Learn in detail what is a reasonable cost for enterprises and how to properly apply regulations when calculating corporate income tax. What is a reasonable cost for enterprises? Determining reasonable costs, deductible costs, and corporate income tax regulations are key factors to help enterprises optimize costs and comply with the law.

What Are Reasonable Expenses for a Business?

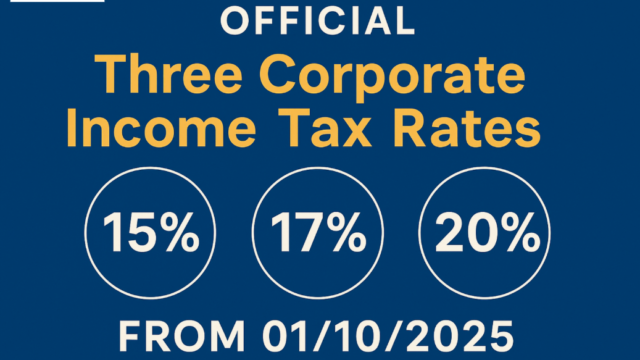

During the course of production and business activities, enterprises incur various types of expenses. However, not all expenses are accepted by the tax authorities when calculating corporate income tax (CIT). Therefore, determining “reasonable expenses” plays a critical role in helping businesses comply with tax laws while optimizing costs.

Criteria for Determining Reasonable Expenses According to Tax Regulations

1. Related to the Business Activities of the Enterprise

Reasonable expenses are those directly serving the business operations of the enterprise. For example: costs of purchasing raw materials, employee salaries, depreciation of fixed assets, office rent, utilities, etc. All must contribute to increasing revenue or maintaining operations.

2. Supported by Sufficient and Legal Invoices and Documents

An expense is only considered reasonable when it is supported by complete documents such as VAT invoices, sales invoices, economic contracts, liquidation minutes, etc., as required by regulations. Missing documentation will result in the expense not being recognized.

3. Paid in Compliance with Legal Payment Methods

According to regulations, invoices with a value over VND 20 million, or multiple invoices from the same supplier issued on the same day with a total value over VND 20 million, must be paid via non-cash payment methods (bank transfer, payment authorization) to be recognized as legitimate expenses.

4. Compliant with Normal Spending Levels and Within Prescribed Limits

Incurring high-level expenses such as salaries, client entertainment, office supplies, etc., compared to revenue may result in partial disallowance. Enterprises must adhere to the expenditure ratios stipulated in the Corporate Income Tax Law.

5. Recorded in the Correct Accounting Period

No matter how reasonable an expense may be, if it is recorded in the wrong period (e.g., posted to an incorrect fiscal year or wrong account), it will not be accepted.

Non-Deductible Expenses for CIT Purposes

Non-deductible expenses for CIT purposes are those incurred by the enterprise during operations but do not meet the requirements for deductibility when determining taxable income.

For example: expenses for individuals not related to the business, expenses lacking complete and lawful documentation, excessive depreciation beyond regulatory limits…

Unreasonable expenses are disallowed and increase the amount of tax payable.

Efficient Accounting and Documentation of Reasonable Expenses

Proper and complete accounting and storage of expense documentation not only help businesses control costs but also serve as crucial evidence during tax inspections and audits. Enterprises should follow these principles:

-Record expenses under the correct accounting account and in the correct accounting period.

-Store all related documents such as invoices, payment vouchers, contracts, acceptance reports, liquidation records… These documents must be original, clear, lawful, and contain full signatures and seals (if required).

-Use accounting software or an ERP system to track and store documents electronically to prevent loss.

-Train accounting staff to stay updated with tax regulations and proper documentation procedures.

Some common questions related to Reasonable and Unreasonable Expenses

Example 1: Paying salaries to employees – having a labor contract, employees sign the payroll and the salary is in accordance with the company’s salary/bonus agreement.

=> Record reasonable expenses

Example 2: Paying monthly office rent of 30 million VND – having a house rental contract, having a VAT invoice from the rental service provider, paying by the company’s bank account.

=> Record reasonable expenses

Example 3: Director takes his personal car for maintenance, issues a VAT invoice to the company, requests payment and records it as an expense.

=> Not recorded – eliminated (personal property, not used for production and business).

Example 4: Buying office supplies at a grocery store – the seller does not issue an invoice, only has a handwritten sales receipt and a cash payment slip

=> Not recorded – eliminated (no legal invoice).

Understanding and correctly applying the concept of reasonable expenses will help businesses both save legitimate costs and avoid risks during tax audits and inspections. Enterprises should closely coordinate with accounting, finance departments, and legal advisors to establish a transparent, reasonable, and effective cost system.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).