In business activities, enterprises often have to communicate with state agencies such as tax authorities, social insurance, planning and investment departments, or other administrative management units. To ensure that requests, proposals, or explanations are carried out in accordance with regulations, the use of standard official dispatch templates is mandatory.

Official dispatches are usually administrative documents that are exchanges, requests, notifications, explanations, reports, or responses to a specific issue for state agencies and are issued in accordance with the administrative document format prescribed by law. Drafting according to standards helps businesses:

- Avoid having documents returned, requests for additional information, or administrative penalties.

- Save time processing procedures.

- Demonstrate professionalism and respect for the management agency.

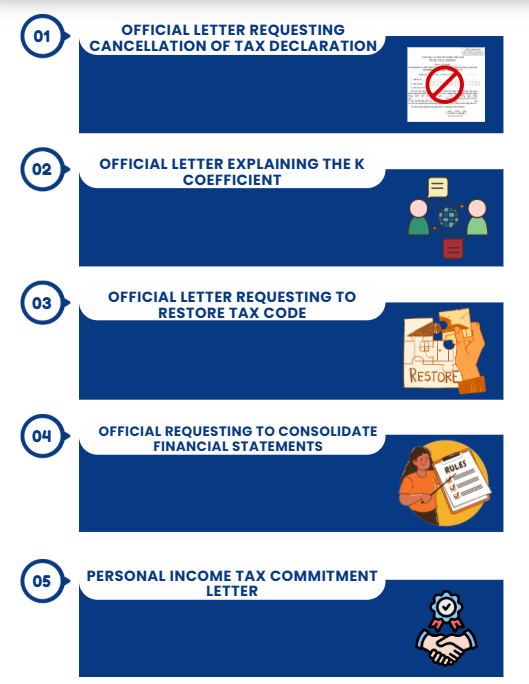

Summary Of 5 Important Official Document Form

1. Official letter requesting cancellation of tax declaration

This official letter form is often used when a business has submitted an incorrect electronic tax declaration (such as declaring the wrong tax period, the wrong type of declaration, or submitting duplicates).

When detecting an error, the accountant needs to quickly make an official letter requesting cancellation of the tax declaration and send it to the directly managing Tax Department to cancel the declaration on the system as soon as possible, avoiding the occurrence or recording of incorrect tax data.

The content of the official letter must clearly state:

- Business information, tax code;

- Type of declaration to be canceled (VAT, PIT, CIT…);

- Reason for cancellation and time of submitting the incorrect declaration;

- Commitment to take responsibility before the law.

Detailed: Sample letter requesting cancellation of submitted tax declarations

2. Official letter explaining the K coefficient

“K coefficient” is an index that determines the revenue – cost – profit ratio of an enterprise. When there is a difference between the financial report and the tax records, the tax authority may request an explanation of the K coefficient.

The official letter must clearly state: Revenue, cost, profit figures for each period, the basis for explaining the difference in figures, commitment to honesty, …

Detailed: K-factor in electronic invoice risk management: Latest update and detailed instructions

Click to download the latest set of official dispatch templates for 2025: Click register now

3. Official letter requesting to restore tax code (MST)

Enterprises whose tax codes are locked are usually due to overdue suspension of operations, tax declaration violations, or failure to submit financial reports. When they want to resume operations, they need to send an official letter requesting to restore their MST. After sending the official letter, the enterprise needs to supplement the accompanying documents such as the decision to restore business operations, missing tax reports, and a confirmation of no tax debt, if any.

Detailed: Form No. 25/DK-TCT – Detailed instructions on tax code recovery procedures for businesses

4. Official dispatch requesting to consolidate financial statements (BCTC)

Newly established enterprises within a short period before the end of the fiscal year are allowed to choose to consolidate the financial statements of the year of establishment to the next fiscal year.

This regulation is not mandatory but is a reasonable choice to reduce accounting work, save costs and be consistent with the initial operating procedures of the enterprise.

Detailed: Newly established business within 90 days: When can financial statements be combined?

5. Personal Income Tax Commitment Letter

PIT Commitment Letters are often made when employees have low income or have only worked for less than 3 months at the enterprise, with the purpose of the enterprise temporarily not deducting PIT, avoiding overpayment or tax refund later.

Enterprises should store the original commitment letter of each employee along with the labor contract to ensure valid records when the tax authority checks.

Detailed: Form 08/CK-TNCN: Instructions for committing to exempt PIT

Preparing a set of necessary official dispatch templates for businesses not only helps ensure compliance with legal regulations but also improves the efficiency of the accounting and administrative departments.

This collection is a useful tool to help businesses be proactive in all situations – from processing tax records, tax refunds, restoring tax codes to committing to personal income tax.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).

Click register now to get the form here