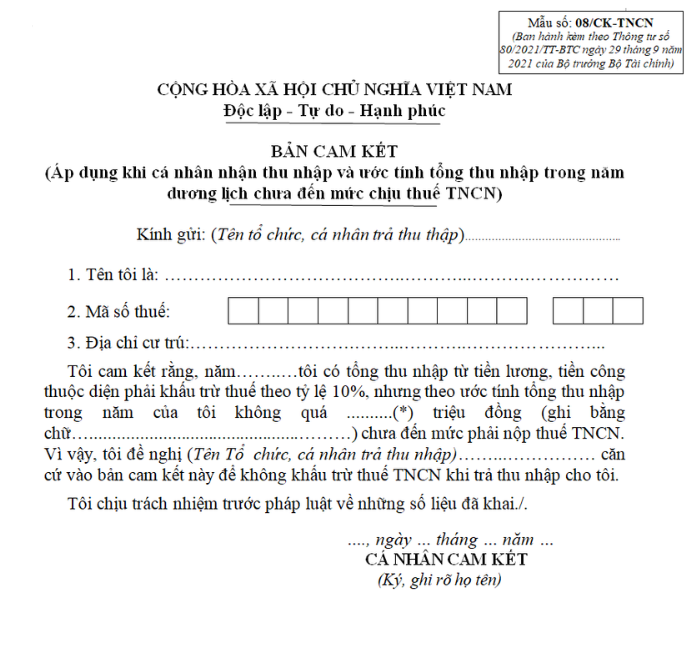

Learn about Form 08/CK-TNCN – the latest personal income tax commitment form to help you avoid unnecessary tax deductions. Form 08/CK-TNCN: The latest personal income tax commitment form is updated according to the latest regulations of the law, helping employees temporarily avoid personal income tax deductions. This is an important form in the annual tax settlement dossier.

What is Form 08/CK-TNCN?

Form 08/CK-TNCN, issued under Circular No. 80/2021/TT-BTC, is a commitment form used to request exemption from personal income tax (PIT) withholding for individuals whose income does not reach the taxable threshold.

Eligible employees may submit this form to their income-paying organization to avoid unnecessary tax deductions.

This form not only helps reduce the tax burden on employees but also ensures transparency during the annual tax finalization process.

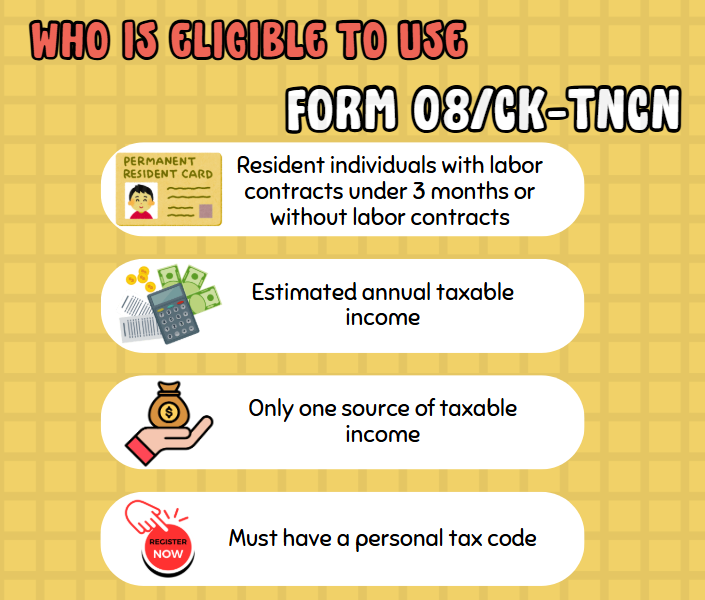

Who is eligible to use Form 08/CK-TNCN?

The use of Form 08/CK-TNCN is governed by legal regulations and is applicable only to individuals who meet all the following conditions:

1. Resident individuals with labor contracts under 3 months or without labor contracts

The income commitment applies only to resident individuals in Vietnam.

⇒ Non-resident individuals are not eligible to make a PIT exemption commitment.

Those who are residents and sign short-term contracts under 3 months or work under service, probationary, internship, or task-based agreements (not standard labor contracts) can use this form.

⇒ Individuals with labor contracts of 3 months or more or indefinite-term contracts are not eligible to make this commitment.

2. Estimated annual taxable income

Individuals must estimate that their total annual taxable income, after family deductions (personal and dependent deductions), does not reach the taxable threshold.

For individuals with no dependents, this threshold is 132,000,000 VND/year. For those with dependents, an additional 4,400,000 VND per dependent is deducted — with no limit on the number of dependents.

3. Only one source of taxable income

Individuals must have only one source of income from salary or wages from a single employer and no other income from any other source during the year. The total income must be from 2,000,000 VND/time or more.

4. Must have a personal tax code

Individuals must be registered with the tax authority and have an active tax code at the time of submitting the commitment form.

Obligations of the enterprise or income-paying organization

The employer is responsible for providing legal guidance, supporting procedures, and facilitating employees in submitting Form 08/CK-TNCN as needed.

Upon receiving the form, the company will proceed to pay salaries without PIT withholding in accordance with the law.

At year-end, the enterprise must consolidate all individuals who submitted the commitment and declare them in Appendix 05-2/BKQTT-TNCN of the Personal Income Tax Finalization declaration. This must be submitted on the electronic tax system within 90 days from the end of the calendar year.

Important notes when preparing Form 08/CK-TNCN

1. Submission timing

The form must be prepared and submitted before the income-paying organization executes any salary payment, i.e., before any PIT is withheld. Late or incorrectly submitted forms may result in tax being withheld and declared by the employer according to regulations.

2. Fulfill all conditions

Individuals must meet all four stated conditions to be eligible to use this form. If not, the employer must proceed with standard PIT withholding from the employee’s income.

3. Legal responsibility

If an individual submits false information in the commitment leading to incorrect tax declaration or non-payment, they may be subject to administrative fines, tax recovery, or legal action, depending on the severity of the violation.

Form 08/CK-TNCN plays a vital role in protecting employees from improper PIT withholding. Understanding the eligibility criteria, timing, and submission process can help prevent future disputes, tax recovery, or penalties. Enterprises should guide their employees to use this form in compliance with regulations to avoid legal risks.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).

Click register now to get the form here