Instructions on how to include Facebook and Google advertising costs in valid expenses to help businesses optimize taxes.Including Facebook and Google advertising costs in valid expenses is an important requirement for businesses to reduce tax obligations. This article will help you understand how to account for and prepare the necessary documents.

- How to Include Facebook and Google Advertising Expenses as Deductible Business Costs in Vietnam

- Conditions for Advertising Expenses to Be Deductible

- Additional Considerations for Validating Advertising Expenses

- Steps to Account for Facebook and Google Advertising Expenses

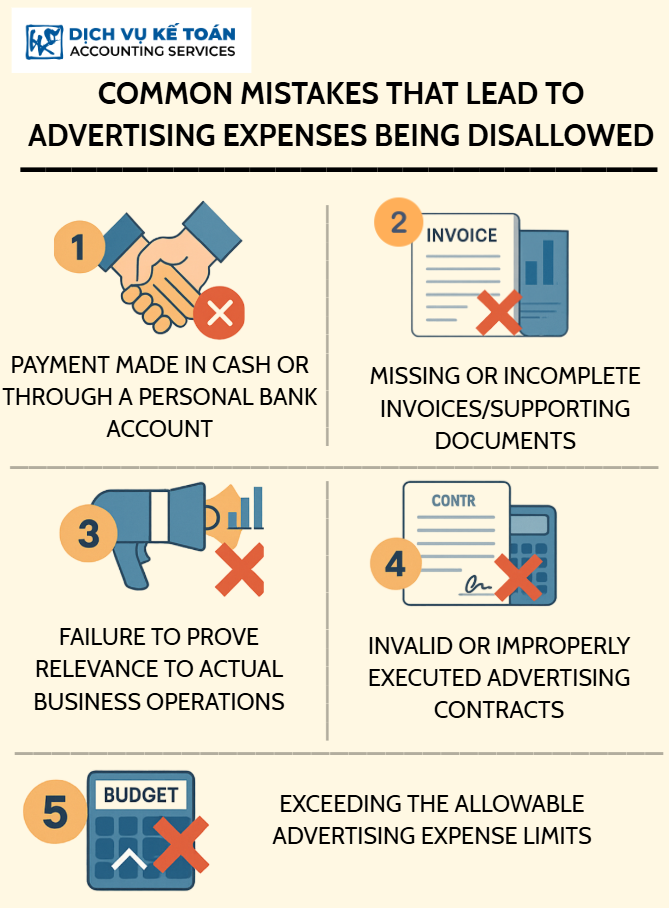

- Common Mistakes Leading to Disallowed Expenses

- Support Services for Managing Advertising Expenses

How to Include Facebook and Google Advertising Expenses as Deductible Business Costs in Vietnam

Advertising expenses on platforms like Facebook and Google can be considered deductible business costs under Vietnam’s Corporate Income Tax (CIT) law. Proper accounting of these expenses can reduce the taxable income of a company. However, to qualify, businesses must meet specific documentation and compliance requirements.

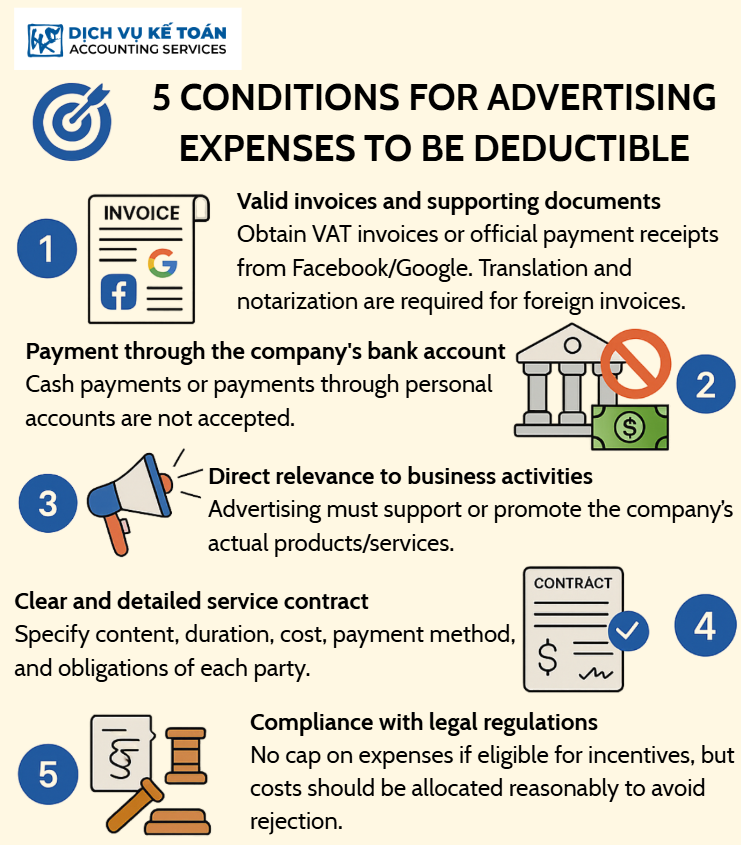

Conditions for Advertising Expenses to Be Deductible

1. Valid Invoices and Documentation

Businesses must obtain valid invoices or payment documents from Facebook or Google. If services are provided by foreign entities, invoices may need to be translated and certified.

2. Appropriate Payment Methods

Payments should be made through the company’s bank account. Cash payments or payments through personal accounts are not acceptable.

3. Direct Relation to Business Activities

The advertising expenses must directly relate to the company’s business operations. Expenses not clearly linked to business activities may be disallowed.

4. Clear Service Contracts

There should be a written contract detailing the advertising services, including duration, content, costs, payment methods, and obligations of both parties.

5. Compliance with Legal Limits

According to the Law on Corporate Income Tax No. 14/2008/QH12, advertising expenses are not subject to a cap if the company is enjoying tax incentives. However, expenses should still be reasonable and well-documented.

Additional Considerations for Validating Advertising Expenses

1. Consistency in Company Information

The name and tax code on invoices must match the company’s registered information. Using personal accounts for payments can lead to disqualification of the expense.

2. Timing of Expense Recognition

Expenses should be recorded in the accounting period in which they occur. Misalignment can result in non-deductibility.

3. Actual Business Activities

Advertising should promote products or services that the company is actively offering. Promoting inactive or non-existent products can raise concerns.

4. Legitimate Service Providers

Engaging with intermediaries lacking legal status or proper documentation can jeopardize the deductibility of expenses.

Steps to Account for Facebook and Google Advertising Expenses

1. Prepare Contracts and Supporting Documents

Establish contracts with Facebook, Google, or their authorized partners. Maintain records of communications, advertising content, and detailed cost breakdowns.

2. Obtain Proper Invoices

If using local agencies, ensure they provide valid VAT invoices. For direct payments to Facebook or Google, retain electronic invoices and translate them if necessary.

3. Record in Appropriate Accounting Accounts

Allocate advertising expenses to account 641 (selling expenses) or other suitable accounts.

4. Maintain Comprehensive Records for Tax Audits

Store all related documents, including invoices, bank statements, contracts, acceptance reports, and confirmation emails, for at least 10 years.

5. Monitor Expenses Using Accounting Software

Regularly input and reconcile advertising expenses in accounting software to ensure accuracy and compliance.

Common Mistakes Leading to Disallowed Expenses

1. Using Cash or Personal Accounts for Payments

Such payments are not recognized for tax deduction purposes.

2. Lack of Proper Documentation

Missing invoices, bank statements, or contracts can result in disqualification.

3. Unrelated Advertising Content

Advertising not directly linked to business operations may be deemed unnecessary.

4. Invalid Contracts

Contracts lacking signatures, clear terms, or mutual agreement can be problematic.

5. Exceeding Reasonable Expense Limits

Even without a formal cap, excessive advertising expenses without justification can be scrutinized.

Support Services for Managing Advertising Expenses

1. Accounting Services for Advertising Expenses

Professional accounting firms in Vietnam can assist in verifying the legitimacy of advertising expenses, ensuring proper documentation, and preparing transparent financial reports.

2. Tax Advisory Services

Experienced tax consultants can help analyze and evaluate advertising expenses to determine their eligibility for deduction, guiding businesses in preparing appropriate documentation to avoid legal and tax risks.

Incorporating Facebook and Google advertising expenses as deductible business costs requires strict adherence to Vietnam’s tax regulations. Proper documentation, appropriate payment methods, and clear linkage to business activities are essential. Engaging professional accounting and tax advisory services can facilitate compliance and optimize tax benefits.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).