Step-by-step guide for foreign enterprises on the FDI identification process and legal procedures in Vietnam. Business identification for FDI enterprises is a crucial step for compliance with Vietnamese law. This article provides a detailed explanation of the procedures and legal requirements for foreign companies.

What is Electronic Identification for Enterprises?

Electronic identification (e-ID) for enterprises is the process of verifying a business’s legal identity through the “National e-Identification Application (VNeID)” to ensure that all transactions, administrative procedures, and business operations are conducted securely, transparently, and in compliance with Vietnamese laws.

Purposes of electronic identification for enterprises:

– Enable businesses to carry out electronic transactions with government authorities (e.g., tax submission, customs declaration, business registration), thereby improving operational efficiency and speeding up processing times.

– Enhance enterprise information security, prevent fraud, and limit legal violations.

– Promote digital transformation in business operations, legalize activities, and encourage electronic transactions.

Legal Regulations on Electronic Identification for FDI Enterprises

1. Legal Basis

Article 2 of Decree No. 69/2024/ND-CP, issued on June 25, 2024, stipulates that: “Vietnamese organizations and individuals, foreign organizations and individuals residing or operating in Vietnam who are involved in or related to electronic identification, electronic authentication, or electronic ID card activities” are subject to the regulations.

⇒ Accordingly, not only domestic enterprises but also foreign-invested enterprises (FDIs) whose legal representatives are foreigners must comply with the Decree on electronic identification and are required to register and use a VNeID account as prescribed by law.

2. Legal Provisions

Article 12 of Decree No. 69/2024/ND-CP – Procedures for issuing e-ID accounts for agencies and organizations:

The legal representative or head of the organization, or a person authorized by them, must log in to the National e-ID application using their level-2 e-ID account, provide the required information as instructed, and submit a request to create an organizational e-ID account after obtaining approval from all other legal representatives of the entity (if any).

⇒ Unlike Vietnamese citizens who mostly already possess a personal ID number and level-2 e-ID account, foreigners must complete the application process for a level-2 e-ID account to register the enterprise’s e-identification on the VNeID system.

Guide to Registering an e-ID Account for FDI Enterprises

1. Registration Documents

The legal representative of the enterprise must prepare the following documents:

– Application form for issuance of an e-ID and electronic ID card – Form TK01, issued under Decree No. 69/2024/ND-CP.

– Passport or internationally recognized travel document.

– Business registration certificate, email address, and registered phone number.

– Information the foreigner wishes to integrate into the national e-ID application.

2. Registration Process

The legal representative must visit the Immigration Department under the Ministry of Public Security or the provincial police office during official working hours (Monday to Friday, excluding public holidays) to submit the application for the e-ID account.

The officer in charge will input the provided information into the e-ID and authentication system, collect biometric data (facial image and fingerprints), verify the data with the national immigration database, and confirm the request to create the e-ID account.

The registration result will be notified to the registered mobile number or email within 3 working days.

Guide to Organizational Identification on the VNeID Application

Once the level-2 e-ID account is issued, the legal representative must follow these steps to complete the organization identification process:

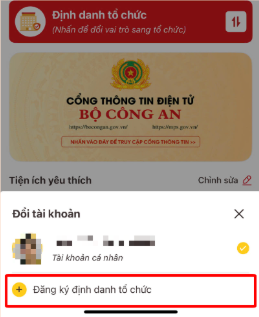

Step 1: Log into the VNeID application and select “Organization Identification.”

Step 2: On the screen, choose “Switch account” and select “Register organization ID.”

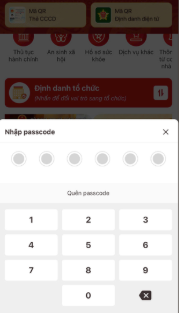

Step 3: Enter passcode or authenticate via fingerprint/face recognition.

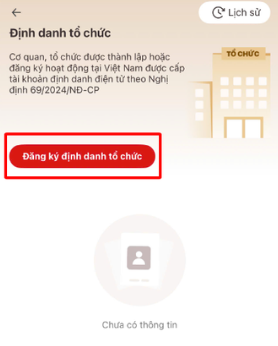

Step 4: Choose “Register organization ID” and select the declarant.

Step 5:

– Enter all required information accurately (fields marked with * are mandatory).

– After completing the form, tick the box: “I confirm the above information is correct and I wish to create an organization ID account” and click “Submit request.”

Step 6: Enter the passcode or use fingerprint/face authentication to finalize the submission.

After submission, you can track the processing status and check the result in the “Organization Identification” section under “Registration history.”

Electronic identification for FDI enterprises is a crucial first step in establishing a lawful presence and expanding business opportunities in Vietnam. This article has outlined the essential procedures, required documents, and legal framework involved. Enterprises are advised to prepare thoroughly and accurately to ensure smooth and sustainable business operations.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).

Click register now to get the form here