All new regulations on compulsory Social Insurance for Directors of 1-Member LLCs and Business Household Owners. A complete guide to the 2025 SI Law changes. Vietnam’s 2025 Law on Social Insurance is here. This guide covers all new regulations on compulsory SI for 1-Member LLC Directors and Business Household Owners, clarifying rules for non-salaried directors and enrollment obligations for household businesses.

The 2025 Law on Social Insurance (SI) officially took effect on July 1, 2025, bringing one of the biggest and most direct changes to business owners in many years. No longer a draft, these regulations are now mandatory requirements. This article will provide a complete update on all new regulations regarding compulsory Social Insurance for 1-Member LLC Directors and Business Household Owners, clarifying the hottest questions such as “Are business household owners required to pay compulsory SI?” and how “non-salaried directors paying SI” will be handled. This is information that must be understood to avoid the risk of retroactive collection and heavy penalties.

- What is the new regulation on compulsory SI for 1-Member LLC Directors and Business Household Owners? (Law on Social Insurance 2025)

- Part 1: Regulations on Compulsory SI for Directors of 1-Member LLCs

- Part 2: Detailed Analysis of Compulsory SI for Business Household Owners (and contribution comparison)

- Rights and Registration Procedures

What is the new regulation on compulsory SI for 1-Member LLC Directors and Business Household Owners? (Law on Social Insurance 2025)

The 2025 Law on Social Insurance (amended) marks a turning point in expanding the social security net, bringing two important groups into the compulsory SI system. Previously, Directors of 1-member LLCs owned by individuals and Business Household Owners (BHOs) were often in a legal “grey area,” with most not participating in compulsory SI.

However, the new Law has officially ended this situation. The regulation aims to ensure fairness among different business types while providing social security benefits (such as retirement, sickness, maternity) to the owners, managers, and operators of these businesses and households. From July 1, 2025, participating in compulsory SI is no longer a choice but a legal obligation for these individuals.

Part 1: Regulations on Compulsory SI for Directors of 1-Member LLCs

This is one of the topics of greatest concern to small and medium-sized business owners, as it directly affects the costs and obligations of the company’s head.

1. Which 1-Member LLC Directors must participate?

According to the new regulation, the subject required to participate in compulsory SI is clarified as: The enterprise manager of a one-member limited liability company owned by an individual.

This means that if you are the owner and also hold the title of Director or General Director, you are the subject required to participate in compulsory SI. This regulation applies to managers who receive a salary. However, the most complex and debated issue is the case of non-salaried directors.

2. Regulations on non-salaried Directors paying SI

A common practice in 1-member LLCs is for the owner (who is also the Director) to not receive a monthly salary to optimize PIT and SI costs. Instead, they receive after-tax profits at the end of the year.

The 2025 Law on Social Insurance has thoroughly resolved this issue. Regardless of whether the Director is on the payroll, as long as they hold a management title (Director, General Director), they are still considered subjects required to participate in compulsory SI. Not receiving a salary is no longer a reason to be exempt from the SI contribution obligation.

Part 2: Detailed Analysis of Compulsory SI for Business Household Owners (and contribution comparison)

This is the second major change, bringing Business Household Owners into the compulsory SI system for the first time. Below is a detailed analysis and comparison of contribution levels with 1-Member LLC Directors.

1. Roadmap and Applicable Subjects (For Business Household Owners)

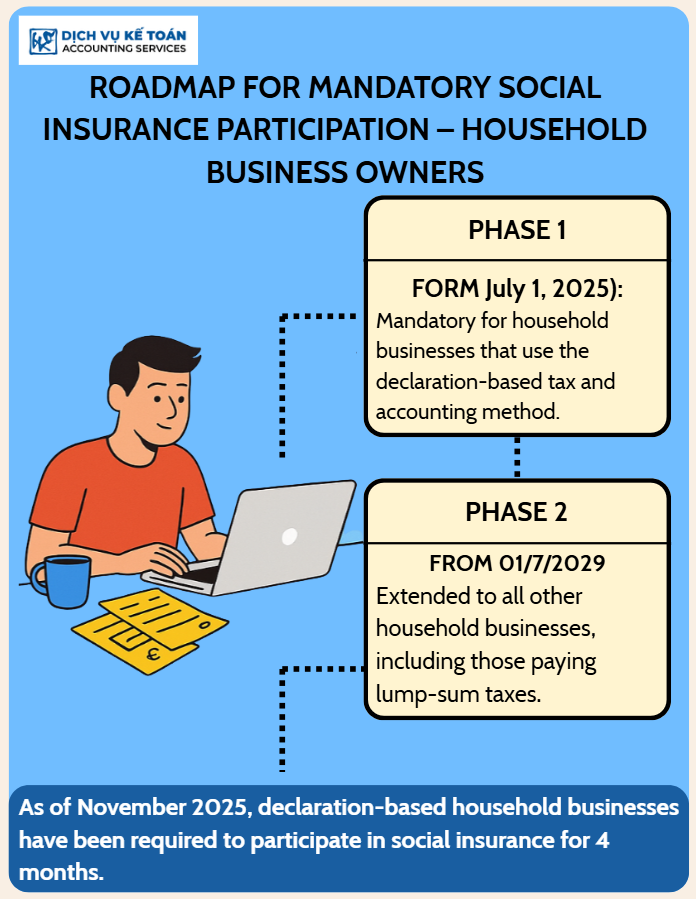

Not all Business Household Owners (BHOs) must participate immediately. The roadmap is divided into 2 clear phases:

- Phase 1 (From July 1, 2025): Compulsory application for Business household owners who follow an accounting regime and pay taxes via the declaration method. These are large-scale BHOs with transparent bookkeeping.

- Phase 2 (From July 1, 2029): Compulsory application for all remaining Business household owners (including those paying fixed tax).

Currently, as of November 2025, BHOs paying taxes via the declaration method have been required to participate for 4 months.

2. Contribution Levels and Basis (Applicable to both BHOs and 1-Member LLC Directors)

This is the most important part, defining the costs that must be paid, as detailed in Decree 158/2025/NĐ-CP (a hypothetical document).

A. For Business Household Owners (BHOs)

BHOs will pay SI based on a “reference level” (assumed to be VND 2,340,000 based on your information). The BHO can choose their income basis for contribution, but it must be within the following range:

- Contribution Rate: A total of 29.5% on the registered income, including:

- 3% to the Sickness and Maternity fund.

- 22% to the Pension and Survivorship fund.

- 4.5% to the Health Insurance (HI) fund.

- LOWEST Contribution (equal to the reference level):

- VND 2,340,000 x 29.5% = VND 690,300 / month

- HIGHEST Contribution (equal to 20 times the reference level):

- (VND 2,340,000 x 20) x 29.5% = VND 46,800,000 x 29.5% = VND 13,806,000 / month

B. For Directors of 1-Member LLCs

The contribution calculation for 1-Member LLC Directors is a bit more complex as it relates to “receiving a salary”:

- Case 1: Director RECEIVES a salary:

- The SI contribution will be based on the actual salary stated in the labor contract and company payroll.

- This contribution is similar to a normal employee (Total 32% of the salary fund, with the company paying 21.5% and the Director paying 10.5%).

- Limit: The salary basis for contribution must not exceed 20 times the base salary (or the new reference level).

- Case 2: Director does NOT receive a salary:

- This is the case where participation is mandatory under the new law.

- The salary basis for SI contribution must not be lower than the reference level (assumed to be VND 2,340,000).

- Monthly, the company must contribute SI for the Director based on this minimum level (e.g., VND 2,340,000 x 21.5% for the company’s portion, and the Director pays 10.5%).

3. Flexible Payment Methods (For Business Household Owners)

To create convenience, BHOs can choose more flexible payment methods than 1-Member LLC Directors (who must pay monthly via the company):

- Monthly.

- Quarterly (every 3 months).

- Semi-annually (every 6 months).

Important Note: After participating continuously for at least 12 months at the chosen level, the BHO can register to adjust the income basis for SI contribution (increase or decrease) to fit their financial situation, as long as it remains within the regulated range.

4. Cases of Business Household Owners Not Subject to Participation

The law also clearly specifies exceptions. A BHO is NOT subject to compulsory SI if they fall into one of the following cases:

- Currently receiving a monthly pension.

- Currently receiving a monthly SI allowance (such as for loss of working capacity…).

- Have reached the statutory retirement age as stipulated in Clause 2, Article 169 of the Labor Code (in 2025, the retirement age for men is 61 years and 3 months, for women it is 56 years and 8 months). (Note: These exemptions may also be considered for 1-Member LLC Directors if they are receiving pensions or monthly allowances).

Rights and Registration Procedures

Participating in compulsory SI is not only an obligation but also brings direct legal benefits to the participant.

1. Benefits (Pension, Sickness, Maternity) BHOs and Directors are Entitled

To When fully participating, 1-Member LLC Directors and BHOs will enjoy all the same benefits as a normal employee, including:

- Sickness Benefits: Receive allowances when on sick leave, certified by a medical facility.

- Maternity Benefits: An extremely important benefit, especially for female business owners/BHOs, or for the wives of male business owners/BHOs.

- Pension (Retirement) Benefits: This is the biggest benefit, ensuring a stable pension upon reaching retirement age, instead of relying on passive income or children.

- Survivorship Benefits: The family will receive a funeral grant and survivorship allowance if the participant passes away.

2. Registration Dossier and Submission Deadline (Within 30 days)

Submission Deadline: According to the regulation, subjects must submit their SI registration dossier within 30 days from the date they officially become subject to participation (e.g., 30 days from July 1, 2025, or 30 days from a new establishment date).

Registration Dossier:

- For BHOs (self-submission): Submit the dossier directly to the district-level SI agency. The dossier includes:

- SI participation registration form (for employees).

- For 1-Member LLC Directors (submission via company): The company will register the Director as an increasing employee. The dossier includes:

- SI participation registration form (for employers).

- List of employees participating in SI (adding the Director’s name).

3. Risks and Penalties for Non-Compliance

As this is a compulsory regulation, non-participation or late participation will lead to strict penalties. As of November 5, 2025, businesses and BHOs subject to the law but not yet registered are facing risks of:

- Retroactive collection of all contributions: The SI agency will collect the full amount owed from July 1, 2025, to the present.

- Late payment penalties: Interest for late payment (usually very high) will be calculated on the total retroactive amount.

- Administrative fines: Penalized for administrative violations regarding SI.

- Ineligibility for benefits: If a risk (sickness, maternity) occurs during the non-payment period, the manager will not be paid benefits by the SI fund.

Bringing 1-Member LLC Directors and Business Household Owners into the compulsory SI system is a major step forward, demonstrating fairness and the state’s effort to ensure social security for all citizens. Although this regulation will increase initial operating costs, it brings long-term benefits and legal protection for the business owners themselves.

The July 1, 2025 deadline has passed. Businesses and business households subject to this law must urgently review and complete the registration procedures immediately to avoid the risks of retroactive collection and heavy penalties. This is the time to contact professional accounting and insurance consultants for guidance on how to comply accurately and safely.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).