Download our complete collection of internal accounting files in Excel. This essential toolkit for businesses in Vietnam helps ensure accurate financial management.

Effective management of internal accounting files is fundamental to financial clarity. This article provides a comprehensive collection of internal accounting files, including ready-to-use internal accounting templates in Excel, to streamline your financial operations.

What is an Internal Accounting File Collection?

Internal accounting files are a set of templates, spreadsheets, and records that a business creates for the purpose of recording, monitoring, and analyzing its internal financial and accounting activities. Unlike tax forms and reports submitted to the tax authorities, internal accounting files are built for internal management, with flexible organization and customizable content.

These files are usually created in Excel format and tailored to fit the size, business model, and management needs of each company.

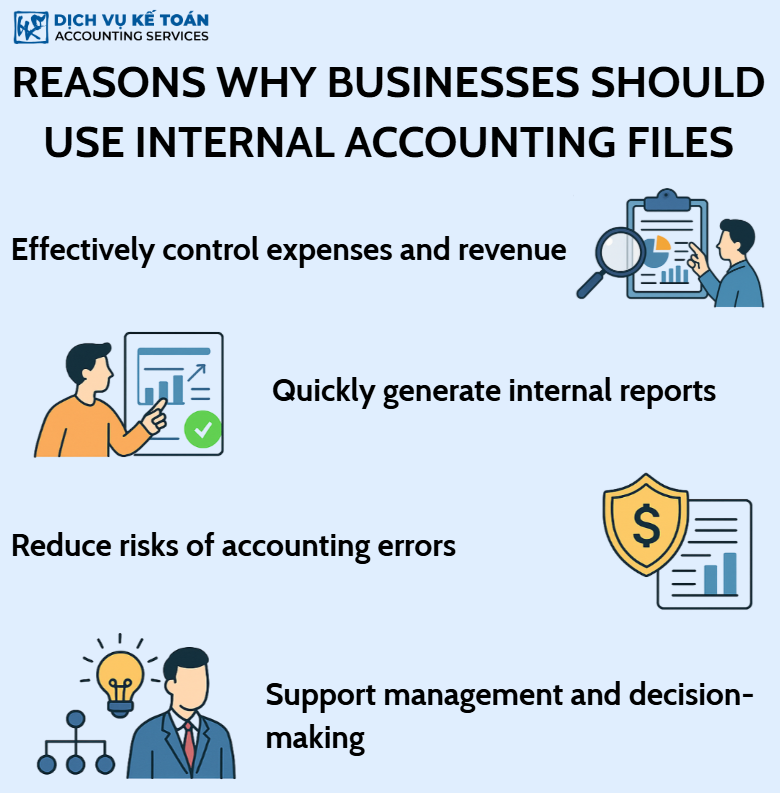

Why Should Businesses Use Internal Accounting Files?

1. Effectively Monitor Revenue and Expenses

Businesses can instantly track income and expenditure, match inflows and outflows, and analyze cost efficiency by department—thereby improving financial performance.

2. Quickly Generate Internal Reports

Internal accounting files help accountants easily summarize key financial indicators such as profit, cost-to-revenue ratios, and cost fluctuations—supporting timely decisions by management.

3. Reduce Errors and Omissions in Records

Using standardized templates and clear documentation procedures minimizes discrepancies, missing data, and mistakes during data collection and reconciliation.

4. Support Management and Decision-Making

Data from internal accounting systems is a critical resource for decisions on investment, budgeting, hiring, and business expansion—ensuring choices are backed by accurate information.

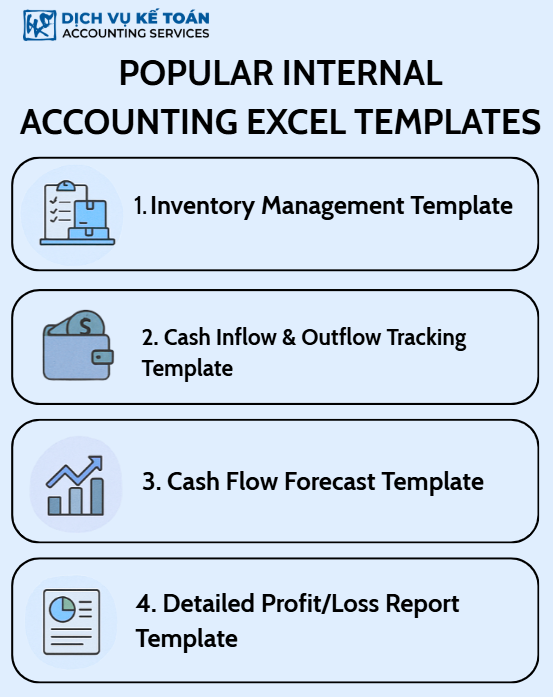

Common Excel Templates for Internal Accounting

1. Inventory Management Template

Tracks stock-in/out/balance by item, lot number, date, and unit cost. Can calculate inventory value using FIFO, weighted average, etc.

Download sample file here

2. Cash Flow Tracking Template

Monitors daily, weekly, and monthly cash inflows and outflows. Links to petty cash and bank accounts. Categorized by department and expense purpose.

Download sample file here

3. Cash Flow Forecasting Template

Projects future cash inflows and outflows (weekly/monthly/quarterly), helping plan payments, balance funding, and avoid cash shortages.

Download sample file here

4. Profit/Loss Report by Project or Job

Records revenue and expenses by project or job to evaluate individual performance and guide future investment analysis.

Download sample file here

How to Organize and Manage Internal Accounting Files Effectively

1. Categorize and Store Logically

Group files by function (cash, inventory, receivables/payables, revenue/expenses…), by time (month/quarter/year), and define access rights.

2. Use Clear File Naming Conventions

File names should indicate content, timeframe, and responsible department.

Example: “CashFlow_AccountingDept_Q1_2025.xlsx”

3. Use Flexible Excel Format

Excel is easy to use and supports formulas, charts, filters, and dynamic reports (Pivot Table). Files can be linked for automated consolidation.

4. Store on Cloud Platforms or Accounting Software

Google Drive, OneDrive, Dropbox, etc. allow flexible sharing and access. Regular backups are recommended. Integration with accounting software reduces manual entry.

Key Notes for Using Internal Accounting Systems

1. Update Regularly to Ensure Accuracy

Avoid delayed entries. Timely updates ensure accurate data for quick reporting and comparisons.

2. Verify Documentation Validity

Only record entries backed by valid documents: invoices, receipts, contracts, signed vouchers, etc.

3. Set Permissions and Ensure Data Security

Assign access rights based on roles: view, edit, approve. Use separate passwords for sensitive files.

4. Tailor to Business Size and Type

Small businesses can use simple templates; larger businesses should adopt more specialized forms. Avoid overcomplication—implement progressively based on real needs.

An internal accounting file system is an essential tool for businesses to maintain financial control, operate efficiently, and make informed decisions. Developing and maintaining a well-structured, flexible file system tailored to your enterprise is a crucial step toward transparent governance, cost savings, and improved competitiveness.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).