The complete set of Accounting Tax Forms (PIT, E-Invoice) & Internal Management Excel Files. Includes key PIT forms, e-invoice notices, and Excel templates. Get your complete of Accounting Tax Forms (PIT, E-Invoice) & Internal Management Excel Files. This resource pack includes the latest Personal Income Tax (PIT) forms (05/QTT-TNCN) and essential Excel templates for cash flow and inventory.

The work of accountants and business owners is not just about numbers; it’s a “maze” of numerous forms, declarations, and management files. Using just one wrong form, submitting one declaration late, or not closely managing cash flow can expose a business to legal risks and unnecessary financial losses.

Understanding this, we have compiled and provided a link to The Complete Set of Accounting Tax Forms (PIT, E-Invoice) & Internal Management Excel Files for 2025. This article is an “all-in-one” resource library, from the most practical PIT tax declaration forms, e-invoice forms, to inventory management Excel files and cash flow management Excel files.

Why is this Set of Accounting & Internal Management Forms Important?

In a context where legal regulations are constantly changing, having a set of standard and up-to-date forms is key to ensuring compliance.

1. For Tax Forms (PIT, E-Invoice):

These are mandatory legal documents. Using the correct form and declaring the correct items as required by the General Department of Taxation is the first step to avoid having your application rejected, administrative penalties, or tax arrears.

2. For Internal Management Excel Files:

These are management tools. While accounting software handles the books, these Excel files help business owners and accountants get a quick, visual overview of the “health” of their cash flow and inventory, enabling them to make accurate business decisions.

This document set was compiled to help businesses save time searching and minimize errors during operations.

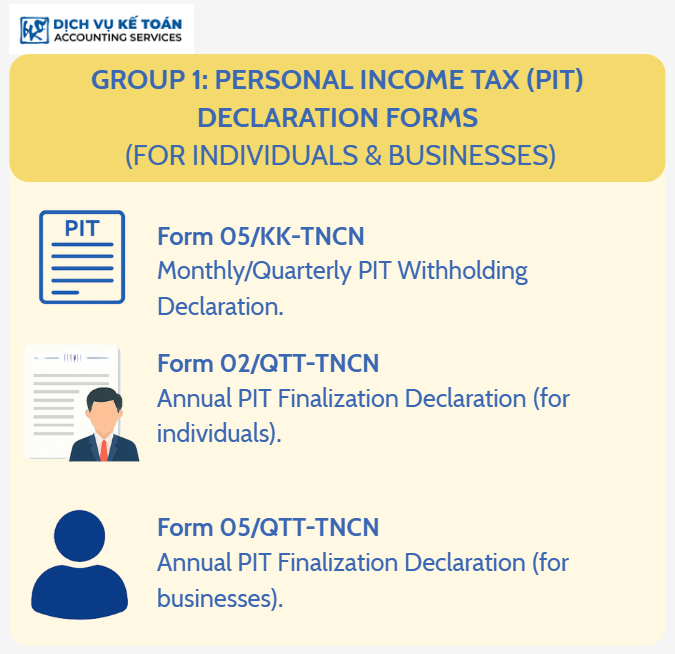

Group 1: Personal Income Tax (PIT) Declaration Forms (For Individuals & Businesses)

Personal Income Tax (PIT) is one of the more complex taxes, requiring various declaration forms for both corporate and individual obligations. Below are the 3 most important forms.

1. Form 05/KK-TNCN: Declaration of Personal Income Tax Withholding (Monthly/Quarterly)

- Purpose of use: This is the form used by enterprises (organizations, individuals paying income) to declare the amount of PIT withheld from the salaries and wages of employees during the period.

- When to use: Businesses submit this declaration on a quarterly basis (most common). If a business declares VAT monthly AND the total withheld PIT in the month is VND 50 million or more, it must be submitted monthly.

2. Form 05/QTT-TNCN: Annual PIT Finalization Declaration (for businesses)

- Purpose of use: This is the most important year-end PIT finalization form. Businesses use this form to summarize and finalize the total PIT withheld from all employees (including employees who have authorized the business to finalize on their behalf) for the entire fiscal year.

- When to use: Submitted annually. The deadline is the last day of the 3rd month after the end of the calendar year (usually March 31st).

3. Form 02/QTT-TNCN: Annual PIT Finalization Declaration (for individuals self-finalizing)

- Purpose of use: This form is specifically for individuals (not businesses) who are self-finalizing their tax obligations with the tax authority.

- When to use: Individuals with income from two or more sources, or who have overpaid tax and want a refund, or fall into other self-finalization cases and cannot authorize their employer. The deadline is the last day of the 4th month (usually April 30th).

View Details: Personal Income Tax Declaration: Key Points You Must Know When Filing

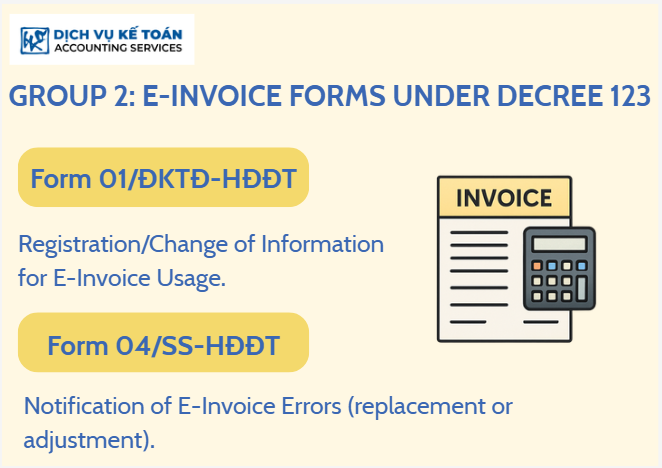

Group 2: E-invoice (HĐĐT) Forms under Decree 123

Since Decree 123/2020/NĐ-CP took effect, e-invoicing is mandatory. The two forms below are the tools for businesses to register and “correct errors” when using invoices.

1. Form 01/ĐKTĐ-HĐĐT: Declaration for Registration/Change of E-Invoice Usage Information

- Purpose of use: This is the “birth certificate” for a business’s use of e-invoices. All newly established businesses must submit this form to be approved by the Tax Authority to issue invoices.

- When to use:

- Initial registration upon establishment.

- Registering a change of information when: switching T-VAN providers, changing the type of invoice (with or without code), changing the data transfer method…

- View Details: How to Register for E-Invoices in Vietnam: A Step-by-Step Guide

2. Form 04/SS-HĐĐT: Notice of E-Invoice Errors

- Purpose of use: This form is used to notify the Tax Authority that an e-invoice that has already been issued (with a code or data already sent) has been found to have errors and needs to be processed (adjusted or replaced).

- When to use: As soon as an issued invoice is found to be incorrect (wrong name, address, tax code, amount, tax rate…). Submitting Form 04/SS-HĐĐT is mandatory before the business issues an adjusted or replacement invoice.

- View Details: Decree 70/2025: 6 Critical Updates Every Business Must Know!

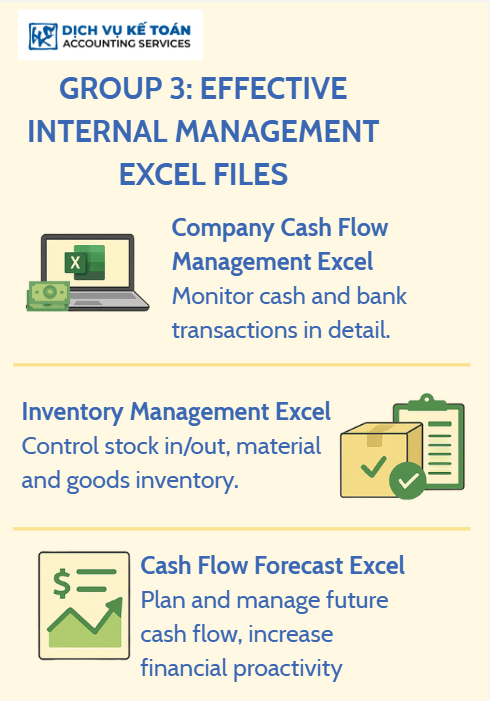

Group 3: Effective Internal Management Excel Files

Tax forms are for submission to state agencies, while these Excel files are “inward-looking” tools for business owners and internal accountants. We provide sample files with basic formulas set up, which you can download and customize.

1. Excel File for Company Cash Management (Cash, Bank)

- Purpose of use: To record and track in detail all daily revenues and expenditures in the company’s cash fund and bank accounts.

- Benefits: Helps business owners know exactly how much money the company has, what it was spent on, where revenue came from, avoids losses, and balances income/expenses instantly.

2. Excel File for Inventory Management (Import – Export – On-hand)

- Purpose of use: To track the quantity and value of every item and material in the warehouse. Records all warehouse transactions (purchases), dispatches (sales, production), and automatically calculates the closing inventory balance.

- Benefits: Tightly controls inventory, allows for early detection of damaged or obsolete stock, and prevents shrinkage. This is a mandatory file for trading and manufacturing businesses.

3. Sample Excel File for Cash Flow Forecasting

- Purpose of use: This is an advanced financial management file. Unlike the Cash Management file (which records the past), this file helps you plan for income and expenses over the next 3-6 months.

- Benefits: Helps business owners predict future periods of “cash shortages” or “cash surpluses,” allowing them to proactively plan for loans, negotiate debt extensions, or plan investments and spending without being reactive.

View Details: Internal Accounting File for Vietnam Businesses (Free Download)

Group 4: Other Administrative Letters and Forms

These are administrative forms commonly used in specific business situations.

1. Sample Official Letter Requesting Tax Payment Extension

- Purpose of use: Used to send to the tax authority when the business encounters special objective difficulties (natural disasters, epidemics, fires, etc.) making it impossible to pay taxes on time.

- Note: Submitting this letter does not mean an automatic extension. It must be submitted before the deadline, and the business must wait for written approval from the tax authority.

- View Details: Tax Payment Extension Letter: Template and Procedure for Vietnamese Businesses

2. Form TK1-TS: Declaration of Participation and Adjustment of SI, HI Information

- Purpose of use: This is the declaration form used to work with the Social Insurance (SI) agency.

- When to use:

- To report an increase and register for SI and Health Insurance (HI) for the first time for a new employee.

- To adjust the personal information of an existing participating employee (change of ID card number, phone number, position, contribution level…).

- View Details: How to Properly Fill Out the Social Insurance Loss Report Form in Vietnam

Guide and Notes on Usage

- Note on Using Tax Forms: The tax forms we provide (PDF/Word files) are mainly for you to reference the items. For actual declaration, you must use the General Department of Taxation’s HTKK (Declaration Support) software to input data and export the .xml file for online submission. Do not submit PDF or Excel files directly.

- Note on Using Excel Files: The internal management Excel files are basic templates. You need to understand your operations and Excel functions to customize them to fit your business’s specific needs. They are excellent management support tools but cannot completely replace professional accounting software.

Using the correct and complete legal forms is the most basic step to ensure business compliance. At the same time, building an internal management system through Excel files will help business owners master their financial “health.”

This document set is a powerful support tool; however, accounting operations always carry complex issues and unexpected policy changes. If you feel overwhelmed or want to ensure absolute safety for your system, contact professional Full-Package Accounting Service units. They will handle all these complex tasks for you, giving you peace of mind to focus on your core business activities.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).