Our guide to E-invoice Registration: Things Businesses Need to Know in Vietnam covers the complete procedure, required documents, and tips for choosing a provider. Registering for e-invoices is a mandatory first step for any new business in Vietnam. This guide provides a clear procedure for e-invoice registration, helping you navigate the process and choose the right e-invoice provider.

The Importance and Mandatory Nature of E-invoices under Decree 123/2020/NĐ-CP

In the digital era, transitioning to the use of electronic invoices (e-invoices) is no longer an option but has become a mandatory requirement for all enterprises, organizations, and business households in Vietnam. The most crucial legal basis for this transition is Decree 123/2020/NĐ-CP, which regulates invoices and documents. This Decree marked a turning point in tax administration, aiming for a transparent, modern, and efficient financial system.

Registering and using e-invoices in compliance with regulations is not just a legal obligation. It also brings countless practical benefits to the business itself: saving costs on printing, storage, and shipping; shortening payment and debt management times; and enhancing security while minimizing the risk of counterfeit invoices. Therefore, mastering the registration process and related regulations is a fundamental lesson for anyone currently operating or planning to operate a business, ensuring that business activities run smoothly and are legally secure from the very beginning.

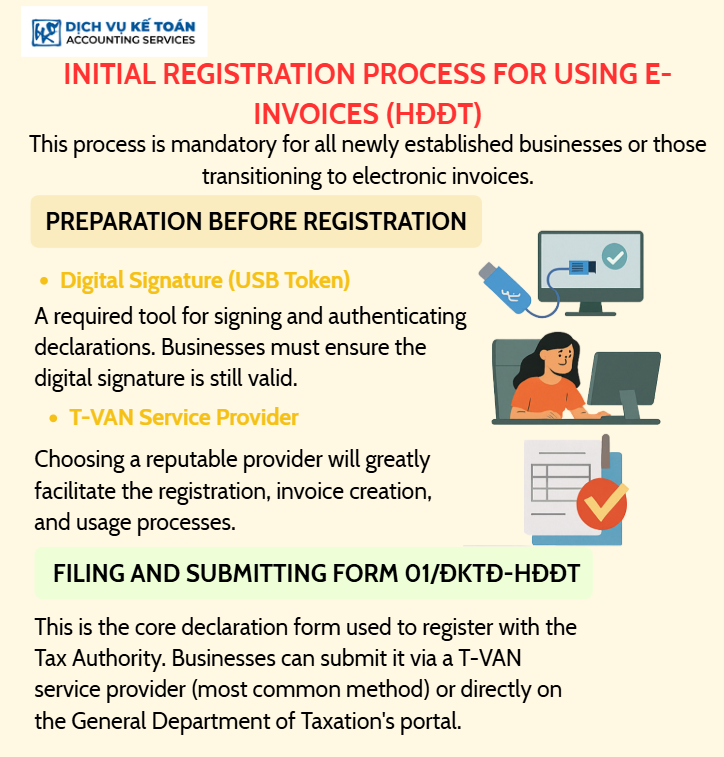

Initial E-invoice (e-invoice) Registration Process

This is a mandatory process for all newly established enterprises or those transitioning to using e-invoices.

- Preparation Before Registration Digital Signature (USB Token): This is a mandatory tool for signing and authenticating declarations. The business must ensure the digital signature is still valid. Service Provider (T-VAN): Choosing a reputable provider will make the registration, creation, and subsequent use of invoices much more convenient.

- Completing and Submitting Form 01/ĐKTĐ-HĐĐT This is the core declaration form for registering with the Tax Authority. The business can submit it through a T-VAN provider (the most common method) or directly on the General Department of Taxation’s web portal.

Waiting Time and Response from the Tax Authority

After submitting the declaration, the business needs to monitor its email for a notification from the Tax Authority.

Processing Time: The Tax Authority will send a notification of the result within 01 working day from receiving the valid declaration. “Accepted” Result: If you receive the Notice Form 01/TB-ĐKĐT, your business has successfully registered and is permitted to start issuing e-invoices. “Not Accepted” Result: The notice will clearly state the reason (e.g., incorrect information, invalid digital signature…). The business needs to correct the declaration form as instructed and resubmit it.

Guide to Changing Registered Information

If there are any changes to the initially registered information (such as changing the T-VAN provider, changing the digital signature, etc.), the business is required to re-register with the Tax Authority.

Procedure: The business simply needs to complete and resubmit Form 01/ĐKTĐ-HĐĐT with the updated information, while also checking the “Change of Information” box. The process and response time are similar to the initial registration.

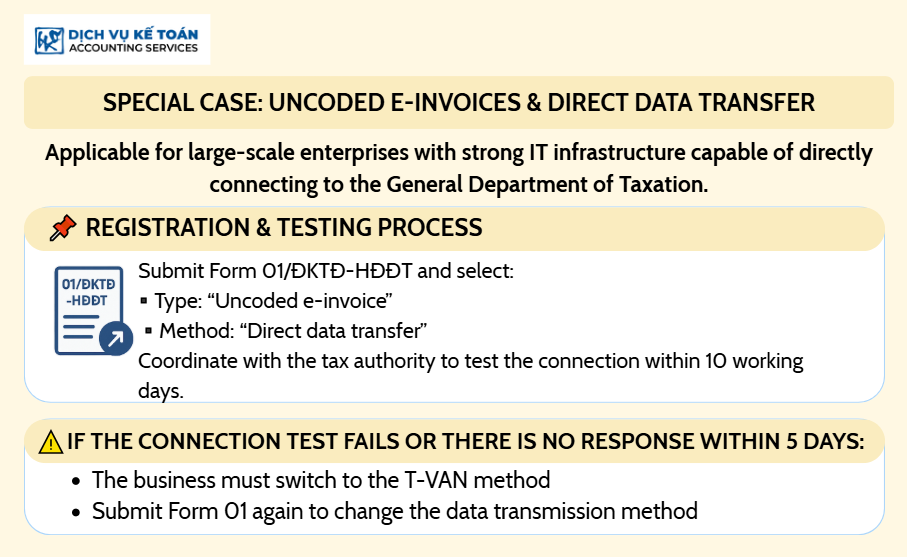

Special Case: Non-Coded Invoices & Direct Data Transfer

This method is exclusively for very large-scale enterprises with a robust IT infrastructure capable of connecting directly to the General Department of Taxation.

- Registration and Testing Process The business still uses Form 01/ĐKTĐ-HĐĐT to register, but must select the “Non-coded invoice” and “Direct data transfer” options. After registering, the business must proactively coordinate with the General Department of Taxation to test the connection. This process takes place within 10 working days.

- Handling a Failed Connection If the test fails, or if the business does not respond within 05 working days after being invited by the Tax Authority, it is mandatory to change the method. In that case, the business must resubmit Form 01 to switch to the method of sending data through a T-VAN provider.

The process of registering and using e-invoices, although simplified, still requires absolute care and compliance from businesses. A clear understanding of the preparation steps, registration process, response times, and how to handle situations like changing information or registering for direct data transfer is the key to ensuring a business’s invoicing operations are always smooth and lawful. Complying correctly from the start will help businesses avoid unnecessary risks and focus their resources on core production and business activities.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).