As natural disasters become increasingly frequent and unpredictable, contributing to the Disaster Prevention Fund is a mandatory obligation for both citizens and businesses under government regulations. This fund serves as a national relief mechanism, providing timely and effective support to localities affected by disasters.

In this article, we’ll explain the purpose, contribution rates, exemptions, and penalties related to the Disaster Prevention Fund — helping individuals and organizations understand their responsibilities and ensure compliance with the latest legal requirements.

- 1. What Is the Disaster Prevention Fund?

- 2. Latest Contribution Rates for the Disaster Prevention Fund

- 3. Who Is Eligible for Exemption, Reduction, or Deferral of the Disaster Prevention Fund Contribution?

- 4. Thời hạn nộp quỹ và mức phạt nếu không đóng

- 4. Deadline for Contributions and Penalties for Non-Payment

- 5. The Role of the Disaster Prevention Fund in Vietnam’s Government Fund System

1. What Is the Disaster Prevention Fund?

Purpose of the Fund

The Disaster Prevention Fund is a government-established fund designed to mobilize social resources for disaster prevention, response, and recovery. It is regulated under Decree No. 78/2021/NĐ-CP and managed by provincial People’s Committees. Vietnam, being highly prone to natural disasters such as storms, floods, droughts, and landslides, faces severe human and economic losses every year. The fund plays a crucial role in ensuring financial preparedness and mitigating disaster impacts on communities and the economy.

Funded Activities

The fund supports essential activities in disaster prevention and recovery, including:

- Emergency relief for affected residents (food, water, medicine);

- Rehabilitation of essential infrastructure such as housing, schools, and clinics;

- Construction of urgent inter-provincial disaster prevention projects;

- Investment in forecasting and early warning systems;

- Training and public awareness programs on disaster response.

These activities directly support social welfare and community protection, ensuring the fund is used for the right purposes and beneficiaries.

Is It the Same as a Relief Fund?

The Disaster Prevention Fund can be considered a mandatory government relief fund, but it differs from voluntary charity funds organized by social groups or NGOs. Contributions are legally required from organizations and individuals of working age, making it a state-administered public fund rather than a voluntary community initiative. In essence, contributing to this fund reflects both a civic duty and a collective effort to strengthen national resilience against climate change and natural disasters.

2. Latest Contribution Rates for the Disaster Prevention Fund

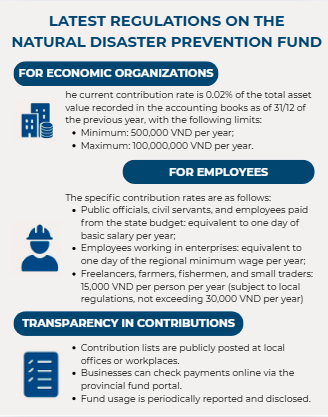

For Economic Organizations

According to Decree No. 78/2021/NĐ-CP, all economic organizations — including enterprises, cooperatives, branches, and representative offices — are required to contribute annually to the Disaster Prevention Fund. The current contribution rate is 0.02% of the total asset value recorded in accounting books as of December 31 of the previous year, with the following limits:

- Minimum: 500,000 VND/year

- Maximum: 100,000,000 VND/year

This contribution is tax-deductible when calculating corporate income tax, meaning it does not increase the actual tax burden. It represents a form of social responsibility and compliance with government funding obligations for community welfare.

For Employees

All individuals of working age (from 18 to 60 for men, and 18 to 55 for women) living or working in Vietnam must contribute to the fund unless they qualify for exemptions or reductions. The specific contribution levels are:

- Public officials and civil servants: 1 day of base salary per year;

- Employees in enterprises: 1 day of regional minimum wage per year;

- Freelancers, farmers, small traders, and fishers: 15,000 VND/person/year (adjusted by local authorities, not exceeding 30,000 VND/year).

Collections are carried out by commune-level People’s Committees or through employers, and then transferred to the provincial-level Disaster Prevention Fund, managed under the state system.

Transparency in Contributions

The Disaster Prevention Fund is a non-profit government-managed fund, supervised by the Fund Management Council, the State Audit, and the public.

- Lists of contributors and contribution amounts must be publicly posted at commune offices or workplaces;

- Businesses can verify payments via the provincial fund’s online portal;

- Fund usage is regularly reported and publicly disclosed.

This transparent mechanism reinforces public trust and distinguishes the fund from unregulated private or spontaneous relief funds.

3. Who Is Eligible for Exemption, Reduction, or Deferral of the Disaster Prevention Fund Contribution?

Exempted Groups

Not everyone is required to contribute to the Disaster Prevention Fund. Under Article 5 of Decree No. 78/2021/NĐ-CP, certain individuals are fully exempt from contributions, including:

- People with meritorious service to the revolution, war invalids, and sick soldiers;

- Individuals receiving regular social assistance;

- Persons with severe disabilities or unable to work;

- Full-time students;

- Women raising children under 12 months old;

- Unemployed individuals or those on unpaid leave;

- Members of poor or near-poor households, and ethnic minorities in especially difficult areas;

- Residents in disaster-affected regions or areas where collection is temporarily unfeasible.

These exemptions reflect the humanitarian and flexible nature of a state-managed relief fund, ensuring social fairness and avoiding additional burdens on vulnerable groups.

Eligible for Reduction or Deferral

Certain individuals or organizations may qualify for temporary deferral or partial reduction instead of full exemption, such as:

- Small and medium-sized enterprises currently enjoying corporate tax relief due to financial hardship;

- Businesses or organizations suffering disaster-related losses exceeding 0.02% of total assets at the time of contribution;

- Enterprises forced to suspend operations for five days or more due to natural disasters or fires;

- Non-profit organizations temporarily inactive or undergoing restructuring.

These measures help ease financial pressure and allow businesses to recover after disasters, aligning with the fund’s humanitarian and sustainable development goals.

Application for Exemption or Reduction

To apply for exemption, reduction, or deferral, individuals or organizations must submit:

- An application form certified by the local authority or tax office;

- Supporting documents proving eligibility (e.g., war invalid certificate, poor household certificate, or social assistance decision);

- For enterprises: a damage report verified by competent authorities such as the Department of Labor, Department of Finance, or local People’s Committee.

The provincial-level Disaster Prevention Fund Management Agency will review and issue a written decision within 15 working days. Once approved, the exemption or reduction is officially recorded in the system, and the applicant will not be subject to penalties.

4. Thời hạn nộp quỹ và mức phạt nếu không đóng

4. Deadline for Contributions and Penalties for Non-Payment

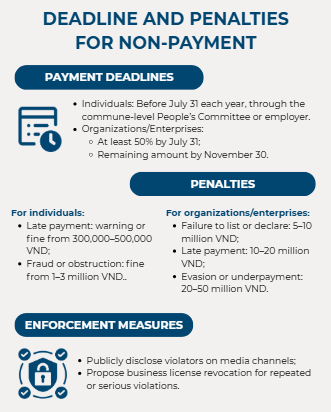

Contribution Deadlines

Contributions to the Disaster Prevention Fund must be made on time to avoid administrative penalties. According to Article 10 of Decree No. 78/2021/NĐ-CP, the deadlines are as follows:

- For individuals (employees, households): Payment must be made before July 31 each year through the commune-level People’s Committee or the employer.

- For organizations and businesses:

- At least 50% of the total contribution must be paid before July 31 of the fiscal year;

- The remaining amount must be completed before November 30 of the same year.

These deadlines apply nationwide. Provincial authorities may issue detailed instructions but cannot extend the deadline beyond these dates.

Penalties for Late or Non-Payment

According to Decree No. 125/2020/NĐ-CP and Decree No. 104/2022/NĐ-CP, individuals or organizations failing to pay or attempting to evade contributions may face the following penalties:

- For individuals:

- Late payment: Warning or fine from 300,000 to 500,000 VND;

- Fraud, concealment, or obstruction of fund collection: Fine from 1 to 3 million VND.

- For organizations and enterprises:

- Failure to list or declare those subject to contribution: Fine from 5 to 10 million VND;

- Late payment: Fine from 10 to 20 million VND;

- Evasion or underpayment: Fine from 20 to 50 million VND, depending on the severity.

In addition, violating enterprises may be required to pay the outstanding amount and lose the right to include contributions as deductible expenses for corporate income tax purposes.

Additional Sanctions

If late payment persists, the provincial People’s Committee or the Fund Management Agency may:

- Publicly announce the names of violating organizations or enterprises via media channels;

- Recommend suspension or revocation of business licenses for serious or repeated violations.

These measures emphasize that the Disaster Prevention Fund, while serving a community relief purpose, is also a mandatory legal obligation under Vietnam’s government-managed fund system.

5. The Role of the Disaster Prevention Fund in Vietnam’s Government Fund System

What is the Fund?

The Disaster Prevention Fund is a government-managed, off-budget fund with its own legal status, seal, and bank account, administered by the provincial People’s Committee. It operates as a non-profit public fund, focusing entirely on disaster prevention, response, and recovery efforts at both local and national levels. Unlike charitable or voluntary aid funds, contributing to this fund is a mandatory obligation for organizations and citizens under Vietnamese law. This underscores its essential role in the public finance structure serving social welfare and community safety.

Relationship with Other Relief Funds

Within Vietnam’s emergency support system, the Disaster Prevention Fund acts as a core mechanism that supplements other relief and welfare funds, such as:

- The Central Disaster Relief Fund managed by the Vietnam Fatherland Front;

- The Social Security Fund;

- The Environmental Protection Fund and various international aid programs.

Unlike voluntary donation-based funds that depend on goodwill, the Disaster Prevention Fund ensures stable and proactive financial resources. When disasters occur, it provides immediate funding for emergency relief before other aid sources are mobilized.

Impact on Businesses and Communities

Fulfilling the obligation to contribute to the fund is both a legal duty and a demonstration of corporate social responsibility (CSR).

For businesses, participation brings several benefits:

- Enhances brand reputation and CSR image;

- Avoids legal risks and administrative penalties;

- Allows contributions to be tax-deductible expenses.

For communities, the fund guarantees readiness of financial resources to respond quickly to disasters, helping to reduce loss of life and property and accelerate recovery. It reflects the connection between economic development and human security, advancing Vietnam’s path toward sustainable growth.

The Disaster Prevention Fund is an essential financial instrument established by the government to strengthen disaster resilience. Complying with regulations on contributions, exemptions, and payment deadlines not only helps businesses avoid penalties but also contributes to building a resilient, compassionate, and sustainable society.

If your enterprise needs guidance, a professional legal and accounting advisory team can assist in ensuring compliance and fulfilling all contribution obligations efficiently.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).