Accurate and ready-to-use template for corporate tax finalization request to support businesses with faster tax procedures. The sample letter requesting tax settlement of the enterprise is an important form in the process of completing tax settlement dossier, helping the enterprise fulfill its obligations to the tax authority in a transparent and legal manner.

What Is the Official Letter Requesting Tax Finalization for Businesses ?

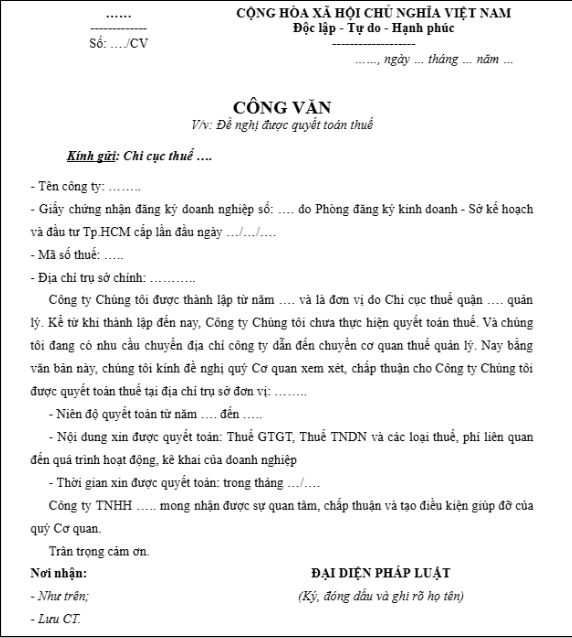

The official letter requesting tax finalization is an administrative document issued by a business and submitted to the tax authority managing it directly. This letter requests the tax authority to conduct a review and audit of the company’s accounting books and declared tax reports for a specific period.

Submitting this letter provides the tax authority with a legal basis to verify the fulfillment of tax obligations and simultaneously protects the business’s legal rights.

The Role and Significance of the Tax Finalization Request Letter

1. Why Must Businesses Finalize Their Taxes?

Tax finalization is a mandatory responsibility of businesses to reconcile and confirm their declared tax data with the actual amount payable. This helps the tax authority determine the accurate amount of tax owed and prevents state budget losses. It also ensures that the business complies with its financial obligations and avoids legal risks or administrative penalties.

Proactively requesting tax finalization at the right time enables businesses to manage their finances transparently, apply for tax refunds, undergo audits, build credibility with partners, and prepare financial records for bank loans.

2. Time to prepare tax settlement request letter

In general, businesses prepare this type of letter in the following cases:

- When preparing to dissolve, cease operations, or change their business structure.

- When relocating the company’s headquarters to a different province or city.

- Periodically, upon request from the tax authority or for internal needs such as bookkeeping transparency or completion of tax obligations.

3. Notes before proceeding with tax settlement

Before initiating the tax finalization process, businesses should take the following steps to ensure compliance and avoid penalties:

– Gather all necessary documents: invoices, business contracts, bank statements, receipts, payroll records, etc.

– Review submitted tax reports (VAT, PIT, Corporate Income Tax finalization, Financial Statements) and ensure that all accounting records align with invoices and declarations.

– Be prepared to explain details such as input costs and revenue. Review deductible expenses to prevent exclusions during audits.

Important Notes When Submitting the Tax Finalization Request Letter

1. Submission Method

Currently, enterprises can submit a tax settlement request in the following ways: Submit directly to the Tax Department.

Depending on the time, enterprises can submit directly to the one-stop department of the tax authority or can contact the tax officer in charge of the enterprise in advance to receive specific instructions.

2. Response Time and Post-Submission Process

Normally, after receiving the official dispatch, the tax authority will:

- Respond in writing about the receipt of the official dispatch and notify the schedule (the time from the time of submitting the official dispatch to the time the tax authority starts working can last from several weeks to several months, depending on each tax branch and the actual situation).

- If the official dispatch is approved, the tax authority will make an inspection decision and send a specific notice or instruct the enterprise to supplement the necessary documents.

- Conduct the Settlement process at the tax authority’s headquarters or set up an inspection team to go directly to the enterprise’s address depending on the proposed plan.

- Finally, notify the settlement results through the working minutes and penalty decisions (if any).

The tax finalization request letter is a crucial document demonstrating a business’s responsibility and transparency in financial management. Properly drafting and submitting this letter at the right time not only helps fulfill legal obligations but also facilitates the inspection and audit process by tax authorities. Businesses are encouraged to retain a standardized template for future use and consult a professional accounting service when necessary to ensure full legal compliance.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).

Click register now to get the form here