Learn about VAT invoice time and things to note to comply with tax regulations and avoid legal risks. VAT invoice time is an important factor to help businesses issue invoices on time, ensuring compliance with “things to note when issuing VAT invoices” and regulations on value-added invoices. Determining the right time also helps avoid unnecessary violations.

What is the timing for issuing VAT invoices?

The timing for issuing VAT invoices refers to the moment when a business must generate an invoice for each transaction involving the sale of goods or the provision of services. Accurately determining this timing not only ensures compliance with tax regulations but also helps businesses avoid administrative penalties for invoice violations.

According to the Law on Tax Administration and current guiding documents, the timing of invoice issuance is regulated based on the nature of the transaction and the method of payment. Understanding these rules helps businesses operate transparently, legally, and efficiently.

Important considerations when issuing VAT invoices

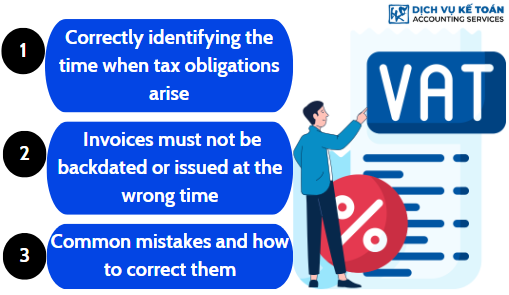

1. Correctly identifying the time when tax obligations arise

Incorrectly identifying the time when tax obligations arise may result in issuing invoices that are not compliant with regulations, leading to tax arrears or penalties. Businesses must stay updated and clearly understand the applicable rules for each type of transaction.

2. Invoices must not be backdated or issued at the wrong time

Issuing invoices at the wrong time (earlier or later than stipulated) may result in administrative fines or be considered tax fraud. The person responsible for issuing invoices must clearly define procedures to ensure accuracy.

3. Common mistakes and how to correct them

Common errors such as incorrect product names, wrong units of measurement, wrong tax identification numbers, missing signatures, or incorrect tax rates often occur. Timely staff training and using professional management software can help reduce these mistakes.

Responsibilities and penalties related to incorrect invoice timing

1. Common administrative penalties

Depending on the nature and severity of the violation, businesses may face fines ranging from 2 million to 20 million VND, or even higher for repeated offenses. Penalties increase if the violation causes damage to related parties or the state budget.

2. Cases of tax arrears and legal consequences

Tax arrears occur when tax authorities discover that invoices were not issued in accordance with regulations, resulting in underpaid taxes. In addition to paying the owed tax, businesses may incur fines and late payment interest. In serious cases, the matter may be referred to investigative authorities.

Mastering the timing of VAT invoice issuance and important considerations helps businesses comply with legal regulations and enhances their professional reputation. Keeping up with new regulations, training staff, and using systems that ensure transparency in processes can help businesses mitigate risks and achieve sustainable growth.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).