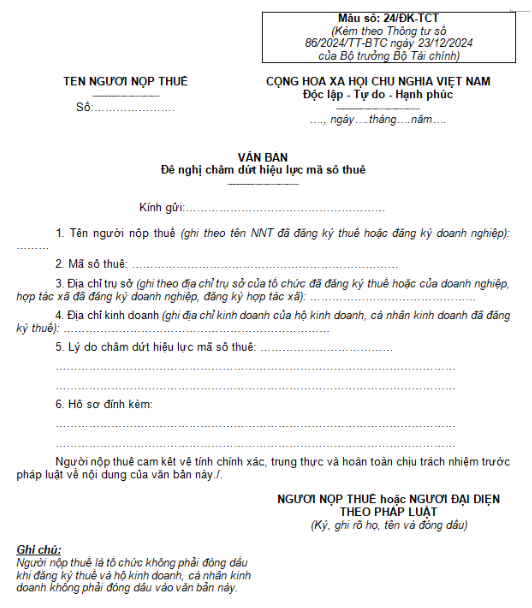

Form No. 24/DK-TCT helps businesses carry out procedures for terminating tax codes easily and legally. Form No. 24/DK-TCT: Document requesting termination of tax code validity is a mandatory form when businesses or individuals want to stop using tax codes. This article provides detailed instructions on how to fill out and submit this form.

Form No. 24/DK-TCT: Request for Termination of Tax Code Validity

A tax code is an identification number issued by the tax authority to businesses upon establishment and is used to fulfill tax declaration obligations. When a business wishes to cease operations and dissolve in accordance with legal regulations, the termination of tax code validity becomes necessary.

Form No. 24/DK-TCT: The latest request for termination of tax code validity was issued under Circular No.86/2024/TT-BTC and applies to organizations and businesses seeking to deactivate their tax codes at a specific point in time.

Understanding the Termination of Tax Code Validity: Concepts & Conditions

1. Termination of Tax Code Validity

The termination of tax code validity means the tax authority records that a business’s tax code is no longer active in the management system. From that moment, the business is no longer obligated to declare, pay taxes, or carry out any tax procedures related to that tax code.

Common cases of tax code termination:

– Businesses undergoing dissolution, bankruptcy, or mergers that wish to cease operations

– Dependent units (branches, representative offices, business locations, etc.) that dissolve or cease operations as requested by the parent company

– Sole proprietorships ceasing business operations

– Foreign organizations terminating their business activities in Vietnam

2. Conditions for Termination of Tax Code Validity

To terminate the tax code, it is necessary to ensure that the organization or enterprise has completed the tax settlement with the tax authority and no longer has any tax obligations in the future. Specifically:

– The enterprise and its dependent units have actually ceased operations and no longer have real-life economic transactions.

– The enterprise has completed the dissolution dossier and procedures at the business registration office (Department of Planning and Investment).

– All bank accounts established by the enterprise during its operation must be closed.

– Tax settlement with the tax authority must be completed: Submit all tax reports, outstanding tax amounts, complete the settlement of accounting data and books, … up to the time of cessation of operations.

Detailed Instructions on Procedures and How to Fill Out Form 24/DK-TCT

Form 24/DK-TCT includes the following main contents:

– Enterprise information (name, tax code, address, …)

– Reason for terminating the tax code (clearly state the specific reason: dissolution, bankruptcy, cessation of business …)

– Taxpayer’s commitment and signature, stamp

Place of submission: Tax authority directly managing the enterprise. The tax officer in charge will conduct verification and comparison of tax obligations before confirming the termination of the tax code for the enterprise.

Note:

– It is necessary to complete the tax report and settle related obligations.

– The terminated tax code cannot be reused.

– Keep the confirmation documents of the tax authority for use when needed.

Submitting Form No. 24/DK-TCT is an important step in the process of terminating business operations or ceasing tax obligations in Vietnam. Individuals and organizations need to comply with the correct procedures, fill in all information and ensure that tax obligations have been settled before requesting to terminate the tax code. This not only ensures legality but also helps businesses to close down neatly and transparently before the law.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).

Click register now to get the form here