Tax accounting management is one of the most critical tasks for businesses to ensure legal compliance and optimize financial efficiency. From tax filing to bookkeeping, every step requires precision and in-depth knowledge. However, many businesses and accountants make unfortunate mistakes that lead to undesired financial and legal consequences. In this article, we will explore detailed information about tax accounting, the correct procedures for filing taxes, and effective bookkeeping methods to minimize risks.

What is Tax Accounting?

Definition of Tax Accounting

Tax accounting is a vital component of corporate financial management, involving the calculation, filing, and payment of taxes in accordance with legal regulations. The role of tax accounting extends beyond ensuring compliance; it also involves optimizing tax expenses legally.

The Role of Tax Accounting in Businesses

Tax accounting acts as a bridge between businesses and tax authorities. It ensures that financial transactions are accurately and sufficiently recorded, helping businesses avoid legal risks such as penalties or tax arrears. This role is especially critical for large enterprises with complex transaction volumes.

Essential Skills for a Tax Accountant

Tax accountants must possess accuracy, meticulousness, and in-depth knowledge of tax laws. Additionally, they should be proficient in accounting software and stay updated on tax policy changes to perform their duties effectively.

Benefits of Professional Tax Accounting Services

Using professional tax accounting services helps businesses alleviate the burden of tax management, ensure accurate filings, and optimize costs. Moreover, these services allow businesses to focus on their core operations.

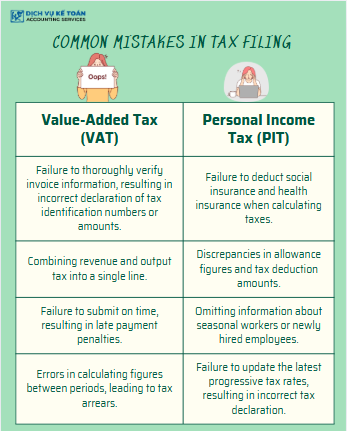

What is Tax Filing and Common Mistakes?

Standard Tax Filing Process

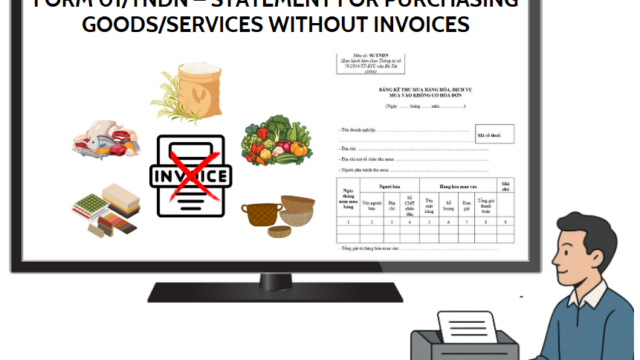

Tax filing is the process of recording and reporting a business’s tax obligations to the tax authorities. This process includes compiling invoices, reconciling figures, and submitting declarations on time via electronic systems.

Learn more:

WHAT IS VAT? ESSENTIAL INFORMATION ACCOUNTANTS SHOULD KNOW ABOUT VALUE ADDED TAX (VAT)

Personal Income Tax: Definition and Calculation Methods

Ways to Improve Accuracy in Tax Filing

To minimize errors, businesses should:

- Implement internal control tools to ensure accuracy in data handling.

- Use specialized accounting software to automate and streamline tax filing processes.

- Regularly organize employee training sessions on tax laws and regulations.

Effective Tax Accounting Bookkeeping Management

The Importance of Tax Accounting Books

Tax accounting books serve as a crucial database for businesses to manage finances and ensure compliance with laws. They are also essential documents for audits conducted by tax authorities.

Common Mistakes in Bookkeeping Management

- Failing to reconcile debts with customers and suppliers.

- Not recording all legitimate expenses.

- Errors in preparing fixed asset depreciation schedules.

- Not retaining invoices and supporting documents as per regulations.

Software to Support Bookkeeping Management

Software such as MISA, Fast Accounting, and Bravo automates bookkeeping processes, reducing errors and saving time for businesses.

Tips for Transparent and Accurate Bookkeeping

- Regularly reconcile data to maintain accuracy.

- Conduct internal audits periodically.

- Clearly assign responsibilities to each accounting staff member.

Proper Tax Accounting to Minimize Risks

Regulations on Tax Accounting

Tax accounting must comply with current regulations to ensure that data in the records matches the reports submitted to tax authorities. This helps businesses avoid risks during tax inspections or audits.

Common Tax Accounting Errors to Avoid

- Failing to record tax penalties fully in the books.

- Omitting input VAT deductions.

- Not making adjustment entries when receiving tax refunds.

Detailed Guidance for Preparing Tax Accounting Reports

Tax accounting reports should clearly present the beginning balance, transactions during the period, and the ending balance. Ensure all entries match related invoices and supporting documents.

How to Handle Errors in Tax Accounting

When errors are identified, immediately create adjustment entries and submit a supplementary report to the tax authorities to avoid penalties or in-depth inspections.

Proper tax accounting management is the key to ensuring legal compliance and cost optimization for businesses. Mastering tax filing, accounting, and bookkeeping knowledge brings long-term benefits to the organization. To reduce pressure and maintain accuracy, consider using professional tax accounting services.

For any inquiries, contact Wacontre Accounting Services via Hotline: (028) 3820 1213 or email info@wacontre.com for prompt assistance. With a team of experienced professionals, Wacontre is committed to providing dedicated and efficient service. (For Japanese clients, please contact Hotline: (050) 5534 5505).