This guide covers the latest tax policy updates effective from July 1, 2025 in Vietnam. Discover what key changes your business needs to be aware of now. As of July 1, 2025, significant changes to Vietnam’s tax regulations are in effect. This article provides a crucial update on the latest tax policies, focusing on the 2025 changes to Value Added Tax (VAT) and Corporate Income Tax (CIT) and outlining what every enterprise needs to know for full compliance.

What Are the New Tax Policies Effective from July 1, 2025?

Starting from July 1, 2025, a wave of new tax policies officially comes into effect, directly impacting all businesses in Vietnam. This article offers an in-depth look into these changes, especially those related to Value Added Tax (VAT) and Corporate Income Tax (CIT), helping businesses stay compliant and optimize tax costs.

This is not just a minor adjustment but a comprehensive tax reform aimed at modernizing tax administration, preventing revenue loss, and aligning with international standards. The key focus areas include VAT, CIT, and tax management in the digital economy. Changes affect taxable subjects, deductible expenses, and introduce the Global Minimum Tax. For businesses, this reform poses compliance challenges, but also provides an opportunity to review financial strategies and enhance competitiveness.

Key Changes in the Revised VAT Law

The revised VAT Law, built upon Law No. 13/2008/QH12 and subsequent amendments, is considered a major component of this reform.

1. Changes in Non-Taxable and 0%–5% Tax Rate Items

Goods/services previously exempt from VAT may now fall under 0% or 5% tax rates. For example, software export services are expected to qualify for 0% VAT, allowing full input VAT deductions.

Meanwhile, goods enjoying a 5% preferential rate may be reclassified to the standard 10% rate if they are no longer deemed essential. Businesses must carefully review product classifications to avoid misapplication and potential back taxes or penalties under Decree 125/2020/NĐ-CP.

2. Adjustments to VAT Timing Rules

The revised rules clarify the timing for VAT determination in complex transactions. For example:

- Real estate: VAT is triggered when the buyer pays ≥95% or upon delivery.

- Long-term service contracts: VAT is determined per completion stage or invoice issuance.

Failure to issue invoices at the correct time may result in administrative violations (Decree 123/2020/NĐ-CP).

3. Stricter Conditions for Input VAT Deductions

VAT input deduction conditions are tightened:

- For fixed assets used for both taxable and non-taxable activities, businesses must allocate deductions accurately.

- All payments ≥20 million VND must be cashless, and beneficiary names must match invoice details, or deductions may be denied.

4. E-Invoice Regulations and Digital Compliance

Effective July 1, 2025:

- Sectors dealing directly with consumers must use e-invoices with tax codes generated from cash registers, integrated with tax authorities.

- Handling incorrect e-invoices is now more flexible, but excessive amendments will be flagged by tax risk analysis systems.

Read more: What is VAT? Essential information accountants should know about Value added tax (VAT)

Corporate Income Tax (CIT): Strategic Changes Ahead

Built on Circular 78/2014/TT-BTC and its amendments, the revised CIT law introduces major changes:

1. Implementation of the Global Minimum Tax

Vietnam applies OECD’s Pillar 2 rules starting July 1, 2025:

- Multinational enterprises (MNEs) with global revenue ≥750 million EUR will pay a top-up tax if effective tax rates in Vietnam are <15%.

- The government may provide indirect incentives (e.g., R&D grants) instead of tax holidays to maintain investment appeal.

MNEs should reevaluate their investment structures accordingly.

2. Deductible Expense Rules Tightened

Key points:

- Interest expense limits remain at 30% of EBITDA (per Decree 132/2020/NĐ-CP).

- Employee welfare expenses (max one-month average salary) must now be supported with:

- Detailed documentation,

- Financial policy inclusion,

- Employee beneficiary lists.

Non-compliant costs will be disallowed in final tax settlements.

3. New CIT Incentives for High-Tech and R&D Sectors

In response to the global tax shift, Vietnam now offers stronger tax incentives tied to real economic value:

- Higher deduction limits for R&D costs (up to 200% of actual value).

- Enhanced Science and Technology Development Fund allowances.

Businesses must meet strict criteria under the High Technology Law to benefit.

4. Enhanced Transfer Pricing and Related-Party Transaction Rules

Under Decree 132/2020/NĐ-CP:

- Definitions of “related parties” now include both ownership and operational control.

- New rules demand greater detail in transfer pricing documentation, including global value chain analyses.

- Failure to file required transfer pricing appendices risks tax assessments and penalties.

Read more: Corporate Income Tax (CIT): Proper Understanding and Optimizing Efficiency

Personal Income Tax (PIT) and Other Tax Reforms

1. PIT on Capital Transfers and Securities

New rules:

- For securities: taxpayers can choose either:

- 0.1% of total sale value, or

- 20% on actual gains (if documentation is available).

- For equity transfers in LLCs: methods for calculating cost and transfer value are clarified to reduce disputes.

2. Special Consumption Tax (SCT) Adjustments

Updates include:

- Sugary soft drinks added to taxable list.

- Continued SCT increases on alcohol and tobacco per a defined roadmap.

Affected businesses must re-calculate costs and pricing strategies accordingly.

3. Tightened Tax Management for E-Commerce

Under Law No. 38/2019/QH14 and Circular 80/2021/TT-BTC:

- Foreign e-commerce providers without permanent establishment in Vietnam must register, declare, and pay tax directly.

- Local e-commerce platforms must:

- Share seller data,

- Withhold and pay tax on behalf of individual sellers (per Circular 40/2021/TT-BTC).

Read more: Personal Income Tax: Definition and Calculation Methods

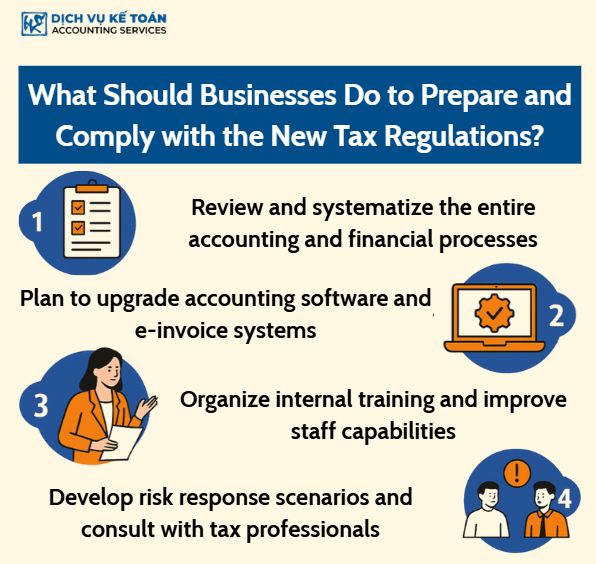

What Should Businesses Do to Prepare?

1. Review and Update Accounting–Finance Processes

Conduct a full audit of accounting procedures and align them with the new regulations. Identify and fix inconsistencies across policies, especially internal financial regulations.

2. Upgrade Accounting Software and E-Invoice Systems

Ensure systems comply with new e-invoicing rules under Decree 123/2020/NĐ-CP. Work closely with software vendors to integrate with tax authorities as required.

3. Conduct Staff Training and Cross-Department Awareness

Provide in-depth tax compliance training not only to accounting teams, but also to sales, procurement, and HR departments to ensure full organizational awareness.

4. Prepare Risk Scenarios and Seek Expert Advice

Develop tax risk management plans proactively. Given the complexity of new rules, consult with professional tax advisors for the safest and most effective compliance strategy, especially under Law on Tax Administration No. 38/2019/QH14.

The sweeping tax reform effective from July 1, 2025, demands proactive adaptation from all businesses. To not only comply but also turn challenges into competitive advantages, companies must quickly update processes, upgrade digital infrastructure, and invest in employee capability.

Given the complexity of these changes, engaging professional tax and accounting consultants is a strategic necessity to ensure stability and growth under the new legal landscape.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).