Since 2022, the use of electronic invoices has become mandatory for most businesses and business households in Vietnam. Understanding the latest regulations—especially those concerning tax-coded invoices, sales invoices, and POS (point-of-sale) invoices—is essential to help enterprises avoid errors and penalties during tax declaration. This article provides a comprehensive overview of definitions, applicable entities, registration procedures, and proper use of e-invoices in compliance with the latest 2025 regulations.

What Is an E-Invoice?

An electronic invoice (e-invoice) is a type of invoice that is created, issued, sent, received, stored, and managed in electronic data form, without the need for printing. This form completely replaces traditional paper invoices and has become mandatory for most enterprises and business households under Law on Tax Administration No. 38/2019 and Decree No. 123/2020/NĐ-CP. Using e-invoices helps reduce printing and storage costs while enhancing transparency in transactions. Businesses should understand the main e-invoice types currently in use: sales invoices, VAT invoices (with or without a tax authority code), and POS (point-of-sale) invoices.

Definition Under the Latest Regulations

According to Clause 2, Article 3 of Decree No. 123/2020/NĐ-CP, an e-invoice is an invoice with or without a tax authority code, created using electronic means in a standardized format, digitally signed, and transmitted to the buyer through software systems. It has the same legal validity as a paper invoice if it meets requirements on identification, format, and data security. A key feature is that, in most cases, e-invoices must carry a tax authority code, enhancing authenticity and preventing tax fraud.

Types of Electronic Invoices

Currently, e-invoices in Vietnam are classified into the following main categories:

- Electronic Value-Added Tax (VAT) Invoice

- Electronic Sales Invoice (for entities not subject to the VAT credit method)

- E-Invoice with Tax Authority Code

- E-Invoice without Tax Authority Code

- POS (Point-of-Sale) Invoice connected directly to the tax authority’s database

Clear classification helps businesses choose the appropriate invoice type according to their business model, scale, and industry regulations.

Read more: 8% Value-Added Tax (VAT) Reduction in 2025: New Policy and Application Guidelines

Is a Sales Invoice Considered an E-Invoice?

Yes — a sales invoice qualifies as an e-invoice if it is created, digitally signed, and issued electronically. Previously, many business households used pre-printed or handwritten sales invoices. However, all types of invoices, including sales invoices, must now be converted to electronic form for entities subject to mandatory e-invoicing. Electronic sales invoices are typically used by entities applying the direct tax method, such as individual business households, mini-marts, pharmacies, and small retail stores.

Difference Between Tax-Coded and Non-Coded Invoices

- Tax-Coded E-Invoices: Issued with an authentication code generated by the General Department of Taxation, serving as a unique identifier. These are mandatory for most small and medium enterprises or those considered high-risk in taxation.

- Non-Coded E-Invoices: Applicable only to enterprises meeting strict conditions—having strong IT systems, full tax compliance, and approval from the tax authority.

Choosing the wrong invoice type may lead to administrative penalties, so businesses must carefully follow the correct registration requirements when implementing e-invoices for the first time.

Who Must Use E-Invoices?

Since July 1, 2022, nearly all enterprises, economic organizations, and individual business households are required to use e-invoices, except for certain cases temporarily exempted or delayed. Key sectors such as petroleum, pharmaceuticals, electricity, e-commerce, and finance were among the first to transition. Additionally, retail businesses like supermarkets, convenience store chains, and restaurants using cash registers (POS systems) must issue POS invoices connected directly to the tax authority’s system.

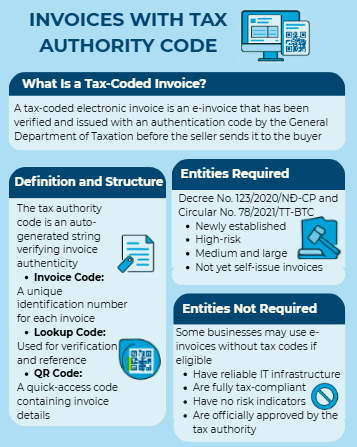

What Is a Tax-Coded E-Invoice?

A tax-coded e-invoice is an electronic invoice that is authenticated and issued with a unique verification code by the General Department of Taxation’s system before the seller sends it to the buyer. Each code contains identifying information that ensures the authenticity, legality, and transparency of the transaction. This type of invoice is mandatory for most businesses in Vietnam, especially small and medium-sized enterprises and those considered high-risk in taxation. Using tax-coded e-invoices enables tax authorities to closely monitor revenue and prevent tax fraud effectively.

Definition and Structure of the Tax Authority Code

The tax authority code is an automatically generated string of characters issued by the General Department of Taxation’s e-invoice management system, consisting of:

- Invoice Code: A unique identification number for each invoice.

- Lookup Code: Used to verify and retrieve invoice details via the General Department of Taxation’s online portal.

- QR Code: A quick-access code containing invoice information for convenient lookup via mobile devices.

When issuing a tax-coded e-invoice, the business must first send the invoice data to the tax authority for authentication and receive the code before delivering it to the buyer.

Entities Required to Use Tax-Coded E-Invoices

Under Decree No. 123/2020/NĐ-CP and Circular No. 78/2021/TT-BTC, the following entities must use tax-coded e-invoices:

- Newly established enterprises;

- Businesses previously involved in invoice misuse or considered high tax-risk;

- Medium and large business households or individuals;

- Companies registered for VAT declaration under the credit method but not yet qualified to self-issue non-coded invoices.

Using tax-coded e-invoices demonstrates compliance and helps reduce the risk of unexpected tax inspections.

Cases Not Required to Use Tax-Coded Invoices

Certain businesses are permitted to use non-coded e-invoices if they meet all the following conditions:

- Have reliable IT infrastructure;

- Maintain good tax compliance for at least 12 consecutive months;

- Are not classified as high-risk;

- Receive official written approval from the General Department of Taxation.

However, if violations occur or an inspection deems it necessary, the business may be reassigned to the tax-coded invoice system. Thus, the use of non-coded invoices is considered a privilege that requires proper risk management.

Regulations on Switching Between Tax-Coded and Non-Coded Invoices

Businesses may apply to switch from coded to non-coded invoices (or vice versa) by submitting a written request to their local tax authority. Approval depends on reasonable justification and tax compliance. During the review process, the enterprise must continue using its current registered invoice type. Once approved, it must update its e-invoice software to synchronize with the General Department of Taxation’s system.

When Must Sales Invoices Have a Tax Authority Code?

Sales invoices (non-VAT) must also carry a tax authority code in the following cases:

- Individual business households with annual revenue of VND 100 million or more;

- Retail stores, restaurant chains, and large business households using POS systems connected to the tax authority;

- Organizations not subject to VAT but operating on a large business scale.

Tax-coded sales invoices help ensure accurate revenue tracking, supporting tax authorities in calculating presumptive tax, personal income tax, and value-added tax correctly.

What Is a POS (Point-of-Sale) E-Invoice?

A POS e-invoice is an electronic invoice generated directly at the point of sale through a cash register or POS system that connects in real time to the tax authority’s database. This is a specialized type of e-invoice designed for retail sectors dealing directly with consumers—such as supermarkets, restaurants, convenience stores, pharmacies, and gas stations.

It ensures timely and transparent transactions while minimizing revenue loss. Under new regulations, several industries are now required to switch to tax-coded POS e-invoices.

Definition and Key Features

According to Circular No. 78/2021/TT-BTC, a POS e-invoice is issued by businesses using POS systems connected directly to the General Department of Taxation’s e-invoice management system. Its main features include:

- Issued immediately upon sale, no need to wait for individual approval from the tax authority.

- Automatically authenticated via real-time connection with the tax system.

- Can be printed at the counter or sent to customers via email/SMS.

- No need for individual digital signatures on each invoice.

This type of invoice is ideal for high-frequency, low-value transactions such as retail, food service, and transportation.

Operational Requirements for POS E-Invoices

To use POS e-invoices, businesses must ensure:

- The POS system has software capable of network connection and direct data transmission to the tax authority.

- Each sales point has a unique identifier to distinguish between branches or cash registers.

- Invoices are issued or sent to buyers immediately after payment.

- Invoice data is transmitted continuously and in real time.

Compliance with these requirements is mandatory to ensure the legal validity of POS e-invoices.

Businesses Required to Use POS E-Invoices

According to Decision No. 1391/QĐ-TCT and related implementation guidelines, the following sectors must apply POS e-invoices:

- Retail: supermarkets, convenience stores, electronics stores, pharmacies;

- Food and beverage: restaurants, cafés, fast-food counters;

- Passenger transport: taxis, buses, ride-hailing services;

- Tourism and accommodation: hotels, homestays, guesthouses;

- Other on-site payment points.

These entities often issue a large volume of small-value invoices, so POS e-invoices help save time and enhance control.

How to Connect POS Systems to the Tax Authority

To implement POS e-invoices, businesses must:

- Purchase or upgrade POS systems compatible with tax authority integration.

- Register sales locations and their unique identifiers with the tax authority.

- Integrate software with the General Department of Taxation via API or Web Service.

- Maintain stable internet connectivity for real-time data transmission.

- Register the invoice template in XML format as required by the tax authority.

Most accounting and POS software providers now offer direct integration with the tax system, making setup simple and efficient.

Benefits for Small and Medium Enterprises (SMEs)

Implementing POS e-invoices provides multiple advantages:

- Enhances professionalism and transparency in sales operations.

- Reduces printing, storage, and paper costs.

- Simplifies tax declaration and submission processes.

- Minimizes revenue loss and invoice fraud risks.

- Builds customer trust through clear and legitimate invoices.

For small businesses and household enterprises, POS e-invoices offer a cost-effective and compliant solution, especially as tax authorities tighten control over invoice management.

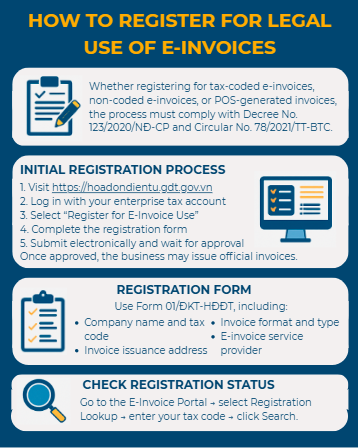

How to Legally Register for E-Invoice Usage

To use e-invoices lawfully, all businesses and household enterprises must complete the official registration process with the tax authority. This registration serves not only as the starting step for issuing invoices but also as the legal basis for the General Department of Taxation’s system to authenticate and manage invoice data. Whether registering for tax-coded e-invoices, non-coded e-invoices, or POS-based e-invoices, the procedure must strictly comply with Decree No. 123/2020/NĐ-CP and Circular No. 78/2021/TT-BTC.

Initial E-Invoice Registration Process

To start using e-invoices, businesses must submit a registration dossier to the tax authority. The process includes:

- Access the General Department of Taxation’s portal: https://hoadondientu.gdt.gov.vn;

- Log in using the enterprise’s tax account;

- Select “Register for e-invoice usage”;

- Fill in all required details — invoice type (coded/non-coded), category, and connection method;

- Submit the electronic dossier and wait for approval (typically within 1–2 working days).

Once approved, the business may officially issue e-invoices. Registration must be completed before issuing the first invoice.

E-Invoice Registration Form

Businesses must use Form No. 01/ĐKT-HĐĐT, issued under Circular No. 78/2021/TT-BTC, including:

- Business name and tax code;

- Invoice issuance address;

- Invoice type (coded or non-coded);

- Invoice category (VAT, sales, or POS-based);

- Software provider (if any).

For POS e-invoices, attach a list of sales points and POS identifiers.

Registering POS-Based E-Invoices

For POS-based e-invoices, the process includes:

- Registering each cash register with its unique ID and business location;

- Declaring the data connection method (API or Web Service);

- Receiving an identifier code from the General Department of Taxation;

- Updating invoice templates with QR codes and XML format as required.

Once approved, businesses may issue electronic sales invoices directly from registered POS machines.

Updating or Amending Registration Information

If any changes occur (e.g., address, invoice type, or switch between coded and non-coded invoices), businesses must:

- Log in to the e-invoice system;

- Select “Edit registration information”;

- Update and attach a justification;

- Submit to the tax authority for review.

During the review period, the business continues to use the previously approved registration to avoid disruptions.

Checking Registration Status

To verify e-invoice registration status:

- Visit the e-invoice portal;

- Choose “Check registration information”;

- Enter the tax code — the system will show “Approved,” “Pending,” or “Rejected.”

If rejected, review the submitted details or contact the managing tax authority.

Regularly monitoring registration status helps businesses promptly resolve issues and avoid penalties for issuing invoices without approval.

How to Handle Errors in E-Invoices

During e-invoice usage, even with proper procedures, businesses may still encounter errors such as incorrect customer details, tax codes, invoice amounts, or issuance timing. Prompt and correct handling is crucial to avoid tax risks and administrative penalties. Below is a guide to handling errors for tax-coded e-invoices, non-coded e-invoices, and POS-based invoices.

Common E-Invoice Errors

Frequent mistakes when issuing e-invoices include:

- Incorrect buyer information (name, address, or tax code);

- Wrong invoice type (sales invoice instead of VAT invoice);

- Wrong issue date compared to the delivery date;

- Duplicate or canceled invoice numbers;

- Invoice issued but not sent to the buyer or not received by the tax authority.

To prevent these, businesses should establish an internal review and control process before invoice issuance.

How to Correct an Incorrect Invoice

Depending on the type of error, there are two main correction methods:

- Issuing an Adjustment Invoice

- Used when errors do not change the original transaction (e.g., wrong buyer name, or price adjustment).

- The new invoice must reference the original invoice number, date, and reason for adjustment.

- Include a written agreement between parties if necessary.

- Issuing a Replacement Invoice

- Used when the entire invoice content is incorrect.

- The old invoice must be canceled (only if not yet sent or declared).

- A new, correct invoice is then issued.

- The e-invoice system must support adjustment and replacement in XML standard format.

Can an Issued E-Invoice Be Canceled?

Once a tax-coded e-invoice has been validated by the tax authority, it cannot be canceled manually.

- If the invoice has not been sent to the buyer and not declared for tax, a cancellation request may be submitted through the system, followed by issuing a replacement invoice.

- For POS e-invoices, which are issued in real time, cancellation is not possible; only an additional adjustment invoice can be created.

Therefore, verifying all details before sending or printing an invoice is essential.

Distinguishing Between Incorrect and Invalid Invoices

Not all incorrect invoices are invalid:

- Incorrect invoices corrected properly remain valid.

- Invalid invoices are those missing a tax authority code (if required), wrong XML format, missing mandatory information (date, number, content), or issued after the tax authority has revoked usage rights.

Proper classification helps businesses handle errors appropriately without unnecessary cancellations.

Penalties for E-Invoice Errors

According to Decree No. 125/2020/NĐ-CP, violations may result in:

- VND 2–8 million fine for incorrect invoices;

- VND 4–8 million fine for failure to send invoice data to the tax authority;

- VND 10–20 million fine for using invalid, fake, or revoked invoices;

- Additional sanctions: mandatory reissuance, tax arrears, or invoice usage suspension in serious cases.

Handling invoice errors promptly and properly protects businesses from fines, financial losses, and reputational damage.

Read more: Professional Tax Accounting Services: Common Taxes and Work Process

Complying with e-invoice regulations—from registration to issuance and error correction—is mandatory for all businesses today. It is essential to distinguish between tax-coded invoices, sales invoices, and POS-generated invoices to ensure the correct type is used according to your business sector and scale. If you’re facing challenges in implementation or are uncertain about the legal procedures, our professional accounting services are here to assist you. Don’t let e-invoice mistakes affect your company’s reputation or finances!

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).