OFFICIAL: Vietnam will apply 3 new Corporate Income Tax (CIT) rates of 15%, 17%, and 20% starting October 1, 2025. Learn which rate applies to your business and how to prepare. Effective October 1, 2025, Vietnam will introduce a new multi-tier Corporate Income Tax system. This guide details the upcoming 15%, 17%, and 20% CIT rates, which businesses they apply to, and the necessary preparations for this major change.

In less than two months, one of the most significant changes to Corporate Income Tax (CIT) policy in years will officially take effect. The regulation on a new 3-tier CIT rate structure will begin to be applied, creating both opportunities and challenges for the business community. Preparing from now on will not only help businesses comply with the law but is also a key factor in optimizing costs and replanning financial strategy for the end of 2025 and beyond. This article will provide a comprehensive overview, in-depth analysis, and a specific action plan for businesses before this major change.

New Regulation on 3 CIT Rates from Oct 1, 2025: What Is It?

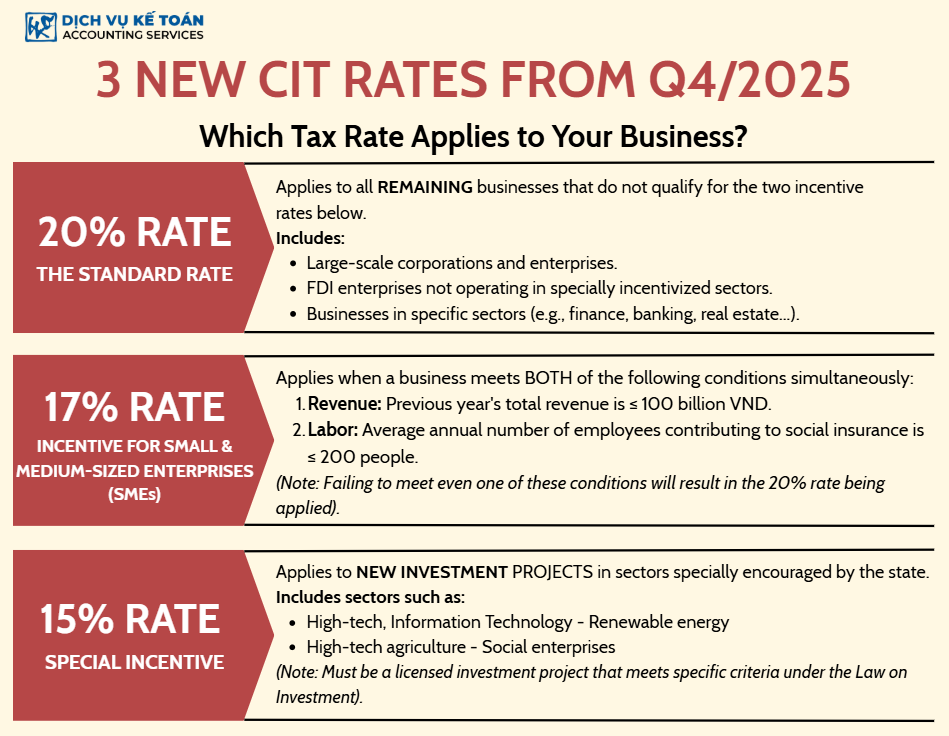

According to the latest amended Law on CIT, passed by the National Assembly and officially effective from October 1, 2025, Vietnam’s CIT rate structure will be changed from a single standard rate to a multi-tiered model, including three levels: 15%, 17%, and 20%. This is a strategic move by the Government to achieve multiple goals simultaneously: creating a fairer tax environment, supporting small and medium-sized enterprises (the backbone of the economy), and directing investment capital into high-tech, sustainable sectors that the nation is prioritizing for development.

This change is more than just an adjustment of numbers. It reflects a shift in policymaking philosophy, moving from applying a uniform policy to a model with classification, selection, and clear objectives. For businesses, this means the amount of CIT payable will no longer be a default constant but will depend on the scale, industry, and field of operation of the business itself. A clear understanding of the nature and objectives of this policy will help managers not only comply but also leverage preferential opportunities most effectively, turning tax policy into a competitive advantage.

Detailed Analysis: Which Businesses Will Apply Each New Tax Rate?

Accurately determining which tax rate bracket your business falls into is the most critical task at this stage. Below is a detailed analysis of each tax rate.

1. The 20% Rate: The Standard General Rate

This will remain the standard CIT rate, applicable to the majority of businesses operating in Vietnam that are not eligible for incentives. These businesses include:

- Large corporations and general corporations with outstanding capital and revenue.

- Foreign-invested enterprises (FIEs) operating in sectors not on the special investment incentive list.

- Businesses in specific sectors such as finance, banking, insurance, real estate, and professional services like accounting, auditing, and legal consulting (unless specific regulations apply).

- Other businesses that do not meet the criteria for the 17% or 15% rates.

Basically, if your business is currently applying the 20% rate and there is no change in your scale or industry towards an incentivized category, you can expect to continue applying this rate.

2. The 17% Preferential Rate: For Small and Medium-Sized Enterprises (SMEs)

This is a new point that directly benefits the private enterprise sector, especially SMEs. To be eligible for the 17% preferential rate, a business must meet the criteria for an SME as regulated. Specifically, an enterprise is considered an SME when:

- Total revenue of the preceding year does not exceed VND 100 billion.

- AND the average annual number of employees participating in Social Insurance does not exceed 200 people.

This regulation aims to reduce the tax burden, helping SMEs gain more resources to reinvest, expand production and business, enhance competitiveness, and create more jobs. Businesses should review their financial and personnel data for 2024 to determine if they fall into this category to apply it for the tax period starting from Q4/2025. This is a golden opportunity for growing businesses to break through.

3. The 15% Special Preferential Rate: For Encouraged Investment Sectors

The 15% rate is the highest incentive, reserved for businesses with new investment projects in sectors specially encouraged by the state, aiming to attract high-quality capital and promote sustainable development. These sectors include, but are not limited to:

- High Technology: Production of high-tech products, biotechnology, new materials.

- Information Technology: Software production, digital content, critical IT services.

- Renewable Energy: Wind power, solar power, and clean energy projects.

- High-Tech Agriculture: Application of biotechnology and automation in agricultural production and processing.

- Social Enterprises: Businesses operating to solve social and environmental issues and using the majority of their profits to reinvest in these goals.

To enjoy this rate, a business must not only operate in the above sectors but also have a licensed investment project that meets specific criteria on scale and technology as stipulated in the Law on Investment and related guiding documents.

Impact of the New CIT Policy on Businesses

The change in tax rates will create multi-dimensional impacts, requiring businesses to calculate and adjust their strategies carefully.

1. Changes in Financial Planning and Cash Flow Forecasting

This is the most direct and obvious impact. Businesses will have to recalculate their projected CIT payable for Q4 2025 and create a new budget plan for the entire year 2026. For businesses whose tax rate is reduced from 20% to 17% or 15%, they will have significant savings that can be used for reinvestment, debt repayment, or increasing contingency funds. Conversely, incorrectly forecasting the tax rate can lead to under- or over-provisioning of tax expenses, affecting the after-tax profit and actual cash flow of the company.

2. Opportunities for Tax Optimization and Compliance Challenges

The new policy opens up opportunities for businesses to restructure their operations to qualify for preferential tax rates. For example, a company with multiple business lines might consider spinning off its high-tech segment into an independent legal entity to enjoy the 15% rate. However, this also poses a major compliance challenge. Incorrectly identifying the category or lacking sufficient supporting documents can lead to the risk of tax arrears and heavy penalties in future audits and inspections. In particular, businesses on the “upper edge” of the SME criteria need to manage their growth carefully to avoid the “shock” of a sudden tax increase upon exceeding the threshold.

3. Important Notes on Declaring and Finalizing CIT Under the New Law

The tax declaration and finalization process will certainly change. The provisional CIT declaration forms and annual finalization forms will be updated to include new fields for businesses to self-determine their applicable tax rate. When finalizing the 2025 tax year, businesses will have to calculate their payable tax in two stages: the first 9 months under the old tax rate and the last 3 months under the new one. This requires the accounting department to be professionally prepared, update their knowledge, and closely follow guidance from the tax authorities to ensure correct and complete execution.

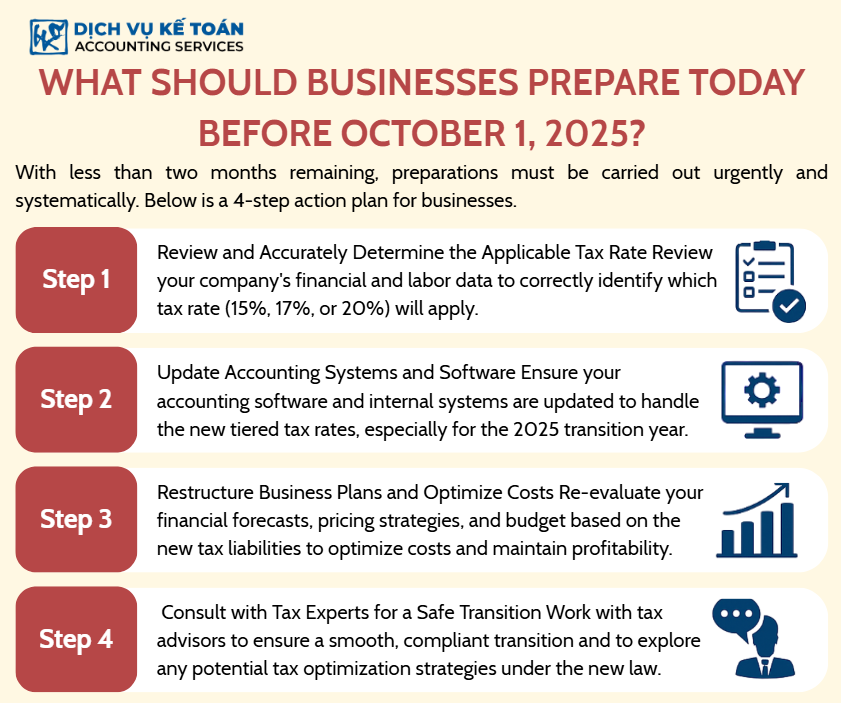

What Should Businesses Prepare Today Before October 1, 2025?

With less than two months remaining, preparations need to be carried out urgently and systematically. Below is a 4-step action plan for businesses.

Step 1: Review and Accurately Determine the Applicable Tax Rate for Your Business

This must be done immediately. The management and accounting department need to sit down and compare the revenue and labor data for 2024 and the current field of operation against the criteria analyzed above. There must be a definite answer: “From October 1, 2025, which tax rate will our company apply?”. This determination is the basis for all subsequent preparation steps.

Step 2: Update Accounting Systems and Software to Comply with New Regulations

Contact your accounting software provider immediately to ask about the roadmap for updating to a new version capable of calculating CIT at different tax rates. This should be done early to ensure that by October 1, 2025, your system is ready for accurately accounting and preparing the provisional declaration for Q4, avoiding manual errors.

Step 3: Rebuild Business Plans and Optimize Costs

Based on the newly determined tax rate, update the financial plan for the final months of 2025 and project for 2026. If your tax is reduced, create a specific plan for using the saved amount: where to reinvest, which markets to expand into, or whether to increase employee benefits. If you remain at the 20% rate, consider strategies for optimizing deductible expenses to increase pre-tax profit.

Step 4: Consult with Tax Experts for a Safe Transition Roadmap

Facing a major change with many binding conditions, self-interpreting the law can be risky. Seek out professional accounting and tax consulting firms. They can not only help you accurately determine your tax rate but can also advise on restructuring solutions (if needed), assist in preparing legal documents, and ensure your transition process is safe, compliant, and as effective as possible.

The three-tiered CIT policy taking effect from October 1, 2025, is a positive signal, showing the Government’s efforts to support businesses and attract selective investment. Although any change brings challenges in the initial phase, this is also an opportunity for businesses to self-reflect, restructure, and replan their strategies for more sustainable growth. Proactive, careful, and timely preparation in the next two months will be the decisive factor in helping your business enter the new phase with confidence and fully leverage the benefits this policy brings.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).