Learn the signs and factors that identify businesses with high tax and invoice risks, helping to minimize risks and ensure compliance with the law. Businesses can encounter tax and invoice-related issues if not strictly controlled. Timely identification of tax and invoice risks helps businesses prevent errors and minimize the risk of being penalized.

What is the identification of high risk businesses regarding tax and invoices?

Identifying businesses with high tax and invoice risks is an important factor in protecting businesses from legal issues. Risks can seriously affect businesses if not detected and handled promptly.

Correctly identifying the factors and signs of businesses that are likely to encounter risks will help us take appropriate preventive measures, minimize costs and avoid penalties.

Signs to identify businesses with high risks regarding taxes and invoices

According to Official Dispatch No. 1873/TCT-TTKT dated June 1, 2022 on strengthening the review and inspection to detect taxpayers with signs of invoice risks and combating VAT refund fraud, warning signs for businesses with high risks of tax and invoices that need to be noted:

1. Businesses change their legal representative 2 or more times within 12 months or change their legal representative and simultaneously change their business location.

2. Businesses have changed their operating status or business location 2 or more times in a year.

3. Newly established businesses have an unstable business location (changing business location many times within 1-2 years of operation).

4. Businesses change their business location after receiving a Notice of inactivity at the registered address.

5. Enterprises established by individuals with family relationships who contribute capital such as Wife, Husband, brothers, sisters, etc.

6. Newly established enterprises whose directors or legal representatives have a company whose business address has been notified by the tax authority to be abandoned (with tax arrears), temporarily suspending business operations for a period of time.

7. Enterprises established for many years without generating revenue, then resold or transferred to others.

8. Enterprises established without a license to exploit minerals but issue invoices for resources and minerals.

9. Enterprises with goods sold or purchased that are not suitable for the conditions and characteristics of each region.

10. Enterprises that have not paid enough charter capital as registered.

11. Enterprises that buy, sell, or merge with a value of less than 100 million VND.

12. Enterprises operating supermarkets (retailing consumer goods, electronics); food and beverage, restaurant, hotel businesses; transportation business; construction materials business; petroleum business; business in the field of mining soil, stone, sand, gravel; mineral business (coal, kaolin, iron ore …); agricultural and forestry business (wood chips, wood panels, wood bars, …); there is a labor leasing business (large increase).

13. Revenue increases suddenly, specifically: The previous declaration period has very low revenue, approximately 0 but the following period has a sudden increase in revenue or the following period has a sudden increase in revenue (from 3 times or more compared to the average revenue of previous periods) but the amount of value added tax (VAT) payable is low (VAT payable < 1% of the revenue generated in the period).

14. Revenue is large but the warehouse is not commensurate or there is no warehouse, no warehouse rental costs arise.

15. Annual declared revenue arises from over 10 billion VND but the amount of tax payable is low, under 100 million VND (1%).

16. Enterprises use invoices in large quantities (from 500 to 2000 invoices). The number of deleted invoices is large, on average accounting for about 20% of the invoices used.

17. Enterprises using electronic invoices according to Decree No. 123/2020/ND-CP, Circular No. 78/2021/TT-BTC have an unusual decrease in the number of electronic invoices compared to the number of invoices used according to Decree No. 51/2010/ND-CP.

18. Enterprises do not have an invoice issuance notice or have an issuance notice but do not have a report on the status of invoice usage (or are late in reporting).

19. Enterprises have the value of goods sold, output VAT equal to or very small difference compared to the value of goods purchased, input VAT.

20. Enterprises have goods and services sold that do not match the goods and services purchased.

21. The enterprise has large revenue and output and input VAT but does not generate tax payable, has negative VAT for many periods.

22. The enterprise has no fixed assets or very low fixed asset value.

23. The enterprise has suspicious transactions through the bank (money is received and withdrawn on the same day).

24. The enterprise uses labor disproportionate to the scale and industry of operation.

25. An individual (legal representative) establishes and operates many enterprises.

Consequences when businesses fail to identify tax and invoice risks

1. Fines and tax collection

If a business fails to fully comply with tax and invoice regulations, it may be subject to penalties from the tax authorities, including fines and tax collection for invalid expenses.

2. Increased financial costs due to violations

In addition to fines, businesses also have to bear costs arising from correcting errors, adjusting invoices and reporting taxes. These costs can increase operating costs and reduce profits.

3. Impact on business reputation and relationship with tax authorities

Once a business is found to have violated taxes or used illegal invoices, its reputation may be affected and its relationship with tax authorities may become strained. This can make it difficult for businesses to cooperate and maintain business relationships.

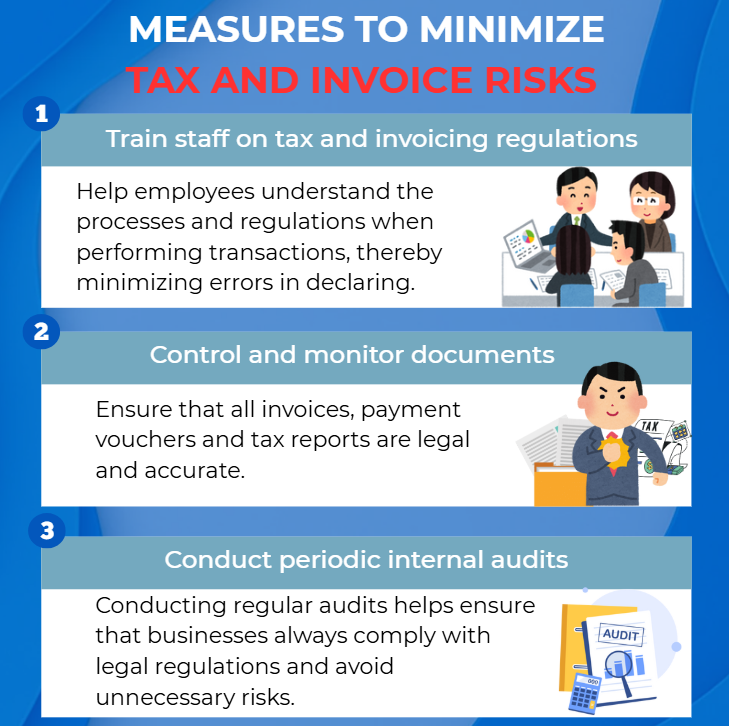

Measures to minimize tax and invoice risks for businesses

1. Train employees on tax and invoice regulations

Training employees on legal regulations related to taxes and invoices is extremely important. This helps employees understand the processes and regulations when making transactions, thereby minimizing errors in declaring and using invoices.

2. Strengthen the document control and monitoring system

Enterprises need to establish a strict document control system to ensure that all invoices, payment documents and tax reports are legal and accurate. Regular inspection and monitoring will help detect errors early and make timely adjustments.

3. Conduct periodic internal audits

Internal audits help businesses detect issues related to taxes and invoices before the tax authorities intervene. Conducting periodic audits helps ensure that businesses always comply with legal regulations and avoid unnecessary risks.

Identifying and managing tax and invoice risks is an indispensable part of a business’s financial management process. Understanding the factors that identify businesses with high tax and invoice risks, as well as the possible consequences of not controlling these issues well, will help businesses come up with effective preventive measures. From there, businesses can minimize costs, avoid penalties and maintain good relationships with tax authorities and business partners.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).