A clear guide to accounting for free promotional goods under Vietnam’s current accounting and tax regulations. Accounting for free promotional goods is a crucial task for any business accountant. This article provides detailed guidance on handling cases of “free promotional items” and “gifted goods” according to the latest Vietnamese accounting standards.

What is the accounting treatment for free promotional goods?

The accounting treatment for free promotional goods refers to recording in the accounting books the transactions related to a company providing goods free of charge to customers for promotional, marketing, or appreciation purposes.

This is a common practice in business, but the accounting and tax recognition must comply with legal regulations to ensure cost legitimacy and avoid errors in tax declaration.

Common types of promotional goods in enterprises

1. Free promotional goods under registered marketing programs

This refers to businesses giving away goods without collecting payment, as part of a registered promotional program with competent authorities. In this case, the business is allowed to issue an invoice with a value of zero and is not required to recognize revenue. However, the cost of these goods is still recorded under selling expenses if supported by valid documents.

2. Promotional goods in the form of discounts or rebates

Some businesses do not give away products directly but offer discounts or rebates after purchase. These are not considered “free promotional goods” but rather revenue adjustments. Accountants must distinguish clearly to ensure accurate accounting treatment.

3. Internal promotional goods for employees or partners

When a company gives away goods to employees, agents, or partners without collecting payment, it is not part of a registered marketing program. Therefore, such transactions should be recorded as welfare or gift expenses, and the business must issue an invoice and calculate VAT accordingly.

Read more: Criteria for determining reasonable costs for enterprises according to the latest regulations

Accounting and tax regulations for promotional goods

1. Difference between promotional goods with and without revenue

- Promotional goods with revenue: Recognize revenue and account as usual.

- Promotional goods without revenue: Do not recognize revenue; account costs separately according to the promotional program.

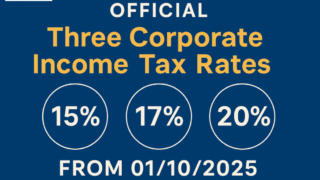

2. Determining deductible expenses for corporate income tax (CIT)

Only promotional expenses that follow a registered program and are supported by valid documentation are considered deductible when calculating taxable income.

3. VAT treatment for promotional goods

– For valid promotions under the Law on Commerce: No VAT output declaration is required.

– For gifts outside promotional programs: VAT output must be declared based on the taxable price of similar goods.

Detailed accounting entries for each case of promotional goods

1. Accounting entry for free promotional goods

When issuing promotional goods without collecting payment:

– Debit Account 641 (Selling expenses)

– Credit Account 156 (Inventory – goods)

At the same time, issue an invoice with zero value if the promotion is registered.

2. Accounting for gifts with VAT invoice

If the goods given are outside registered promotions:

– Debit Account 641 or 642 depending on nature

– Debit Account 3331 (VAT payable)

– Credit Account 512 (Internal revenue) or similar

– Credit Account 511 in special cases

– Credit Account 156 (Inventory – goods issued)

Important notes on invoicing and tax declaration

1. How to record promotional goods on VAT invoices

– For registered promotions: clearly note on the invoice “promotional goods under program no…”, unit price 0, VAT rate 0%.

– Avoid recording a positive price then applying a 100% discount, which could be misinterpreted as a price reduction.

2. Handling errors or missing promotional invoices

– If an invoice was missed: issue a supplementary invoice immediately.

– If the promotional details were incorrect: issue a correction document along with a revised invoice.

Accounting for free promotional goods requires accountants to thoroughly understand legal provisions and the nature of each transaction. Businesses must ensure accurate invoicing, proper accounting, and correct tax declarations for each scenario. This not only prevents tax risks but also helps manage promotional expenses and revenue more effectively.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).