Determining and provisionally calculating Corporate Income Tax (CIT) quickly and accurately is a vital task that enables businesses to proactively fulfill their tax obligations. This article provides a detailed and standardized guide for determining and provisionally calculating CIT according to the latest 2025 regulations in Vietnam.

What is Corporate Income Tax (CIT) and Provisional CIT?

Corporate Income Tax (CIT) is a tax that business organizations must pay to the State based on taxable income during the tax period. In practice, businesses are required not only to accurately determine the CIT payable but also to make provisional tax payments quarterly to ensure compliance with tax regulations.

Determining CIT and making provisional CIT payments are crucial processes for businesses to proactively calculate their tax obligations. Proper and complete execution helps businesses avoid legal risks and optimize costs by leveraging applicable tax incentives.

Current Legal Regulations Related to CIT

1. Latest Corporate Income Tax Law

The legal framework for determining CIT currently includes:

- Corporate Income Tax Law 2008, amended in 2013 and 2014.

- Decrees and circulars guiding the implementation, such as Decree 218/2013/ND-CP and Circular 78/2014/TT-BTC.

- Recent updates like Decree 126/2020/ND-CP and Circular 80/2021/TT-BTC.

2. Detailed Guiding Documents and Decrees

In addition to the core laws and decrees, businesses should also stay updated with:

- Circular 96/2015/TT-BTC, amending deductible expenses in CIT calculation.

- Official letters and guidance from the General Department of Taxation and local tax authorities related to specific industries.

How to Accurately Determine CIT

1. CIT Calculation Formula

CIT Payable = (Taxable Revenue – Deductible Expenses) x CIT Rate

Where:

- Taxable Revenue: Includes all income from production, business activities, services, and financial operations.

- Deductible Expenses: Reasonable and legitimate expenses related to business activities, supported by valid invoices and documents.

- CIT Rate: Generally 20%; certain industries may enjoy preferential rates.

2. Deductible and Non-Deductible Expenses

Deductible Expenses must:

- Be actually incurred and related to business activities.

- Have sufficient legal invoices and documents.

- Be paid via non-cash methods for invoices valued at 20 million VND or more.

Non-Deductible Expenses include:

- Expenses not related to business activities.

- Expenses without valid invoices or documents.

- Expenses exceeding regulatory limits (e.g., advertising expenses exceeding 15% of revenue).

3. CIT Incentives for Enterprises

Some enterprises are eligible for CIT incentives, such as:

- Newly established enterprises from investment projects in preferential investment areas.

- Enterprises operating in high-tech fields or scientific research.

- Innovative startup enterprises.

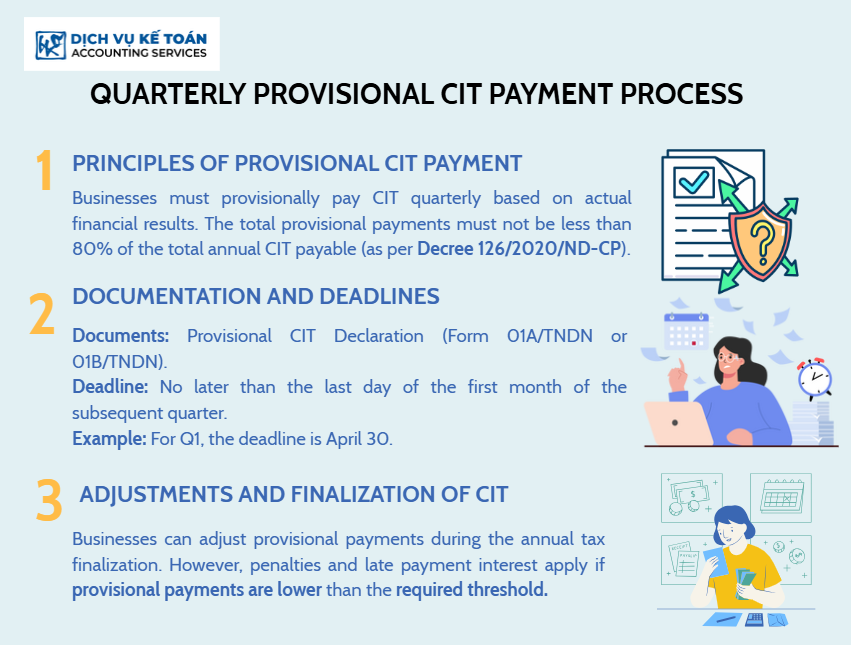

Quarterly Provisional CIT Payment Process

1. Principles of Provisional CIT Payment

Enterprises must make quarterly provisional CIT payments based on actual business results. The total provisional CIT payments for the year must not be less than 80% of the annual CIT payable (as stipulated in Decree 126/2020/ND-CP).

2. Documentation and Deadlines

- Documentation: Provisional CIT declaration forms (Form 01A/TNDN or 01B/TNDN).

- Deadline: No later than the last day of the first month of the subsequent quarter.

For example: The deadline for Q1 provisional CIT payment is April 30.

3. Adjustments and Finalization of CIT

If there are errors in provisional payments, enterprises are allowed to make adjustments during the annual CIT finalization. However, note that if the total provisional payments are less than the required threshold, the enterprise will be subject to penalties and late payment interest.

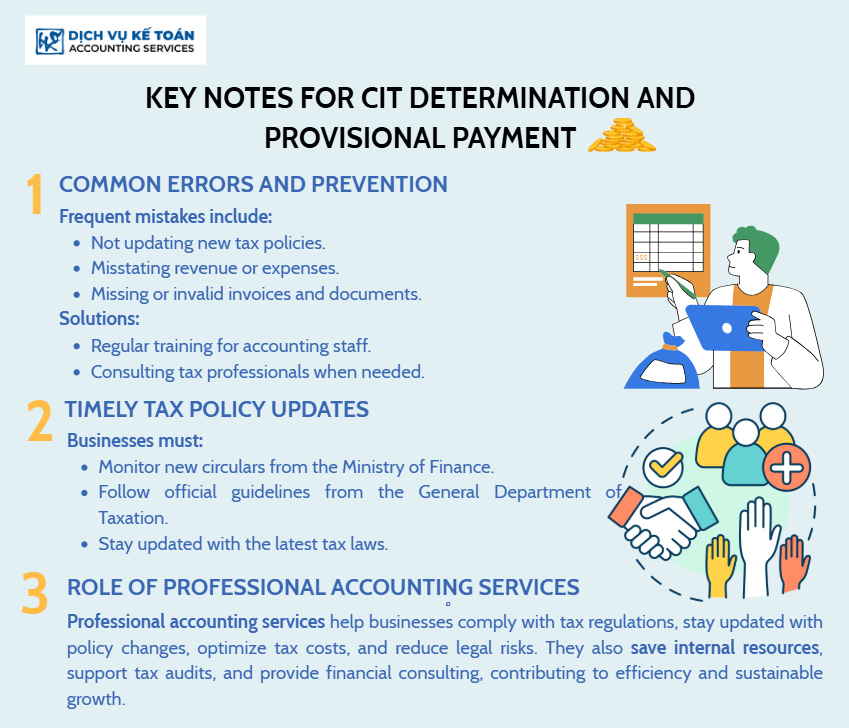

Important Notes When Determining and Making Provisional CIT Payments

1. Common Mistakes and How to Avoid Them

Common mistakes include:

- Not updating new tax policies in a timely manner.

- Incorrectly recording revenue and expenses.

- Lacking valid invoices and documents.

To avoid these:

- Regularly train accounting staff.

- Consult tax professionals when necessary.

2. Timely Updates on Tax Policies

CIT regulations are frequently updated. Therefore, enterprises should proactively monitor:

- New circulars from the Ministry of Finance.

- Official guidance from the General Department of Taxation.

- Newly issued legal documents.

3. Role of Professional Accounting Services

Professional accounting services assist enterprises in ensuring compliance with tax regulations, timely updates on policy changes, and minimizing legal risks. They also support enterprises in optimizing deductible expenses, leveraging tax incentives, saving internal resources, assisting with audit processes, and providing strategic financial management advice, thereby enhancing business efficiency and sustainable growth.

Accurately determining and making provisional CIT payments are essential tasks requiring precision, continuous updates, and a deep understanding of Vietnam’s tax laws. Enterprises should establish a robust tax accounting system or collaborate with reputable accounting service providers to ensure proper tax compliance, thereby achieving stable and sustainable development.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).