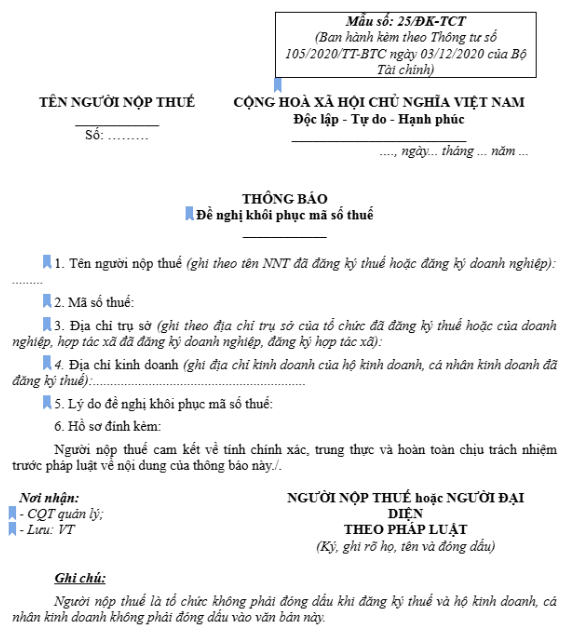

Learn about Form No. 25/DK-TCT – Official letter requesting tax code recovery and the complete and accurate implementation process. Form No. 25/DK-TCT – Official letter requesting tax code recovery is an important form when businesses want to reactivate their tax codes. The article will provide detailed instructions on how to fill out the form, procedures and necessary notes.

Form No. 25/ĐK-TCT – What is the Official Request for Reinstatement of Tax Code?

The Tax Identification Number (TIN) plays a vital role in identifying and managing the tax activities of organizations or businesses. In some cases, the TIN may be deactivated due to a company’s cessation of operations, violation of legal regulations, or administrative errors. When a business wants to resume operations, submitting a formal request to reinstate its TIN becomes mandatory.

Form No. 25/ĐK-TCT, issued by the General Department of Taxation, is the standard template for businesses to formally request the reinstatement of their TIN. This form includes many essential details that help the tax authority review and process the request promptly, ensuring the taxpayer’s legal rights.

What is Tax Code Suspension and Why is a Business’s TIN Suspended?

Suspension of a business’s TIN is the temporary deactivation of its tax code by the tax authority. This means the business cannot fulfill its tax obligations until the TIN is reinstated.

Common reasons for TIN suspension include:

– The business unilaterally ceases operations without notifying or completing dissolution procedures with the tax authority.

– Failure to submit tax declaration reports for multiple consecutive periods or prolonged tax debt.

– No operational activity detected at the registered address during verification by the tax authority: no company signage, location remains closed for extended periods, notices or invitations sent are undelivered or unanswered, local residents or police are unaware of the company’s existence.

– Indications of fraudulent operations such as creating shell companies or other legal violations.

Consequences of TIN Suspension

TIN suspension brings about serious consequences, not only legally but also affecting service quality and a company’s market reputation.

1. Inability to Issue Electronic Invoices (e-Invoices)

Without valid invoices, a business cannot recognize legal revenue.

Previously issued invoices may be deemed invalid, disqualified as legitimate expenses, creating risks for customers who have purchased goods or services.

2. Termination of All Legal Transactions with the Tax Authority

A company with a suspended TIN cannot submit tax declarations via the electronic tax system during filing periods. Late submissions are subject to administrative penalties based on the number of overdue days.

Additionally, the business cannot process tax refunds, register new invoices, update company information, or complete other administrative procedures with the tax authority.

3. Damage to Business Reputation and Brand Image

Information on the national tax portal will display: “Taxpayer is inactive at the registered address.”

This may lead to rejection of applications in tenders, loans, or business licenses. Banks and business partners may suspend cooperation to avoid legal risks associated with the suspended company.

4. Legal Consequences and Penalties

The company may be subject to enforcement measures or tax recovery by the authority (e.g., account garnishment, asset freezing).

Company leaders may face administrative penalties or even criminal prosecution for fraud or tax evasion.

Procedure to Submit a Request for TIN Reinstatement

Prepare Form No. 25/ĐK-TCT clearly stating the reason and fully compile supporting documents for the tax authority’s verification process.

Submit the application in person at the “One-Stop” counter of the District Tax Office where the company is headquartered.

After receiving the documents, the tax authority will process the request in accordance with regulations. The business should monitor the application status and maintain proactive communication with the tax office to shorten processing time and avoid business disruptions.

Form No. 25/ĐK-TCT – Official Request for Reinstatement of Tax Code – is a crucial tool that helps businesses return to legal operations after their TIN is suspended. A clear understanding of the process, complete documentation, and compliance with proper procedures can help businesses save time and costs. More importantly, strict adherence to tax laws is vital for sustainable and lawful development of every enterprise.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).

Click register now to get the form here