When a business begins using its fixed assets, registering depreciation is a crucial step in accounting and tax finalization. Failure to comply with regulations may result in depreciation expenses being disallowed as deductible costs for Corporate Income Tax (CIT) purposes. Therefore, understanding the procedures, timing, and required documents for fixed asset depreciation helps businesses protect their tax benefits and ensure legal compliance. This article provides a step-by-step guide on how to register fixed asset depreciation in accordance with the latest legal requirements.

What Is Depreciation Registration?

Definition

Depreciation registration is a mandatory accounting procedure that businesses must perform when putting fixed assets into use for production or business activities. Under current regulations, companies are required to notify the tax authority of their chosen depreciation method for fixed assets in order for depreciation expenses to be recognized as deductible when calculating corporate income tax (CIT). This process ensures transparency in accounting and directly affects taxable profit and the amount of CIT payable. Depreciation of fixed assets allows a business to gradually allocate the cost of its investment over the asset’s useful life, reflecting its actual wear and tear in the accounting records. Failure to register depreciation correctly and on time may result in the entire depreciation expense being disallowed, leading to higher tax liabilities and potential legal risks during audits or inspections.

Concept of Fixed Asset Depreciation

Fixed asset depreciation is the process of allocating the initial or book value of an asset as an expense over a specific period — typically annually or per accounting cycle. Depreciation reflects the actual use and deterioration of assets, ensuring the accuracy and reliability of financial statements.

There are three common depreciation methods allowed by law:

- Straight-line method

- Declining balance method

- Units-of-production method

Each method suits different types of assets and industries. The chosen method must be based on the nature of asset usage and registered with the tax authority before implementation.

Significance of Fixed Asset Depreciation

Depreciation plays a crucial role in corporate financial management by:

- Recording reasonable business expenses and determining taxable income;

- Reallocating asset investment value into periodic operating costs;

- Supporting maintenance and replacement planning;

- Serving as an essential factor in financial reporting, loan applications, and shareholder presentations.

In addition, proper depreciation helps reflect the true condition of assets in accounting records, thereby increasing reliability in audits and tax reviews.

When Must Depreciation Be Registered?

According to Circular 45/2013/TT-BTC and Circular 96/2015/TT-BTC, all fixed assets used for business purposes must be registered for depreciation with the tax authority.

Specifically, enterprises must:

- Notify the tax office of their chosen depreciation method before starting depreciation;

- Prepare a detailed list of fixed assets to be depreciated;

- Maintain consistency in the registered method throughout the depreciation period, unless a justified change is approved.

If a company changes its method without approval or fails to register, the depreciation expense will not be recognized as deductible for CIT purposes.

Depreciation and Its Impact on Corporate Income Tax (CIT)

Depreciation expenses are considered deductible for CIT only if the following conditions are met:

- The asset is used for business operations;

- There are valid invoices, contracts, and supporting documents;

- The depreciation method was registered before the start of depreciation;

- The asset meets the legal definition of a fixed asset under current regulations.

Failure to meet these conditions may lead to partial or full disallowance of depreciation expenses, resulting in higher tax obligations and increased audit risks. Therefore, registering fixed asset depreciation is a critical step in accounting and corporate tax management.

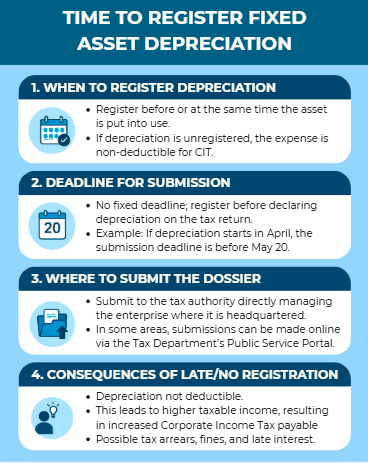

When Should Fixed Asset Depreciation Be Registered?

Determining the correct timing for registering fixed asset depreciation is crucial to ensure that depreciation expenses are legally recognized during the tax period. In practice, many businesses have had their depreciation expenses disallowed by tax authorities simply because they failed to register on time or did not provide a proper written notice. Therefore, accurately identifying the registration timeline and strictly following the required procedures is the only way to ensure that depreciation expenses are accepted as deductible costs during corporate income tax (CIT) finalization.

Should Depreciation Be Registered Before or After the Asset Is Put into Use?

According to current regulations, businesses must register depreciation before starting depreciation or, at the latest, within the first tax declaration period in which depreciation expenses arise. In other words, registration must be done before or at the same time as the asset’s official use. If a business begins using an asset without registering the depreciation method, all depreciation expenses from that point onward will be disallowed as deductible costs for corporate income tax (CIT) purposes. Therefore, it is best to register depreciation immediately after recording the fixed asset in the accounting books to avoid missing the deadline.

Deadline for Submitting the Depreciation Dossier

There is no fixed statutory deadline for submitting a depreciation registration dossier.

However, the general rule is that it must be submitted before declaring depreciation expenses on the tax return. For example, if depreciation begins in April, registration must be completed before filing the tax return for that month or quarter (usually by the 20th of the following month). If errors are discovered after submission, businesses may still make corrections, but they must provide a written explanation and are subject to review by the tax authority.

Tax Authority Receiving the Registration

The depreciation registration dossier must be submitted to the local tax office directly managing the enterprise’s head office. Some provinces and cities now allow online submission via the Tax Department’s Public Service Portal, enabling businesses to file electronically instead of in person. Companies should retain electronic receipts or submission confirmations as legal proof in case of future inspections or disputes.

Consequences of Late or Non-Registration

If a business fails to properly register depreciation on time, the tax authority has the right to disallow all related depreciation expenses when determining taxable income for CIT. This will increase taxable profit and, consequently, raise the amount of tax payable. Furthermore, if the tax authority discovers unregistered depreciation over multiple periods, the business may face tax arrears, late payment interest, and administrative penalties.

Thus, registering depreciation on time and in accordance with regulations is not only an accounting obligation but also a key measure to protect the business from future financial and legal risks.

What Are the Methods of Fixed Asset Depreciation?

After registering fixed asset depreciation, businesses must determine the appropriate depreciation method for each asset type. The chosen method affects not only periodic expenses, but also the business’s profit and tax obligations. Therefore, the selected method must comply with Circular No. 45/2013/TT-BTC and cannot be changed arbitrarily during use unless there is a valid reason.

1. Straight-Line Method

This is the simplest and most common depreciation method in accounting. Under this method, depreciation expenses are allocated evenly over the asset’s useful life. Monthly depreciation is calculated by dividing the original cost by the number of years of useful life as prescribed by the Ministry of Finance. This method is preferred by most businesses due to its stability, ease of accounting, and suitability for assets with consistent usage levels over time.

2. Declining Balance Method

This method allows for higher depreciation in the early years and gradually lower amounts in later years. It is suitable for assets that wear out quickly in the initial period of use, such as technological equipment or specialized machinery. However, not all assets qualify for this method. Businesses must prepare full documentation and register clearly with the tax authority when applying the declining balance method, to avoid depreciation expenses being rejected during tax finalization.

3. Units-of-Production Method

This method applies to assets whose wear and tear depends on production output, such as machinery used in processing or mass production. Here, depreciation expenses are allocated based on the number of units produced during each period, using the ratio of actual output to estimated total output. Businesses must maintain clear and transparent production records to justify this method to the tax authority.

4. Rules for Changing Depreciation Methods

Once a depreciation method has been registered, it must be consistently applied throughout the asset’s useful life.

Changes are only allowed for legitimate reasons, such as:

- a change in asset use,

- a shift in production scale, or

- new official guidance from the authorities.

If a business changes methods without re-registration or without valid grounds, all related depreciation expenses may be disallowed for tax purposes. Hence, businesses should carefully evaluate and select the appropriate method before registration to avoid future tax and accounting risks.

Note: Each method has its own advantages and limitations and is suitable for specific asset types. Businesses should consult with their chief accountant or professional accounting service before registering depreciation to ensure compliance and minimize future risks.

What Does a Fixed Asset Depreciation Registration Dossier Include?

To properly register fixed asset depreciation, businesses must prepare a complete set of documents in accordance with the guidance provided in Circular No. 45/2013/TT-BTC and Circular No. 96/2015/TT-BTC. Preparing the dossier accurately from the beginning helps save time, prevents rejection by the tax authority, and ensures that depreciation expenses are accepted as deductible when calculating corporate income tax (CIT). Below are the essential components of a fixed asset depreciation registration dossier.

Depreciation Registration Notice

This is the primary and mandatory document in the registration dossier. It must clearly include:

- The list of fixed assets to be depreciated;

- The depreciation method to be applied (straight-line, declining balance, or units-of-production);

- The start date of depreciation;

- The reason for the chosen method, if not using the straight-line method.

The notice must also state the company’s tax identification number (TIN), contact information, and legal representative to facilitate communication with the tax authority in case additional clarification or documents are required.

List of Fixed Assets

This list summarizes detailed information about each fixed asset to be depreciated, including:

- Asset name;

- Code or serial number and origin (purchased, contributed capital, self-produced, etc.);

- Original cost, start date of use, and estimated depreciation period;

- Department or unit using the asset and its location.

It is advisable to attach a brief description of each asset’s function to demonstrate that it serves production or business activities. This helps the tax authority assess the validity and reasonableness of the depreciation claim.

Internal Decision on Depreciation

The business must issue an internal decision signed by the Director or legal representative, which clearly states:

- Approval of the fixed assets to be depreciated;

- The depreciation method applied to each asset;

- The start date of depreciation;

- The responsible department or individual overseeing the depreciation process.

This internal document enhances transparency and confirms that the depreciation registration is an intentional and organized process.

Supporting Forms and Documents

In addition to the above, businesses should prepare the following supporting materials:

- Purchase invoices, sales contracts, or handover minutes;

- Acceptance records or commissioning reports;

- Inventory or valuation reports (for contributed or transferred assets);

- Technical documents if applicable — such as operation manuals or production capacity data (for units-of-production method).

All documents must be kept on file and presented when requested by the tax authority during inspection.

Recommendation: It is best to submit the depreciation registration dossier together with the first tax declaration period in which depreciation expenses arise. Additionally, businesses should scan and store digital copies in their internal system for easy reference and verification during future tax audits.

Are Depreciation Expenses Deductible for Tax Purposes?

Depreciation of fixed assets is one of the key expenses used to determine a company’s taxable income. However, not all depreciation expenses are deductible. Only when the business registers depreciation properly and applies it according to the approved method and timeframe will the expense be recognized by the tax authority as deductible for Corporate Income Tax (CIT) purposes. Understanding and complying with these conditions help businesses optimize costs and avoid tax penalties or back payments.

Conditions for Depreciation to Be Deductible

To have fixed asset depreciation accepted as a deductible expense when determining taxable income, businesses must meet the following requirements:

- The asset is used for production or business purposes;

- The asset has valid invoices and documents proving ownership, value, and origin;

- The asset is recorded in accounting books according to regulations;

- The depreciation method is properly registered with the tax authority at the correct time;

- The depreciation period complies with the framework prescribed by the Ministry of Finance (neither shorter nor longer without valid justification).

Failure to meet any of these conditions may result in the depreciation expense being disallowed, increasing taxable income and CIT payable.

Non-Deductible Depreciation Cases

Certain types of asset depreciation are not considered deductible, such as:

- Assets that do not meet the definition of fixed assets (e.g., value under VND 30 million);

- Assets not used for business purposes (e.g., vehicles used for personal matters);

- Assets fully depreciated but still being depreciated further;

- Depreciation applied without proper registration or unauthorized method changes;

- Assets acquired through grants, aid, or free allocation, unless otherwise permitted by law.

Businesses should periodically review their fixed asset lists and depreciation schedules to prevent miscalculations that could affect financial statements and tax reports.

Notes When Recording Depreciation

When accounting for depreciation expenses, accountants must ensure:

- Accurate timing and asset classification;

- Proper allocation of depreciation to the correct departments;

- Recognition of depreciation under the correct cost accounts (e.g., accounts 627, 641, or 642);

- A reasonable allocation method for assets used across multiple functions;

- The accounting software accurately reflects depreciation period, method, and asset cost.

Incorrect accounting can result in disallowed expenses or tax reassessment during audits or inspections.

How to Verify Tax Authority’s Acknowledgment of Depreciation

After registering depreciation, businesses should retain the submission receipt (hard copy or electronic if filed online). They can also contact their managing tax officer to confirm that the depreciation registration has been recorded. In some cases, the registration status can be tracked via e-tax software or the Tax Authority’s online portal. If there is any doubt that the registration has not been processed, the business should send an official confirmation letter to ensure that depreciation expenses are not later disallowed during tax finalization.

Registering fixed asset depreciation on time, with the correct method and documentation, is not only a legal requirement but also a key step in protecting deductible business expenses and optimizing tax obligations. Complying with depreciation rules helps enhance financial transparency, reduce tax risks, and accurately reflect the company’s asset value. If you need assistance in registering or preparing depreciation documentation properly, contact a professional accounting team for fast, accurate, and compliant support.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).