Issuing e-invoices from cash registers enables efficient, compliant, and cost-saving operations for businesses.

Issuing e-invoices from cash registers is a modern solution that helps businesses comply with regulations, save time, and streamline financial management. This article explores the full process and key benefits of integrating e-invoicing directly from your POS systems.

- Guidelines for Properly Issuing E-Invoices from Cash Registers According to Regulations

- What Is E-Invoicing from Cash Registers?

- Benefits of Issuing E-Invoices from Cash Registers

- Process of Issuing E-Invoices from POS Systems

- Legal Regulations to Note When Using POS Systems for E-Invoicing

- Common Issues and Solutions in E-Invoicing from POS Systems

Guidelines for Properly Issuing E-Invoices from Cash Registers According to Regulations

Issuing e-invoices from cash registers helps businesses manage operations more efficiently, stay compliant with regulations, and reduce costs.

Creating electronic invoices directly from cash registers is a modern solution that allows enterprises to comply with tax regulations, save time, and optimize financial management. Learn more about the process and benefits of using e-invoices directly connected from POS systems.

What Is E-Invoicing from Cash Registers?

E-invoicing from a cash register is the process of generating and issuing electronic invoices through terminal devices such as POS (Point-of-Sale) systems. This is a significant step in the digital transformation and modernization of accounting and sales management processes for businesses.

According to Decree 123/2020/NĐ-CP and Circular 78/2021/TT-BTC, certain businesses are required to use tax-coded e-invoices integrated with POS systems. These systems automatically transmit invoice data to tax authorities after each transaction, ensuring transparency and legal compliance.

Implementing this method reduces manual processing, prevents the loss of paper invoices, and enhances the efficiency of revenue and cost control.

Benefits of Issuing E-Invoices from Cash Registers

1. Save Time and Operational Costs

Compared to traditional paper invoices, e-invoicing eliminates printing, storage, shipping, and manual processing costs. Issuing e-invoices takes just a few seconds, streamlining the transaction process and improving customer experience.

2. Minimize Human Error

Automation helps prevent common manual errors such as incorrect data entry, miscalculations, or missing signatures. POS systems integrated with e-invoice software ensure data accuracy and consistency.

3. Greater Transparency and Easy Data Management

All invoices are stored on cloud-based platforms, making it easy for businesses to search, analyze revenue, and prepare financial reports. Transparent sales information also reduces fraud and customer disputes.

4. Comply with Legal Tax Requirements

Tax authorities mandate that certain industries must use e-invoices connected to cash registers. Compliance helps businesses avoid legal risks and administrative penalties.

Process of Issuing E-Invoices from POS Systems

1. Prepare E-Invoice Integration Software

Businesses must select e-invoice software providers authorized by the General Department of Taxation. The software should be compatible with the company’s existing POS systems.

2. Register and Integrate with the Software Provider

Once the software is ready, the business must register with the tax authority and integrate the POS system with the invoicing software. This step often requires technical assistance or IT personnel.

3. Set Invoice Format and Business Information

Businesses should configure invoice templates, symbols, types, and relevant information such as company name, tax ID, and address to ensure proper issuance.

4. Automatically Issue and Send Invoices to Customers

When a transaction occurs, the POS system will automatically generate and send the invoice via email or SMS to the buyer. Simultaneously, it sends the data in real-time to the tax authority’s system.

5. Store and Manage E-Invoices

All issued invoices must be stored for the legally required period (typically 10 years) and can be retrieved anytime through the software, facilitating audits and tax finalization.

Legal Regulations to Note When Using POS Systems for E-Invoicing

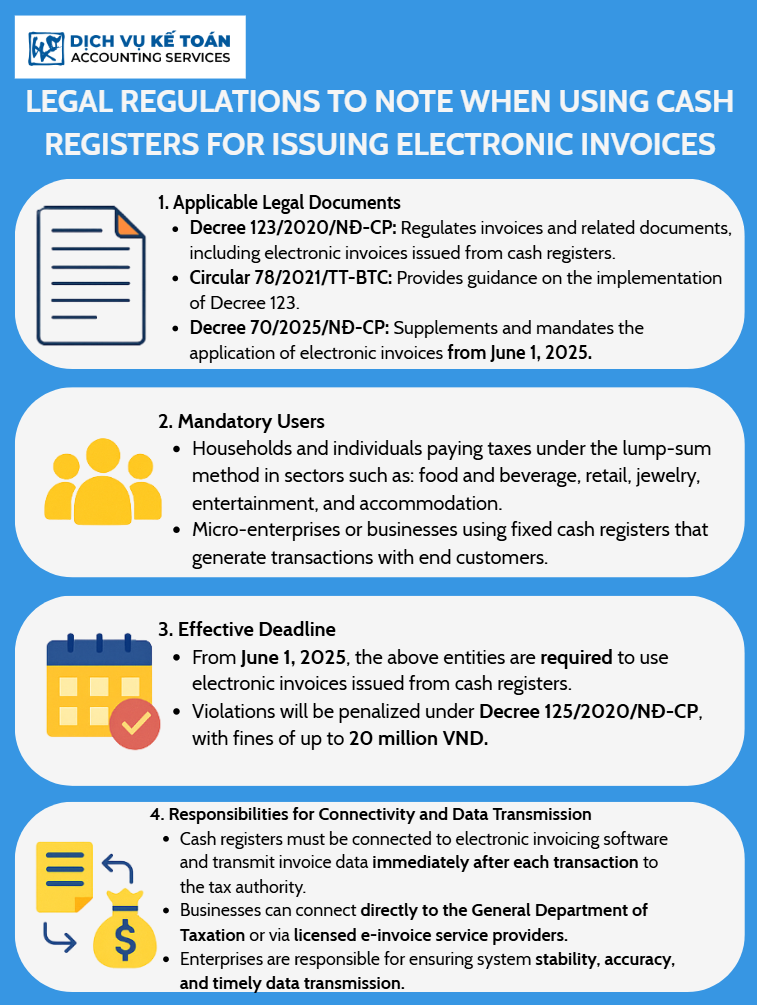

1. Applicable Legal Documents

Businesses must comply with the following regulations when implementing e-invoicing from POS systems:

- Decree 123/2020/NĐ-CP: Regulations on invoices and documents, including POS-based e-invoices.

- Circular 78/2021/TT-BTC: Guidelines for Decree 123, detailing invoice formats and data submission procedures.

- Decree 70/2025/NĐ-CP: Amendments to Decree 123, especially Article 11, which mandates POS-based e-invoicing for certain sectors starting June 1, 2025.

Updating and adhering to these regulations is essential for lawful operations and avoiding administrative penalties.

2. Mandatory Target Groups

According to Clause 8, Article 1 of Decree 70/2025/NĐ-CP, mandatory users of POS-based e-invoices include:

- Tax-registered households and individuals operating in:

- Food and beverage services (restaurants, cafes)

- Retail of consumer goods

- Jewelry trading

- Entertainment services (karaoke, massage, beauty)

- Hospitality (hotels, motels)

- Microenterprises or businesses with fixed POS systems serving end consumers.

Identifying whether your business falls under this category helps ensure timely and accurate implementation.

3. Mandatory Implementation Timeline

As stipulated in Decree 70/2025/NĐ-CP:

- From June 1, 2025, designated businesses and individuals must begin using POS-based e-invoices.

- Non-compliance may lead to penalties under Decree 125/2020/NĐ-CP, with fines up to 20 million VND depending on the violation.

Enterprises should prepare early by upgrading systems, training staff, and choosing reliable software providers.

4. Data Transmission Responsibilities

A key regulation is the real-time transmission of invoice data:

- POS systems must be connected to e-invoice software that immediately sends invoice data to the tax authority after each transaction.

- Businesses are not allowed to delay data transmission except in cases of officially acknowledged technical failures.

Options include:

- Direct connection to the General Department of Taxation’s system

- Via licensed e-invoice service providers

Businesses are responsible for maintaining system integrity, ensuring accurate and timely data transmission, and addressing any issues that arise.

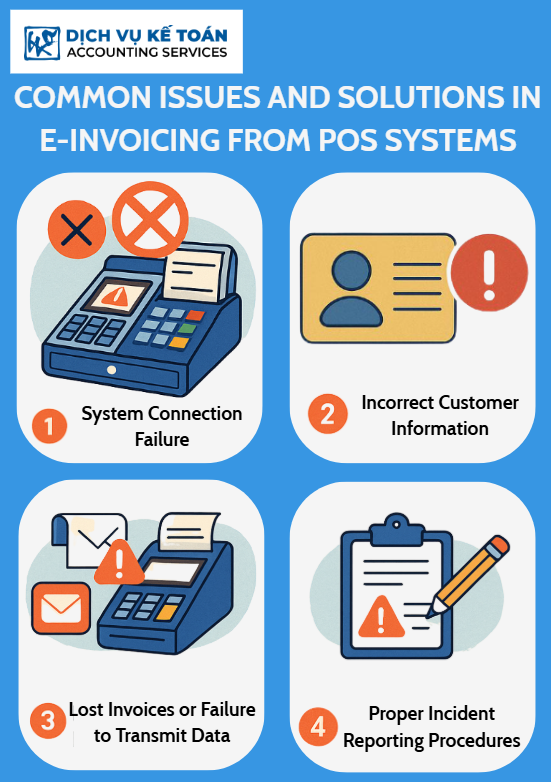

Common Issues and Solutions in E-Invoicing from POS Systems

1. System Connection Failure

Usually due to incorrect configurations or incompatible software. Businesses should contact their software provider for technical support.

2. Incorrect Customer Information

Often caused by human error. Solutions include implementing validation systems and requiring confirmation before invoice issuance.

3. Lost Invoices or Failure to Transmit Data

May result from network issues, software bugs, or system outages. Businesses should implement backup plans and conduct regular system checks.

4. Proper Incident Reporting Procedures

In any incident, businesses must document the issue, retain records, and submit a report to the tax authority within two working days to avoid penalties.

Issuing e-invoices from POS systems is not only a legal requirement but also a strategic move to enhance management efficiency, reduce costs, and improve financial transparency. With new regulations taking effect from June 1, 2025, businesses must act now to ensure compliance and embrace sustainable digital transformation.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).