A complete overview of Decree 70/2025 in Vietnam, analyzing major changes to invoices, social insurance (SI), cash payments, salaries, and providing compliance solutions.

Decree 70/2025 is now active, fundamentally altering Vietnam’s business landscape. This guide provides a full overview of the new rules on e-invoices, mandatory social insurance for business owners, non-cash payments, and salary transparency.

Since officially coming into effect, Decree 70/2025 has been creating a profound reshaping of the business environment in Vietnam. No longer a draft or a future prospect, the new regulations on invoices, social insurance, cash payments, and salary management have become the reality that every business must now confront. This article will provide a complete overview, an A-to-Z analysis of the core changes, and strategic solutions to help businesses not only comply but also turn these challenges into a competitive advantage in the new landscape.

- What is Decree 70/2025 and Why Must Businesses Care?

- A Detailed Analysis of the 4 Core Changes in Decree 70/2025

- 1. Regarding Invoices: Tightening Regulations, Aiming for 100% Transparency

- 2. Regarding Social Insurance (SI): Expanding Subjects, Increasing Compliance Costs

- 3. Regarding Cash: A “Revolutionary” Regulation on Non-Cash Payments

- 4. Regarding Salary: Ending the “Two-Payroll” System via the Etax Mobile App

- The Impact of Decree 70/2025 on Business Structure and Operations

- Comprehensive Solutions for Businesses to Comply with Decree 70/2025

What is Decree 70/2025 and Why Must Businesses Care?

Decree 70/2025/NĐ-CP (hereinafter referred to as Decree 70/2025) is a pivotal legal document, marking a decisive step by the Government to modernize tax administration and establish a transparent business environment. It is not a typical update but a systematic reform with the core objective of thoroughly applying technology to all economic transactions, thereby closing loopholes that cause budget revenue loss and eliminating fraudulent activities.

At this moment, with Decree 70/2025 fully implemented, it is imperative for every business to pay attention because it impacts four vital pillars of any enterprise: cash flow, costs, operational processes, and risk management. Ignoring or delaying adaptation will not only lead to heavy administrative penalties but can also disrupt business operations and result in a loss of competitive advantage. This Decree leaves no one behind; from large corporations to micro-enterprises, each regulation carries deep management implications and demands a shift in the mindset of leadership. Understanding Decree 70/2025 is no longer an option—it is a mandatory requirement for survival and growth.

A Detailed Analysis of the 4 Core Changes in Decree 70/2025

Decree 70/2025 revolves around four main areas, each containing revolutionary new regulations that require immediate adjustments from businesses.

1. Regarding Invoices: Tightening Regulations, Aiming for 100% Transparency

Firstly, the requirement for information on retail invoices has been tightened. For businesses selling directly to consumers, such as supermarkets, restaurants, and convenience stores, issuing invoices without buyer information or pooling multiple transactions into one has become impossible if they wish to remain compliant. The new regulation requires recording the buyer’s full identification details upon request, preventing the practice of selling fraudulent invoices and protecting consumer rights. This is creating significant challenges for checkout processes, requiring staff retraining and more flexible POS systems.

Secondly, the scope of mandatory use of cash registers with a data connection to tax authorities has been expanded. Service industries with large cash transaction volumes like transportation, F&B, hospitality, and retail must now ensure all revenue is transmitted directly to the tax authority’s system in real-time. This is not just an equipment investment but a change in revenue management philosophy, leaving no room for unrecorded income.

Thirdly, and most critically, the process for handling errors has become extremely strict. The concept of “canceling an invoice” has been virtually eliminated. Any error discovered after an invoice has been sent to the buyer must be handled by issuing an adjusted or replacement invoice, accompanied by a clear explanation via Form 04/SS-HĐĐT. This regulation creates an indelible audit trail, demanding near-perfect accuracy from accountants from the very first issuance.

2. Regarding Social Insurance (SI): Expanding Subjects, Increasing Compliance Costs

- The owner of a private enterprise.

- The Director or General Director of a one-member Limited Liability Company (owned by an individual).

- The owner of a business household (applicable to registered business households).

Previously, a common practice was for the owners of these types of enterprises to not include themselves on the payroll to optimize costs, as they receive after-tax profits instead of a salary. However, the new regulation completely closes this “grey area.” The law aims to ensure long-term social security benefits (such as pensions, sickness, and maternity leave) for the leaders and heads of enterprises themselves, while also creating fairness with other employees.

Direct impact on businesses:

- Increased Fixed Costs: The business will have to contribute a monthly amount for SI for the subjects mentioned above, based on an income base for SI contribution stipulated by law (usually not lower than the regional minimum wage). This is an additional mandatory expense that must be calculated and included in the financial plan.

- Declaration and Monitoring Obligations: The accounting and HR departments must immediately carry out procedures for registration, report the increase in labor, and declare and pay monthly SI contributions for these subjects to avoid arrears collection and high-interest late payment penalties.

This is a mandatory regulation that requires business owners to change their cost management mindset and view SI contributions as an investment in their own future.

3. Regarding Cash: A “Revolutionary” Regulation on Non-Cash Payments

All input invoices, regardless of value, must have non-cash payment proof to be eligible for input VAT deduction and to be counted as a deductible expense for CIT purposes.

This regulation completely removes the previous threshold of VND 20 million, meaning that cash payments in business-to-business transactions are now virtually worthless from a tax perspective. The government’s objective is clear: to eliminate cash transactions in the business sector, control 100% of financial flows, and prevent the legitimization of expenses through fake invoices without real transactions. For businesses, however, this presents a colossal operational challenge. They must completely overhaul payment policies, eliminate petty cash for small purchases, and require all departments to use bank transfers, even for minor expenses.

4. Regarding Salary: Ending the “Two-Payroll” System via the Etax Mobile App

Now, any employee can easily log in and check the official salary that their company is declaring for them. This makes the practice of a “two-payroll” system (a low salary on paper for lower SI and tax contributions, with the remainder paid in cash) extremely risky. If employees discover discrepancies, they have the right to complain, and the business will face the collection of PIT and SI arrears, along with related penalties, on the entire actual salary. This regulation forces businesses to confront their true labor costs, including taxes and insurance on total income, marking a major shift in cost structure.

The Impact of Decree 70/2025 on Business Structure and Operations

- Financially: Compliance costs have skyrocketed. Businesses must spend on technology (software, cash registers), personnel costs (fully declared salaries and SI), and consulting services. Cash flow is also affected by the inability to flexibly use cash.

- Operationally: Internal processes must be standardized and tightened. Sales, procurement, advance payments, settlements, and payroll processes must all be redesigned to ensure 100% compliance, leaving no room for flexibility or “experience-based” practices.

- Technologically: Businesses are forced into digital transformation. Maintaining separate, un-integrated software systems will be a fatal weakness. Technology has become a mandatory factor for survival.

- Strategically: The “grey areas” in business have been significantly narrowed. Business models based on cost optimization through informal measures are no longer sustainable. Businesses are forced to compete based on core competencies, product quality, and genuine management efficiency.

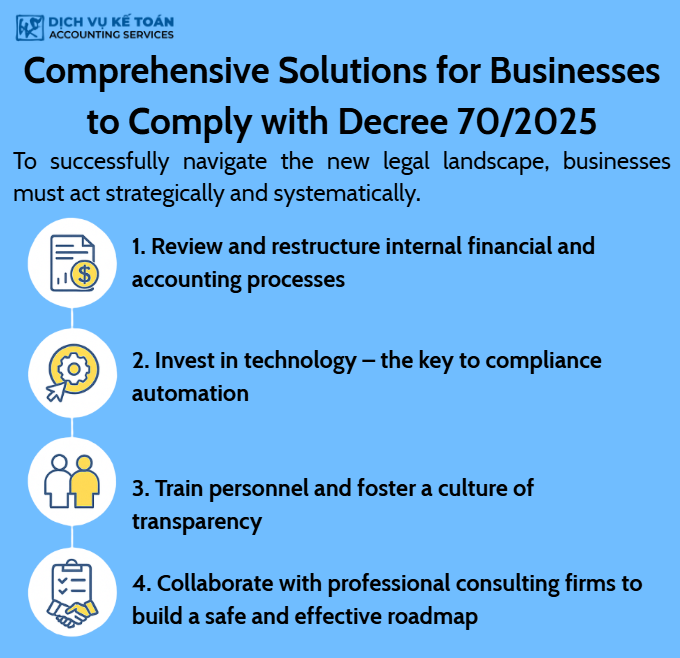

Comprehensive Solutions for Businesses to Comply with Decree 70/2025

1. Review and Restructure Internal Financial-Accounting Processes

2. Invest in Technology: The Key to Automating Compliance

3. Train Personnel and Build a Culture of Transparency

4. Partner with Professional Consulting Firms for a Safe Roadmap

Decree 70/2025 is truly a revolution in tax administration in Vietnam. Although the new regulations may create significant challenges and cost pressures in the initial phase, in the long run, they will build a more transparent, fair, and modern business playing field. The businesses that have a long-term vision, proactively adapt, view compliance as a cornerstone of their corporate culture, and systematically invest in technology and people, will not only overcome the challenges but will also find opportunities to break through, affirm their position, and achieve sustainable growth in the new era.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).