Your 2025 handbook for Maternity & Sickness Benefits provides a detailed guide to applying under Vietnam’s new Law on Social Insurance. Know your rights and procedures. Vietnam’s new Social Insurance Law is now in effect. This guide details the 2025 maternity and sickness benefits, explaining the conditions, procedures, and benefit calculations for employees under the latest regulations.

The 2025 Law on Social Insurance (SI) officially took effect on July 1, 2025, introducing many important changes to better protect the rights of employees. Among them, the Maternity and Sickness Benefit schemes are two of the most practical benefits, directly affecting the health and lives of millions of people. However, the new regulations, procedures, and benefit calculation methods may be confusing for many. This article is the most comprehensive handbook, updating you on everything you need to know about the 2025 maternity benefits and 2025 sickness benefits, complete with a detailed guide so you don’t miss out on any of your rightful entitlements.

What Are the 2025 Maternity and Sickness Benefits? New Points to Note

The Maternity and Sickness Benefit schemes are two core social policies within Vietnam’s social security system, stipulated in the Law on Social Insurance. The purpose of these two schemes is to provide financial support and ensure necessary rest time for employees when they temporarily lose the ability to work due to childbirth, caring for a young child, or personal illness or accident. This is a crucial social safety net that helps employees stabilize their lives and recover their health to continue participating in the labor market.

The enactment of the 2025 Law on Social Insurance has brought many groundbreaking new points, focusing on increasing benefits and simplifying procedures for employees. The most prominent new points you need to be aware of include:

- Simplified administrative procedures: Enhancing online application processing through the VssID application and the National Public Service Portal, minimizing unnecessary paperwork.

- Expanded rights for male employees: Increasing leave duration and providing more flexibility for male employees when their wife gives birth, highlighting the role and responsibility of the father in the family.

- More favorable benefit calculation methods: Some regulations on calculating the average monthly salary for SI contributions have been adjusted to better reflect the employee’s income, leading to higher allowance amounts.

- Shortened processing times: Clearer and stricter regulations on the processing deadlines for both businesses and the SI agency, helping employees receive their allowances more quickly.

2025 Maternity Benefits: Detailed Rights and Eligibility Conditions

The maternity benefit scheme is one of the most humane and widely-followed policies, ensuring the health of both mother and child while helping employees maintain a stable income during their maternity leave.

1. Latest Eligibility Conditions for Maternity Benefits

Having paid Social Insurance for at least 06 months within the 12-month period prior to childbirth or adoption.

The 2025 Law on Social Insurance has further clarified some specific cases:

- For female employees giving birth: The 6-month SI contribution condition remains the primary requirement. In cases where a female employee must take leave for prenatal care as prescribed by a competent medical facility, she is still eligible if she has paid SI for at least 03 months within the 12 months before childbirth.

- When adopting a child under 06 months old: The employee (male or female) must also meet the condition of having paid SI for at least 06 months within the 12 months prior to the adoption.

- For male employees whose wives give birth: Simply being an active participant in the SI scheme is sufficient to be eligible for paternity leave benefits.

2. Benefit Amounts and Calculation Method for 2025 Maternity Benefits

Monthly Allowance = 100% x Average monthly salary subject to SI contributions of the 06 months preceding the maternity leave.

- Total amount for a 6-month leave = Monthly Allowance x 6

Example: Ms. A has an average monthly SI-contributory salary of VND 8,000,000 over the last 6 months. Her monthly allowance during maternity leave will be 100% x 8,000,000 = VND 8,000,000. The total amount she will receive for her 6-month leave is 8,000,000 x 6 = VND 48,000,000.

In addition, female employees giving birth also receive a lump-sum allowance. This allowance is equal to 02 times the statutory base salary in effect during the month of childbirth, for each child.

- Example: If the base salary at the time of birth is VND 1,800,000, the lump-sum allowance will be 2 x 1,800,000 = VND 3,600,000.

3. New Rights for Male Employees When Their Wife Gives Birth

- 05 working days for a normal, single birth.

- 07 working days if the wife undergoes a C-section or gives birth to a child before 32 weeks of gestation.

- 10 working days for a twin birth; for triplets or more, an additional 03 working days are granted for each additional child.

- 14 working days for a twin birth requiring a C-section.

Noteworthy new point: This leave must be taken within the first 30 days from the date of birth. The allowance for these leave days is calculated by taking the average monthly SI-contributory salary of the last 06 months, dividing it by 24 working days, and then multiplying by the number of days taken.

4. Leave Duration and Other Related Benefits (Prenatal check-ups, miscarriage, etc.)

- Leave for prenatal check-ups: Female employees are entitled to 05 instances of leave, 01 day per instance. In cases of living far from a medical facility or having a pregnancy-related pathology, 02 days are granted per instance.

- Leave for miscarriage, abortion, stillbirth, or pathological termination of pregnancy: Depending on the gestational age, the employee is entitled to 10 to 50 days of leave.

- Convalescence and health recovery benefits post-maternity: After the 6-month maternity leave ends, within the first 30 days of returning to work, if the female employee’s health is still weak, she is entitled to an additional 05 to 10 days of leave (including public holidays and weekends). The daily allowance is 30% of the base salary.

2025 Sickness Benefits: Everything Employees Need to Know

The sickness benefit scheme provides financial protection for employees when they unfortunately fall ill, have an accident (not work-related), and must take leave for treatment.

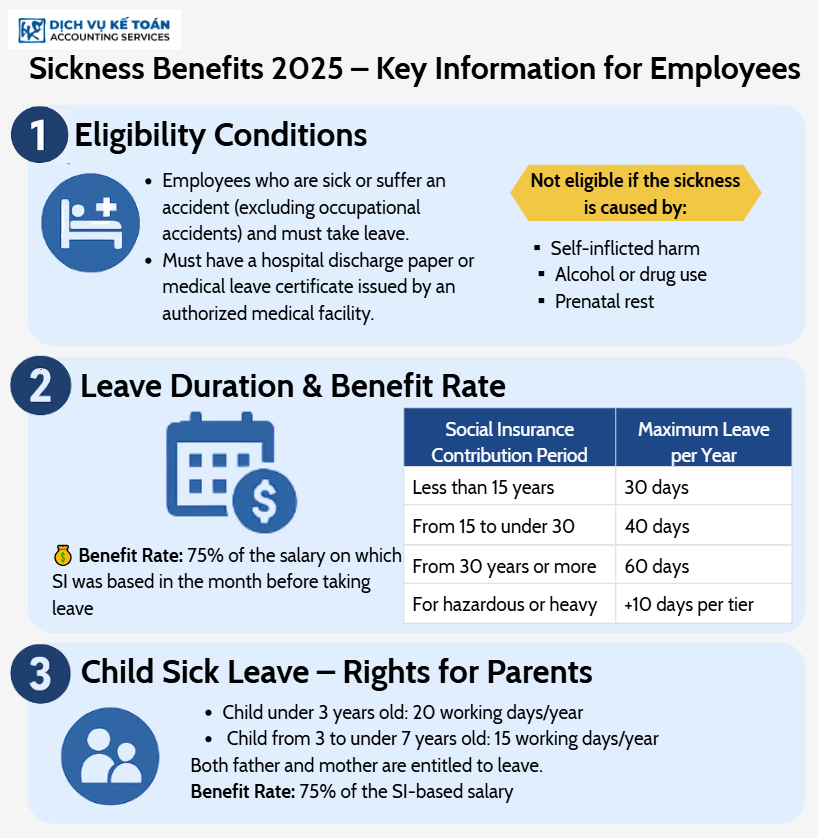

1. General Cases Eligible for Sickness Benefits

- Must take leave due to sickness or a non-work-related accident.

- Must have certification from a competent medical facility as prescribed by the Ministry of Health (usually a Certificate of Leave for SI Benefits or a Hospital Discharge Certificate).

Note on ineligible cases:

- Sickness or accident due to self-harm.

- Caused by alcohol intoxication or the use of narcotics or narcotic precursors.

- The employee is on leave for prenatal care.

2. Maximum Leave Duration and Benefit Amount Per Year

- 30 days/year if SI contribution is less than 15 years.

- 40 days/year if SI contribution is from 15 years to less than 30 years.

- 60 days/year if SI contribution is 30 years or more.

For employees in heavy, hazardous, or dangerous occupations, an additional 10 days are added to each tier.

How to calculate the sickness benefit amount:

- Allowance = 75% x SI-contributory salary of the month immediately preceding the leave.

Example: Mr. B’s SI-contributory salary for June 2025 was VND 10,000,000. In July 2025, he took 5 days of sick leave. His sickness allowance is calculated as follows:

- Daily allowance = (75% x 10,000,000) / 24 days = VND 312,500.

- Total allowance for 5 days = 312,500 x 5 = VND 1,562,500.

3. Benefits for Caring for a Sick Child: Conditions and Rights for Parents

- 20 working days/year if the child is under 03 years old.

- 15 working days/year if the child is from 03 to under 07 years old.

If both parents participate in SI, the leave entitlement for each person is as stated above. The allowance is also calculated at 75% of the SI-contributory salary of the preceding month.

Guide to Procedures for Claiming Maternity and Sickness Benefits

The 2025 Law on Social Insurance has significantly simplified procedures, with a strong encouragement for online submissions.

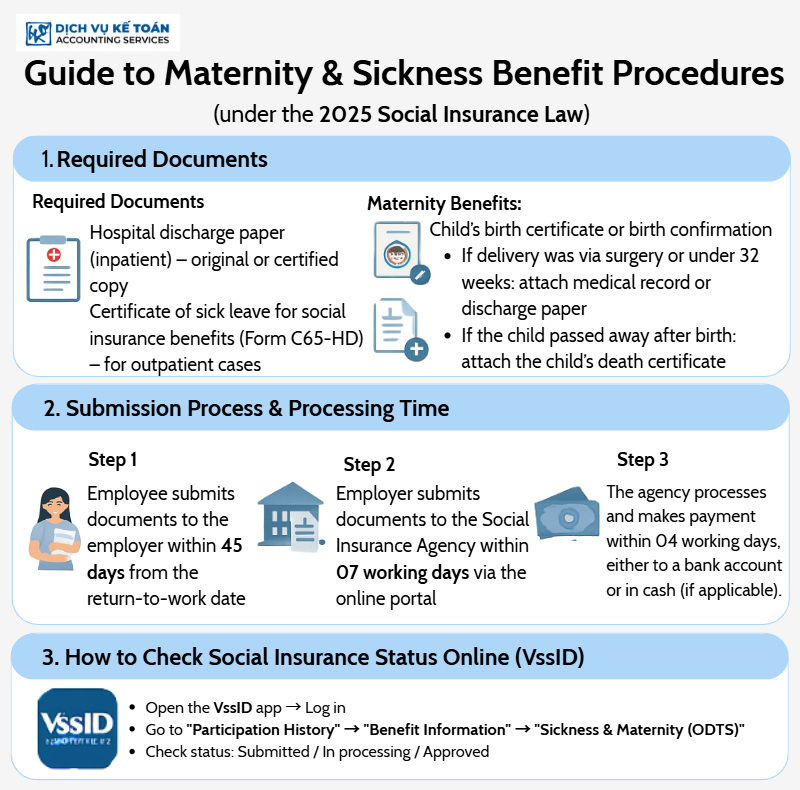

1. What Documents Are Needed for Each Benefit?

For Sickness Benefits:

- Original or certified copy of the Hospital Discharge Certificate (for inpatient treatment).

- Original Certificate of Leave for SI Benefits (Form C65-HD) (for outpatient treatment).

For Maternity Benefits:

- Copy of the child’s Birth Certificate or Birth Attestation.

- In case of a C-section or birth before 32 weeks: A medical summary or hospital discharge certificate stating this is required.

- In case of the child’s death after birth: A copy of the child’s Death Certificate is required.

2. Application Process and Processing Timeline in 2025

- Step 1: Employee submits documents to the employer. Within 45 days of returning to work, the employee must submit the complete application file to the company’s HR department.

- Step 2: Employer submits the application to the SI agency. Within 07 working days of receiving the complete file, the employer must prepare a list (Form 01B-HSB) and submit the entire dossier to the SI agency. Electronic submission is now the preferred method.

- Step 3: SI agency processes and pays. The SI agency will process the application within 04 working days of receiving a complete and valid file. The allowance will be paid to the employee via their registered method (bank account or direct collection).

3. How to Track Your SI Application Status Online

VssID – Digital Social Security

- Log in to the VssID app on your phone.

- Select “Participation History.”

- Select “Benefit Information” and then “Sickness, Maternity (ODTS).”

- The app will display the detailed status of your application: submitted, in process, or approved for payment.

Frequently Asked Questions (FAQs)

Below are detailed answers to the most common questions that employees and HR departments encounter when applying the 2025 Maternity and Sickness benefits.

1. Can I receive maternity benefits if I have already resigned from my job?

Answer: YES, if you meet the eligibility conditions.

This is a very important right protected by the 2025 Law on Social Insurance. Specifically, if you have terminated your labor contract (resigned) but give birth or adopt a child under 06 months old within 12 months from the termination date, you are still entitled to maternity benefits if you meet the core condition: having paid SI for at least 06 months within the 12 months prior to childbirth or adoption.

- Important Note: In this case, you will not submit the application through your former company. Instead, you must prepare the complete file (including your SI book, a copy of the child’s birth certificate, and other related documents) and submit it directly to the SI agency at your place of residence (permanent or temporary) for processing.

2. How many sick leave days per year are paid for by Social Insurance?

Answer: It depends on your total years of Social Insurance contribution.

The 2025 Law on Social Insurance clearly defines the maximum number of paid sick leave days (for common sickness) per year:

- Maximum 30 days/year: If you have contributed to SI for less than 15 years.

- Maximum 40 days/year: If you have contributed for 15 to less than 30 years.

- Maximum 60 days/year: If you have contributed for 30 years or more.

If you take more sick leave than this maximum, the excess days will not be paid by the SI agency. Those days will be handled according to your company’s policy, which could be unpaid leave or annual leave (if available).

3. How do I receive the allowance payment? (Cash, bank account, etc.)

Answer: The top priority is payment via a bank account (ATM).

The 2025 Law on Social Insurance and its guiding regulations strongly encourage the payment of social security allowances through non-cash methods to ensure speed, transparency, and accuracy.

- Via personal bank account (ATM): This is the preferred and fastest method. When you apply, ensure you have provided your correct bank account number to your company (or to the SI agency if applying directly). The money will be transferred directly to your account as soon as the application is approved.

- Cash payment: The option to receive cash directly at an authorized post office still exists, but it usually takes more time due to related administrative procedures. You should only choose this method if you do not have a bank account.

To ensure the fastest payment, you should open a bank account and register this information with the SI agency through your company or on the VssID application.

See more: Social Insurance – The Latest Updates on Social Insurance Policies

Mastering the regulations on Maternity and Sickness Benefits under the 2025 Law on Social Insurance is not just a responsibility but also a practical right for every employee. The changes in the new law demonstrate the state’s efforts to simplify procedures, increase social welfare, and move towards a more comprehensive and modern social security system. Proactively learning and equipping yourself with this knowledge not only helps you protect your legitimate rights but also shows the role of a modern employee in the digital age. We hope this handbook will be a useful companion, helping you confidently master your social security benefits.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).