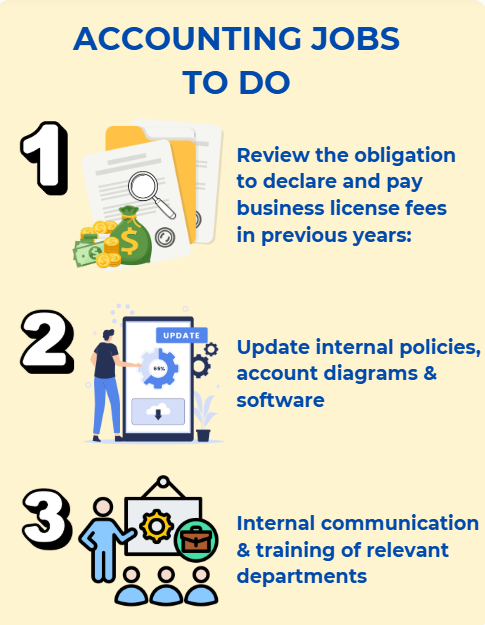

Accounting jobs to do

1. Review the obligation to declare and pay business license fees in previous years:

- Compare 2025 records: Check the declaration/Form 01/LPMB according to Circular 80/2021/TT-BTC, payment documents, expense account ledger.

- Check the payment deadline: Ensure that it has been paid by January 30, 2025 (or according to the specific arising date), to avoid late payment fees.

- Review dependent units: Branches, representative offices, business locations arising/opening in 2025 have declared and paid taxes yet.

2. Update internal policies, account diagrams & software

- Amend financial regulations: Remove the item “business license fee expenses” from the 2026 budget

- Account diagram: From 2026, there will be no more provision for business license fee expenses; transfer the corresponding QLDN cost allocation rules.

- Accounting software: Turn off the automatic deadline reminder workflow, remove the cost code/separate item for the business license fee, update the management report so that this indicator is no longer there.

3. Internal communication & training of relevant departments

- Officially notify departments about the abolition from January 1, 2026, refer to Clause 7, Article 10 of Resolution 198/2025/QH15 so that everyone has unified information.

- Short training for the business/sales team to communicate correctly to customers (no more business license fee); avoid wrong advice that leads to complaints.

The official abolition of business license fees from January 1, 2026 is a reform step to reduce compliance costs, simplify the business environment and help the finance and accounting department reduce workload at the beginning of the year. Enterprises need to close the 2025 obligations, adjust the process – system – budget accordingly, and clearly communicate to relevant parties. The core legal basis is Clause 7, Article 10 of Resolution 198/2025/QH15; the Ministry of Finance has also initiated the process of issuing a guiding decree to unify implementation nationwide.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).